Financial Skeptic Bulletin, June 2009

Prev

| Contents |

Next

June

Matt Taibbi’s latest Rolling Stone article, “The

Great American Bubble Machine,” undresses Goldman Sachs–and finds a

“giant vampire squid wrapped around the face of humanity.” Not only

do former Goldmanites essentially run the world, they help manufacture

and burst economic bubbles, harvesting mean profits the entire time.

Taibbi details how the bank manipulated

investors, starting during the Great Depression.

Zero Hedge scanned the entire article onto Scribd; find it

here.

With a subtitle like "From tech stocks to high gas prices, Goldman Sachs

has engineered every major market manipulation

since the Great Depression - and they're about to do it again"

run, don't walk, to your nearest kiosk and buy Matt Taibbi's latest

piece in Rolling Stone magazine.

One of the best comprehensive profiles of Government Sachs done to

date.

Speaking of GS, they sure must be busy today, now that Bernanke is

about to be impeached and take the fall for all their machinations.

Taibbi’s conclusion: “It’s a gangster state, running on gangster

economics, and even prices can’t be trusted anymore; there

are hidden taxes in every buck you pay. And maybe we can’t stop it,

but at least we know where it’s all going.”

The Bank of International Settlements (BIS) will

release their

annual report tomorrow. The Guardian has a preview:

Recovery threatened by toxic assets still hidden in key banks

... Despite months of co-ordinated action around the globe to stabilise

the banking system, hidden perils still lurk in the world's financial

institutions according to the Basle-based Bank of International

Settlements.

"Overall, governments may not have acted quickly enough to remove

problem assets from the balance sheets of key banks," the BIS says

in its annual report. "At the same time, government guarantees and

asset insurance have exposed taxpayers to potentially large losses."

... As one of the few bodies consistently sounding the alarm about

the build-up of risky financial assets and under-capitalised banks

in the run-up to the credit crisis, the BIS's assessment will carry

weight with governments. It says: "The lack of progress threatens

to prolong the crisis and delay the recovery because a dysfunctional

financial system reduces the ability of monetary and fiscal actions

to stimulate the economy."

It also expresses concern about the dilemma facing policymakers

on when to start reining in the recovery. "Tightening too early

could thwart the recovery, whereas tightening too late may result

in inflationary pressures from the stimulus in place, or contribute

to yet another cycle of increasing leverage and bubbling asset prices.

Identifying when to tighten is difficult even at the best of times,

but even more so at the current stage," it says.

Also, the WSJ has an article on the incredibly shrinking PPIP:

Wary Banks Hobble Toxic-Asset Plan

I think the stress tests showed that the U.S. should have pre-privatized

BofA, Citigroup and GMAC. Oh well ...

Scrooge McDuck ()

Sorry,

CR, but got

pigged

States Turning to Last Resorts in Budget Crisis

"All but four states must have new budgets in place less than two

weeks from now — by July 1, the start of their fiscal year. But most

are already predicting shortfalls as tax collections shrink, unemployment

rises and the stock market remains in turmoil."

"In all, states will face a $121 billion budget gap in the

coming fiscal year, according to a recent report by the National Conference

of State Legislatures, compared with $102.4 billion for this fiscal

year."

"As a result, governors have recommended increasing taxes and fees

by some $24 billion for the coming fiscal year, the survey found. This

is on top of more than $726 million they sought in new revenues this

year."

http://www.nytimes.com/2009/06/22/us/22states.html?bl&ex=1245816000&en=6...

Faber is too simplistic and he was often wrong... Most respectabe

forecaster do not hyperinflation at least for several next years (2009-2012)...

June 25, 2009 | moneyshow.com

A: I'm not sure that the risk/reward now is particularly favorable.

The inflationary school of thought says the Federal Reserve has no other

option but to print money, and that will lift asset prices. The Standard

& Poor’s 500 could get to 1,000 or 1,100 or depending on how much money

they print, possibly even higher than that.

Between March and today, the S&P is up 40%, and in an environment

of zero interest rates, that's a huge gain. Many of the resource stocks

we were recommending in November and December have tripled. So, maybe

we have for two or three months now a reversal in expectations, where

people suddenly realize that maybe the economy doesn't recover a lot

and that deflationary pressures are still there. But if the S&P was

to come down to 800 or 750, the Fed would probably increase its money

printing activity. So, I kind of doubt that we'll see new lows.

Q. You've warned that US risks Zimbabwe-style hyperinflation and

then more recently said US inflation could reach 10% to 20% in five

to ten years. Isn't there a big gap between those outcomes?

A. We have the worst recession since the Second World War and actually

the prices of necessities are still rising, including food and energy.

So, one day within the next ten years, when the economy slowly recovers

and when further dollar weakness occurs, inflationary pressures will

increase. And once you have inflation increasing, it's not easy to stop

it unless you implement tight monetary conditions, which would imply

very high real interest rates. And I don't think that Mr. Bernanke or

the US government have any intention whatsoever of having positive real

interest rates. Combine easy monetary policies with large fiscal deficits,

and the likelihood of much higher inflation is there. Once we go to

10% inflation, 20% becomes quite likely and once we go to 20%, we can

easily go into hyperinflation.

While the CRB index is flat on the week, the implied inflation rate

in the 10 yr TIPS has fallen 22 bps this week to 1.71%, the lowest since

May 20th. It also coincides with the conventional 10 yr bond yield falling

to the lowest since May 25th on the heels of the three solid bond auctions

this week. Why is this? Inflation fears got ahead of itself (the y/o/y

May PCE rose just .1% today)? The FOMC, while maintaining their current

QE program, didn’t add to it and they also believe that inflation will

remain subdued for some time due to ’substantial resource slack’? Yesterday’s

jobless claims data has traders worried again about the economy and

the labor market and the deflationary implications, notwithstanding

the upside surprise in durable goods orders on Wednesday? Or is it just

a consolidation of the sharp move higher in inflation expectations over

the past few months?

From trucking data it looks pace of decline is diminishing and we might

be approaching the point of stabilizing the economy on a new lower

level... But the USA may need to see consumption

drop significantly before we can achieve a sustainable position.

CalculatedRisk

From the American Trucking Association:

ATA Truck Tonnage Index Increased 3.2 Percent in May

... ATA Chief Economist Bob Costello said the month-to-month

improvement was encouraging, but cautioned that tonnage is unlikely

to surge anytime soon. “I am hopeful that the worst is behind us,

but I just don’t see anything on the economic horizon that suggests

freight transportation is ready to explode,” Costello said. “The

consumer is still facing too many headwinds, including employment

losses, tight credit, rising fuel prices, and falling home values,

to name a few, that will make it very difficult for household spending

to jump in the near term.” He also noted that

he doesn’t expect tonnage to deteriorate

much further and that any growth in tonnage over the next few months

is likely to be modest.

... ... ...

Trucking serves as a barometer of the

U.S. economy, representing nearly 69 percent of tonnage carried

by all modes of domestic freight transportation, including

manufactured and retail goods

CalculatedRisk

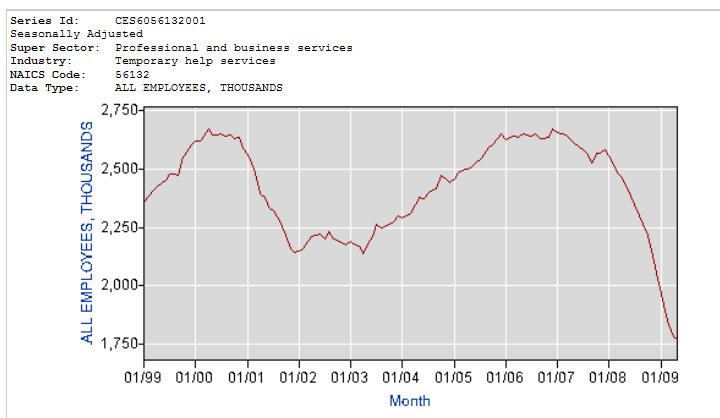

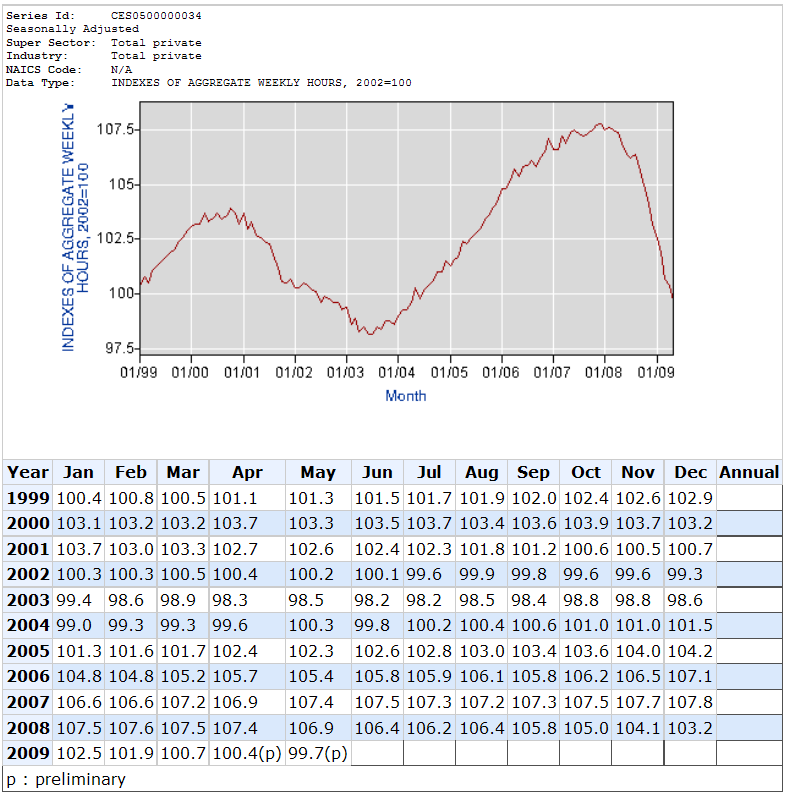

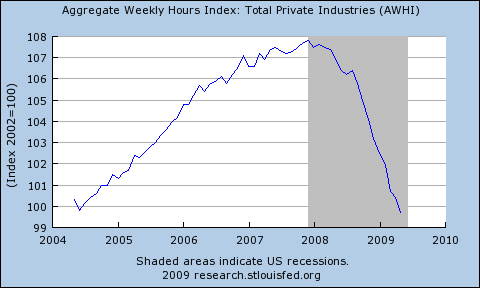

There are many reasons for the rising delinquency rate. Earlier today

we discussed some

new research suggesting a number of homeowners with negative equity

are walking away from their homes ("ruthless default"). There are also

negative events that can lead to delinquencies - like death, disease,

and divorce - but one of the main drivers

is probably loss of income.

6/27/2009 | CalculatedRisk Here is an interesting new paper on homeowners

with negative equity walking away:

Moral and Social Constraints to Strategic Default on Mortgages by

Guiso, Sapienza and Zingales. (ht Bob_in_MA)

The WSJ Real Time Economics has a summary:

When Is It Cheaper to Ditch a Home Than Pay?

The researchers found that homeowners start to default once their

negative equity passes 10% of the home’s value. After that, they

“walk away massively” after decreases of 15%. About 17% of households

would default — even if they could pay the mortgage — when the equity

shortfall hits 50% of the house’s value, they found.

...

“Our research showed there is a multiplication effect, where the

social pressure not to default is weakened when homeowners live

in areas of high frequency of foreclosures or know others who defaulted

strategically,” Zingales said. “The

predisposition to default increases with the number of foreclosures

in the same ZIP code.”

... ... ...

I think one of the key points in the research are changing social

norms - the more people a homeowner knows that he believes "walked

away" the more open the homeowner will be to mailing in their keys.

This is what I

wrote in 2007:

One of the greatest fears for lenders (and investors in mortgage

backed securities) is that it will become socially acceptable

for upside down middle class Americans to walk away from their

homes.

This research suggests that this is happening in significant numbers.

Thus, first some proposals on altering the foundation of our economic

and financial system:

- Tightly regulate money supply by linking its growth to renewable

energy and the creation of a Sustainable Economy. That's

my Greenback proposal.

- Start actively dismantling the Permagrowth Economy. Some suggestions

could be to tax "black" energy heavily, cap and trade greenhouse

gas emissions and impose a national Value Added Tax (VAT) on all

transactions.

- Place the financial sector back at the "tail" of the economy,

where it belongs; it is the dog that should wag its tail, not the

other way round. One example would be to gradually increase reserve

ratios and capital requirements for banks (e.g. Tier I capital to

20%).

- Cease all financial sector bailouts and, where practicable,

ask for the government's money back, with interest.

Taking a firm position in an ongoing debate in the financial markets,

Buffett says he's not concerned about deflation, but thinks inflation

will be a problem in coming years.

TRANSCRIPT

BECKY: It continues to be? You

don't think any of the urgency has come away?

BUFFETT: No, I don't think the urgency has come

away. The urgency has moved away from a total meltdown of the

financial sector which we faced last fall. I've never seen anything

like that. But I would give enormous credit to the people there.

(Federal Reserve Chairman) Bernanke did a fabulous job. We were

right at the point where people lost faith in money-market funds, when

commercial paper stopped being issued. People would be having

a problem meeting their payroll, very big companies, if that hadn't

gotten addressed very quickly. And I give credit to people for

doing that. So that part, we've moved past that particular period.

We haven't got the economy going again.

The Coming Collapse of the Middle Class

Distinguished law scholar Elizabeth Warren teaches contract law, bankruptcy,

and commercial law at Harvard Law School. She is an outspoken critic

of America\'s credit economy, which she has linked to the continuing

rise in bankruptcy among the middle-class.

Series: \"UC Berkeley Graduate Council Lectures\" March 2007

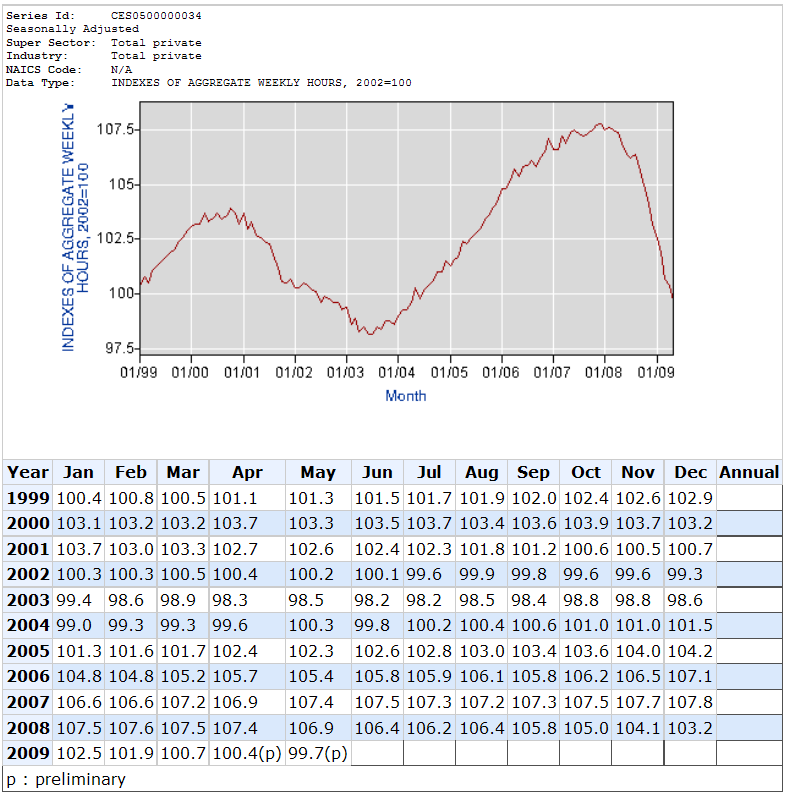

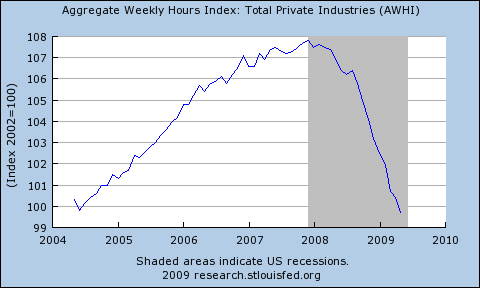

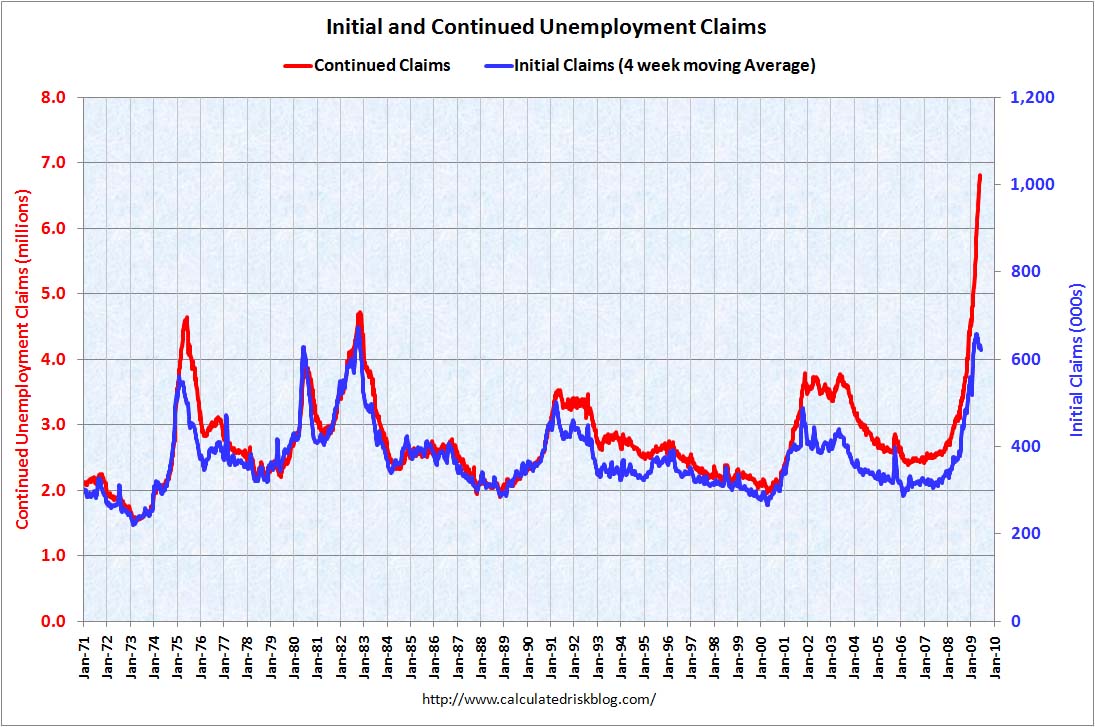

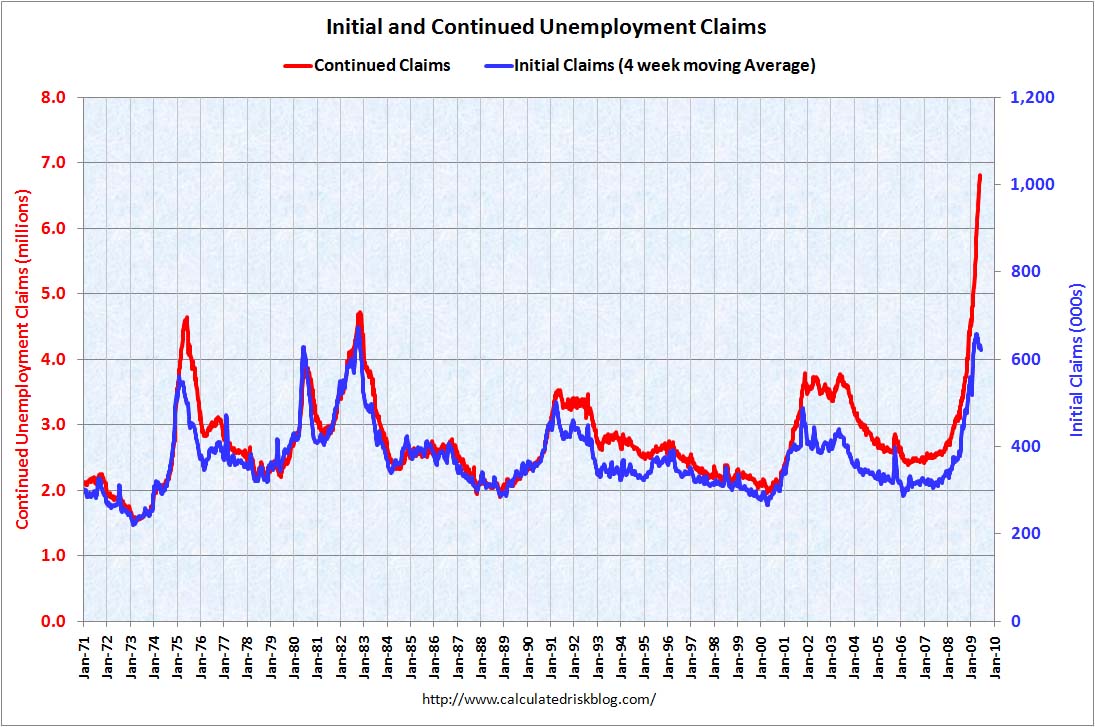

On Monday, we looked at the impact of the Exhaustion Rate on Continuing

Unemployment Claims (See

Continuing Claims “Exhaustion Rate” and

Exhausted Claims part II). Those charts and tables made it clear

that Continuing Unemployment Claims were dropping not due to folks getting

jobs, but simply using up all of their benefits.Wednesday, we learned

of a)

record credit card chargeoffs and Increasing minimum Credit Cards

payments from

2% to 5% at Chase.

Now, lets see what happens if we can put those two together:

- dead hobo Says:

June 25th, 2009

Charge offs hit a 10% annual rate and may go to 12% soon. In

personal terms, this is an indication of a lowered quality of life.

After reading the below link about the history of GS, I can only

do two things

1) Want to start punching people

2) Campaign for chargeoff rates to go from 10% - 12% to as much

as you fricken don’t want to pay off. These banks don’t care about

anyone but themselves. Why should anyone who is feeling a little

crimped worry about paying them off? They’re all criminals and don’t

play using the same rules. Why should those who are paying the highest

prices care about these thieves?

http://zerohedge.blogspot.com/2009/06/goldman-sachs-engineering-every-major.html

At this time, almost everything in finance is a rigged came,

courtesy of Uncle Stupid and clever crooks of finance, with help

from an incompetent and often complicit media.

- call me ahab Says:

June 25th, 2009 at 9:09 am

dh Says-

“Why should anyone who is feeling a little crimped worry about

paying them off? They’re all criminals and don’t play using the

same rules.”

I have made this same point- hostility against the banks may

get to the point that folks who would normally want to do the right

thing will just tell the credit card issuers to screw themselves

and quit paying- where is their special treatment?- where is their

bailout?- especially now with record bonuses being reported-

here are the keys to my house- thank for the 2 or 3 years I lived

in it . . .oh . . .and by the way, those credit cards- I won’t being

paying those in the future either

- dead hobo Says:

June 25th, 2009 at

I’m feeling especially pessimistic this morning. I’m starting

to think that talk of a recovery in a few months is completely wrong.

We’re on a plateau on our way down to the new normal.

1) Massive CC charge off rates forecast to go higher

2) High unemployment compensation exhaustion rate likely to go

much higer

3) Massive initial claims and both increasing massive continuing

claims

4) Poor real estate market

5) Poor retail sales

6) Recent stock market increase probably partially due to liquidity

injection into markets for the purpose of making it easier to sell

new bank stocks at best prices. Fed injected liquidity possibly

gone.

7) Durable goods orders up BUT shipments, inventory and backlog

down substantially. Orders much less than shipments. A growing market

would show orders exceeding shipments and an increasing backlog,

just like any growing business would show. Inventories not being

replenished.

Massive continuing failures in auto business

9) Transportation companies describing dismal current and dismal

expected future conditions

10) Speculator driven high oil prices, choking the economy of

sustainable life

11) I can’t find even ONE good thing that points to growth, with

the possible exception of people changing behavior and downsizing

their consumption behavior, improving the business of low price

substitutes. If any real green shoots exist that have real economic

effect, please enumerate.

I’m at a loss to see a green shoot here. I think a new level

of down is coming. Once computers lose interest in jiggling the

stock markets, look out below.

Right now, the market is very tough. But in two years, or at most

three years, it will recover so we want to make sure we have the means

to meet demand then," said Niimi, who heads manufacturing operations

in Toyoda's new-look executive team.

"The company will have to learn to adjust to this new paradigm of

lower sales growth and higher technology spending. But they are definitely

in a better position than U.S. companies to do so," said Yoji Takeda,

a Hong Kong-based vice-president with RBC Investment Management (Asia)

Ltd.

In the United States, Toyota's biggest and until recently most profitable

market, its sales have dropped 38 percent year to date.

6/24/2009 | CalculatedRisk

From Bloomberg:

King Says U.K. Recovery May Be ‘Long, Hard Slog’ (ht Jonathan)

“There has to be a risk that it will be a long, hard slog”

because of the problems in the banking system, King told lawmakers

in London today. “I feel more uncertain now than ever. This

is not the pattern of a recession coming into recovery that we’ve

seen since the 1930s. Having an open mind and not pretending

to foresee the future when it’s so uncertain is important.”

...

King said that there’s “not much evidence to change our view” since

the bank released forecasts in May showing that the economy won’t

return to growth on an annual basis until the second half of next

year.Comrade Coinz (homepage, profile) wrote on Wed, 6/24/2009

- 4:58 pm

Someone clearly did not get the memo. Fed says stuff is sorta

OK, no deflation, no inflation. Life goes on, bra.

wrote on Wed, 6/24/2009 - 5:04 pm

OT:

Apparently there is a new branch of the Appalachian Trail that

runs to Argentina.

It's called the Happy Trail...I'll be here all week, folks.

Comrade Coinz (homepage, profile) wrote on Wed, 6/24/2009

- 4:58 pm

Someone clearly did not get the memo. Fed says stuff is sorta

OK, no deflation, no inflation. Life goes on, bra.

Mike in Long Island (profile) wrote on Wed, 6/24/2009 - 5:05

pm From the prior thread(.

Citizen AllenM wrote,

This model was beyond stupid, yet pursued with great vigor.

I think you meant to say

This model preyed upon the stupid and was pursued with visions

of great vigorish yet to be collected.

creditcriminalslovetarp (profile) wrote on Wed, 6/24/2009

- 5:05 pm

maybe he's onto something with that Argentina Happy Trail..

Good for trade..

http://www.surfersvillage.com/gal/pictures/MissReefArgentina640_4.jpg

.Not One Cent (homepage, profile) wrote on Wed, 6/24/2009

- 5:05 pm

We need a hedonic adjustment for British understatement.

Mike in Long Island (profile) wrote on Wed, 6/24/2009

- 5:05 pm From the prior thread(.

Citizen AllenM wrote,

This model was beyond stupid, yet pursued with great vigor.

I think you meant to say

This model preyed upon the stupid and was pursued with visions

of great vigorish yet to be collected.

creditcriminalslovetarp (profile) wrote on Wed, 6/24/2009

- 5:05 pm

maybe he's onto something with that Argentina Happy Trail..good

for trade..

http://www.surfersvillage.com/gal/pictures/MissReefArgentina640_4.jpg

UnrealEstate (profile) wrote on Wed, 6/24/2009 - 5:08 pm

There will be a recovery? I thought the Western Civilization

has been now in the initial stages of the meltdown with the

Globalist pit bulls having a death grip on its throat.

HomeGnome (profile) wrote on Wed, 6/24/2009 - 5:09 pm

Reuters:

World wants "major reserve currencies" stable: China

China suggested in March that the International Monetary Fund's

Special Drawing Rights, or SDRs, could play a role as a future

reserve currency, which would lessen the reliance on the U.S.

dollar as the world's top reserve unit.

A review of the basket is due in late 2010.

2010.

The End, my friend.

Comrade Coinz (homepage, profile) wrote on Wed, 6/24/2009

- 5:11 pm

Since Mervyn is talking macro, I've been trying to figure

out the best indicators to look at for a possible up turn and

to watch for inflation spikes.

Here are main things I am watching:

- Chicago Fed National Activity Index (CFNAI)

- Treasury yield curve

- St. Louis Fed EMRATIO (continuing claims no longer much value)

- Initial jobless claims

- price of oil, gold, and copper

- Case-Schiller home prices

What does everyone watch?

nincompoop (profile) wrote (in reply to...) on Wed, 6/24/2009

- 5:20 pm

Comrade Coinz Best indicators to look for possible up turn?

Unemployment figures only. Forget

about the rest. In addition I want to see unemployment

figures which can be used to determine

where the jobs are coming from. Forget

about unemployment figures being a trailing indicator as who

cares if you are a little late with your assessment.

barfly (profile) wrote on Wed, 6/24/2009 - 5:42 pm

Green Shoots is one of the boldest con games I have witnessed

in my life.

- how does it stack up against WMD in Iraq?

Lucifer (profile) wrote on Wed, 6/24/2009 - 5:41 pm

I thought the great con game started in 1980... it is still

going on.

//"Green Shoots" is one of the boldest con games I have witnessed

in my life. //

Mike in Long Island (profile) wrote on Wed, 6/24/2009

- 5:46 pm

Citizen Allen,

We will have to agree to disagree. Maybe I'm too cynical but

I bet that the majority of those "loss leaders" of unsecured

lending were predicated on a certain percentage of borrowers

running up huge balances and then missing a payment triggering

the penalty rate.

Kind of like the meth dealer who

gives away some product knowing most freebies will result in

return business at much higher margins.

6/23/2009 | CalculatedRisk

Proposals for reform of financial regulation are now everywhere.

The most significant have come from the US, where President Barack

Obama’s administration last week put forward a comprehensive, albeit

timid, set of ideas. But will such proposals make the system less

crisis-prone? My answer is, no. The reason for my pessimism is that

the crisis has exacerbated the sector’s weaknesses. It is unlikely

that envisaged reforms will offset this danger.

At the heart of the financial industry are highly leveraged businesses.

Their central activity is creating and trading assets of uncertain

value, while their liabilities are, as we have been reminded, guaranteed

by the state. This is a licence to gamble with taxpayers’ money.

The mystery is that crises erupt so rarely.

Wolf discusses how it is rational for management and shareholders to

gamble when the risks are asymmetrical (huge potential winnings, limited

losses). And he argues that "creditors ... appear to have lent to a

bank. In reality, they have lent to the state." He also discusses how

tighter regulation isn't enough because the banks will find a way round

the new regulations.

Wolf concludes:

Such a crisis is not only the result of a rational response to incentives.

Folly and ignorance play a part. Nor do I believe that bubbles and

crises can be eliminated from capitalism. Yet it is hard to believe

that the risks being run by huge institutions had nothing to do

with incentives. The unpleasant truth is that, today, the incentive

to behave in this risky way is, if anything, even bigger than it

was before the crisis.

Regulatory reform cannot end with incentives. But it has to start

from incentives. A business that is too big to fail cannot be run

in the interests of shareholders, since it is no longer part of

the market. Either it must be possible to close it down or it has

to be run in a different way. It is as simple – and brutal – as

that.

Talk about pessimism.

Another financial crisis is unfortunately inevitable - all we hope to

do with reform is to put it off for a couple of decades or more.

pavel.chichikov wrote on Tue, 6/23/2009 - 6:01 pm

"A business that is too big to fail cannot be run in the interests of

shareholders, since it is no longer part of the market. Either it must

be possible to close it down or it has to be run in a different way.

It is as simple – and brutal – as that."

Lobbyist Ben Dover wrote on Tue, 6/23/2009 - 6:02 pm

It is not abnormal to over do it a bit. It is totally abnormal to put

a blind eye to the most basic signs of theft. Our Federal regulators

and politicians are the real crooks for not doing the slightest discipline

or for not warning of what was taking place!

Amen.

Counterpointer wrote on Tue, 6/23/2009 - 6:09 pm

There was no meaningful reform after the Asian Crisis, related to global

systemic weaknesses, but there were one hell of a lot of meetings and

new acronyms created. Countries had already gone national, G-L-B as

a rather good example. IMF multilateral surveillance was a late run

to address the impending bubble. No systemically important regulator

had the remotest intention of seeing that it worked.patientrenter

wrote on Tue, 6/23/2009 - 6:11 pm

Martin Wolf is correct, I am afraid. We have responded to a problem

by making its causes worse. Investors (including people who buy homes

for well over twice their income) no longer bear the full risks of their

decisions. Taxpayers and savers (through the subtle tax created by future

inflation)

pick up the tab for many of the losses. This was what created the bubble,

and now we have expanded, formalized and institutionalized the process.

This fix will last for a shorter time than the last one, and the next

fix after that will last for an even shorter period, and so on, until

all credibility is lost and real (lasting, sustainable) solutions must

be developed.

Far from some inevitable, harmless evidence of progress, this increase

in risk transfer is a mistake. It's an avoidable mistake as much as

Greenspan's extended cheap money policy was an avoidable mistake.

Lucifer

How kind of them..

banker= worker

__________________

Citigroup Is Said to Be Raising Pay for Workers

http://www.cnbc.com/id/31514432

By: Eric Dash, The New York Times | 23 Jun 2009 | 08:56 PM ET Text

Size

After all those losses and bailouts, rank-and-file employees of Citigroup

are getting some good news: their salaries are going up.

The troubled banking giant, which to many symbolizes the troubles

in the nation’s financial industry, intends to raise workers’ base salaries

by as much as 50 percent this year to offset smaller annual bonuses,

according to people with direct knowledge of the plan.

Lucifer> wrote on Tue, 6/23/2009 - 6:39 pm

But we rewarded them for lying and scamming us..

_________________________________________

The 86 Biggest Lies On Wall Street

http://www.cnbc.com/id/31491232/

Posted By:Gloria McDonough-Taub

In his newest book, The 86 Biggest Lies on Wall Street, John R Talbott

answers my question first by writing, "I know what you're thinking,

how was I able to narrow down the number of lies to just eighty-six."

Here are some samples from the "Biggest Lies on Wall Street"

Going into the current crisis, the American economy was the strongest

and most resilient in the world

This was simply a subprime mortgage problem that no one could have foreseen

Like the Great Depression, this is primarily a liquidity problem, and

injecting cash into the system will solve it

CEO pay is deserved because it is determined in a highly competitive

market

Excessive regulation is not needed in the financial markets because

anyone who is harmed can seek redress in the courts

Government regulation is bad for economic growth and prosperity

pavel.chichikov wrote on Tue, 6/23/2009 - 6:42 pm

"In his newest book, The 86 Biggest Lies on Wall Street, John R Talbott

answers my question first by writing, "I know what you're thinking,

how was I able to narrow down the number of lies to just eighty-six."

But when lies are compulsive and compulsory, it means that reality

is sliding out of our grip. Compulsive drinking, compulsive gambling

- compulsive banking?

pavel.chichikov

"I see, Pavel. You are afraid that circumstances that would cause the

general populace to lose faith in ever-larger doses of our current financial

medicines would also lead to social breakdown."Not quite, patientrenter.

I believe it's social break down that's leading the financial crisis.

"I think that people here in the US have enough remembered history

of individual economic responsibility to come to their senses when the

carrots stop coming even as they keep pushing the "easy food" button."

I hope you're right.

dryfly wrote

Regulations are useless (anyway the regulations that Obama wants).

Do you think that it's regulations that kept 1929 from happening for

80 years? No it's psychology. The bust turned out so bad that market

participants became very

risk averse.The bigger the bubble, the bigger the bust

(and in this respect the bubble of the 20"s was a picnic compared to

today). Odds are that the outcome will be so bad that such a crisis

will not happen again before, a long, very long time.

Regulations are like traffic laws - they only work if the population

wants to makes them work [i.e. the psychology]. After the depression

almost all market participants wanted to make them work... the few that

didn't were constrained by enforcement of those 'useless regulations'.

By the 80s the majority of participants wanted those useless regulations

thrown aside and didn't remember why they were there in the first place.

They got thrown aside. They now why they were there.

Lucifer wrote on Tue, 6/23/2009 - 6:52 pm

"Experience keeps a dear school, but fools will learn in no other"

_________________________________________________________

By the 80s the majority of participants wanted those useless regulations

thrown aside and didn't remember why they were there in the first place.

They got thrown aside. They now why they were there.

ghostfaceinvestah wrote on Tue, 6/23/2009 - 7:01 pm "REGULATE

THE MORTGAGE INDUSTRY

30 yr fixed, 20% down on EVERYTHING."

Amen to that, Danny. That one simple step would be a huge step in

avoiding another housing bubble.

Ain't gonna happen, unfortunately.

Lucifer wrote on Tue, 6/23/2009 - 7:03 pm

It will work out that way.. eventually.//Why can't you all just accept

that everything is for the best in this the best of all possible universes.//

patientrenter wrote on Tue, 6/23/2009 - 7:05 pm

"They are failing today just as then... we can't cover them all or

even cover some of them all the way. We aren't halfway through this

pain fest."

In the 1930's, when banks failed, the people who put their money

into them lost some of it. Not true today. It really is different today.

Oh, and another amen to the 30 yr fixed, 20% down on everything comment.

With that one change, our housing market would be almost normal again.

But the house price gain orgy would be well and truly over for 2/3 of

our population. The end of the biggest

free lunch scheme ever hatched. So, it ain't going to happen.

Lucifer wrote on Tue, 6/23/2009 - 7:06 pm

You mean, common people should be more moral than banksters or businessmen?

Why?

//When people decided they wanted it, deserved it NOW.//

ghostfaceinvestah wrote on Tue, 6/23/2009 - 7:07 pm

"Going into the current crisis, the American economy was the strongest

and most resilient in the world"

Agreed, anyone who still believes the US economy is/was the strongest

and most resilient in the world needs to think some more.

The real joke though is how, during the Asian crisis, people like

Geithner et al went around and lectured the Asians on how to run their

economies.

No wonder they are trying to bail on our currency and economy today.

ghostfaceinvestah wrote on Tue, 6/23/2009 - 7:08 pm

"A resonance phenomenon? "

I think so, brought to you by a pure fiat currency and fractional

reserve banking.

Lucifer ()

Respectibility of western thought and people is one of the biggest

casualty of this crisis.

//The real joke though is how, during the Asian crisis, people like

Geithner et al went around and lectured the Asians on how to run their

economies.//

Lobbyist Ben Dover wrote on Tue, 6/23/2009 - 7:12 pm

Twenty percent down will show also the home prices are to high. Flake

financing has created the need to pump people into homes they can not

responsibly afford. Bang we have a warped reality!

Lucifer wrote on Tue, 6/23/2009 - 7:21 pm

Is UBS not leveraged 50x and > 4X the GDP of Switzerland? Do they

have any credibility? Does anyone big have any credibility left?

//UBS cuts Swiss Life to "sell"//

km4 wrote on Tue, 6/23/2009 - 7:25 pm

What .....you mean financial (

ponzi scheme ) engineering of the US economy is not sustainable

going forward

Anak wrote on Tue, 6/23/2009 - 7:37 pm

Who was it some time ago who opined that in future banking should

be no more exciting and remunerative than a public utility?

Lucifer ()

Many have opined that.. including Taleb.

//Who was it some time ago who opined that in future banking should

be no more exciting and remunerative than a public utility?//

Comrade Dazed and Amused wrote on Tue, 6/23/2009 - 7:42 pm

josap (profile) wrote on Tue, 6/23/2009 - 9:04 pm

Lucifer

The problem started not because of infaltion. During the high inflationary

times we just bought less or on sale only. Still no credit card.

When people decided they wanted it, deserved it NOW. And credit card,

TV rental companies figured out how to give it to them. That was the

begining of the end.

Marketing helped, allot. All the you "deserve it" commercials, the

"you can have it now" ads.

In 1994 I started a business in Mexico. After the peso devaluation

in Dec 1994, I lost everything, including my house in the US and $40k

in credit card lines of credit. It was the most liberating experience

of my life because it forced me to live on a cash-only basis. You really

CAN live on cash only. It forces you to evaluate very purchase, and

to plan what and where you are going to spend your hard earned cash

on.

I think this is something that many people in the US are going to

have to come to grips with soon. "You can have it now" is going

to become "You can have it when you pay off the lay-away".

Life will go on. It's just the transition that will be painful.

broward wrote on Tue, 6/23/2009 - 7:57 pm

Their debit is my credit. Folks will get it soon enough.

---------

"Survival of the fittest" don't work so good when your lifeline is

tied to the guy you put out of work.

Rob Dawg wrote on Tue, 6/23/2009 - 8:03 pm

Tech bubble -> housing bubble -> government debt bubble.

I knew an old lady, she swallowed a fly...

peAk wrote on Tue, 6/23/2009 - 9:04 pm

Credit cycle becomes increasingly unstable as debt gets larger

and larger..

Historians will note that while the credit-collapse was swift,

the ensuing fall in asset prices was anomalously slowed, intentionally

by those seeing the danger of liquidation and undertaking to disguise

the reality of the price drops so as to discourage self-reinforced

selling, and unintentionally by those who hopefully or ignorantly

expected buying and lending to re-emerge at each new low. The antidote

to the credit-asset-price-collapse contagion will prove to have

been the liquidation of non-distressed business and personal assets,

even at decreasing "below-market" levels, and the preservation of

cash in whatever forms appeared more essentially durable, but the

remedial solution will have remained invisible to almost all, hiding

in plain sight.

June 22, 2009 | Yahoo(ETFguide.com)

Is the worst over? It's an open-ended question that solicits many

diverse opinions but none that yields any clear answers. And no matter

how good the thesis sounds about which way the market is headed, the

future is forever unknowable. What does this mean for your investment

portfolio?

Not knowing the future is hardly an endorsement for leaving your

investments up to chance.

Even during difficult economic periods and directionless markets,

it's possible to achieve profitable results. For example, four of ETFguide.com's

live model ETF portfolios have outperformed major benchmarks like the

S&P 500 (NYSEArca:

SPY -

News) and the MSCI EAFE Index (NYSEArca:

EFA -

News) on a year-to-date basis. What does it prove? Getting the correct

mix of assets inside your portfolio still works. Desirable results don't

typically happen by accident.

What can you do to prepare your money for the next market decline?

Let's evaluate three simple strategies.

Avoid Financial Puberty

'Financial puberty' is a term I invented to describe a state of financial

immaturity that prevents people from prospering. The three main aspects

of financial puberty are:

- Having behavioral disorders counterproductive to successful

investing;

- Having limited or no education about the realities of successful

investing, and

- Having a distorted investment philosophy or having no investment

philosophy at all.

Do you have symptoms of financial puberty?

One way to know is through self-examination of your attitudes. For

example, many investors have adopted a defeatist attitude. 'If my neighbor's

portfolio is down 60% and mine is down 50%, I'm not gonna complain,'

they tell themselves. Other investors have become callus to risk. They've

convinced themselves, 'My portfolio is down so much, I need to take

on more risk to earn back my losses.'

In both cases, this kind of flawed reasoning is rooted in financial

puberty, an all encompassing self-destructive characteristic.

Remember: This isn't 'Play Money'

Entrusting your money to investment managers is no guarantee

of success and sometimes results in full-blown disaster. Not realizing

this caught many people by surprise.

In 2008, the Oppenheimer Core Bond A (Nasdaq:

OPIGX -

News) cratered 35.83% yet the Barclays Aggregate Bond Index as tracked

by Vanguard's Total Bond Market ETF (NYSEArca:

BND -

News) climbed 5.17%. How long

will it take Oppenheimer's bond fund shareholders to make up that 41%

deficit?

'Thousands of parents of college-age children who thought their college

savings were sheltered in low-risk portfolios watched their accounts

shrink last year after a bond fund (Oppenheimer Core Bond Fund) offered

by at least four state 529 plans lost more than a third of its value,'

reported the USA Today. OPIGX was offered by 529 plans in Oregon, Texas,

Maine and New Mexico.

What if 529 state administrators in charge of this mess had enough

sense to just use low cost index funds or index ETFs? Is it possible

they could have protected college savers from the nightmare scenario

they're now facing? Treat your money and invest your money like you

care. It isn't play money.

Be Alert, Stay Vigilant

Nothing can be more dangerous to a soldier's safety than his or her

own complacency. Sometimes when it appears everything is calm and safe

is right when the enemy strikes! From an investment perspective, being

inattentive, apathetic or lazy could cost you a bundle.

Towards the end of February and early March, the downtrend for the

Nasdaq Composite began to slow (NasdaqGM:

ONEQ -

News). Much earlier the Dow and S&P 500 had already dropped significantly

below their 2008 lows, whereas, the Nasdaq did so much later and to

a smaller degree, which indicated a shift towards riskier stocks.

This, along with a composite of other indicators, led the

ETF Profit Strategy Newsletter to issue a Trend Change Alert on

March 2nd, only four days before the S&P 500 bottomed on March 6th.

Along with a number of ETF profit strategies for conservative, moderate,

and aggressive investors, the alert forecasted the following: 'A multi-month

rally, the biggest rally since the October 2007 all-time highs, should

lift the indexes by some 30-40%. Tuesday's 4% spike may be an indication

of the initial intensity of the rally.' Being alert to this reversal

in stock prices paid off. For aloof investors, they were too busy doing

nothing to notice.

What's Your Action Plan?

This is not the friendly stock market of a few years ago. Combining

today's bear market and economic recession with the wrong investment

philosophy will inevitably lead to financial disaster. Millions of investors

have lost more far more of their wealth than they expected to lose.

And millions more will join them. What will you do?

If the stock market has trashed your portfolio, isn't it time you

made the necessary changes to get your money back on track? Avoiding

financial puberty, treating your money with care and staying alert are

three simple steps to preparing your money for whatever lies ahead.

Taipei Times

...much of the rise is not justified, as it is driven by excessively

optimistic expectations of a rapid recovery of growth toward its potential

level and by a liquidity bubble that is raising oil prices and equities

too fast too soon. A negative oil shock, together with rising government-bond

yields — could clip the recovery’s wings and lead to a significant further

downturn in asset prices and in the real economy.

Jun 21, 2009"Decidedly the worst (of the crisis) is already behind

us," said Soros, a 78-year-old Hungarian-born American with Jewish roots.

He did not elaborate but went on to stress the uniqueness of the

current economic turmoil.

"This is not like previous crises but marks the end of an era. The

system to date had been based on the false assumption that markets can

independently regain their equilibrium and that the system is self-correcting,"

he explained

By Chris Reiter

June 20 (Bloomberg) -- Chancellor Angela Merkel said the slumping

German economy has nearly hit bottom and will unlikely recover quickly,

the AP reported, citing a speech she made in Berlin.

The chart of the German economy may look more like a “bathtub”

than a “V” as output stagnates before recovering, she said, according

to the news agency. “I hope it is a children’s bathtub and not a bathtub

for people with particularly long legs,” Merkel is quoted as saying

by the AP.

[Jun 21, 2009]

Buyers Fatigue? By Barry Ritholtz

June 20, 2009 | The

Big Picture

Some 15 weeks after the March 666 lows, indices are 40% higher. After

that sprint, might the buyers be suffering from some fatigue? Are the

markets now fully reflecting a second half recovery?

Are we priced for perfection?

Those questions are looked at in

Barron’s Up & Down Wall Street column this week:

“There were hints, as well, that bullish sentiment, which for

a spell remained fairly constrained, had escalated to something

approaching euphoria. Investors Intelligence readings of advisory

sentiment showed most of these supposed savants, who often function

best as contrary indicators, have come a bit late to the party;

in recent weeks, the percentage of bulls among them have registered

in the mid-40s, compared with the low 20s for the bears.

Moreover, trading took on a distinctly more speculative tone,

with small stocks chalking up big gains despite their conspicuous

lack of very much in the way of sales and nothing in the way of

profits or prospects. And perhaps the most persuasive evidence of

the gamier spirit abroad in Wall Street is that, despite the mounting

demolition of the commercial-property market, Morgan Stanley plans

to sell re-securitized commercial mortgages.

Which, as one portfolio pro acidly observed to Dow Jones Capital

Markets, amounts to peddling tarnished assets nicely repackaged

with higher ratings. That kind of thing has been going on in residential

asset-backed securities in recent months, presumably fueled by the

notion that the housing decline has bottomed. But that it now has

spread to commercial mortgages when things are getting notably worse

is clear indication that the mind-set and, indeed, some of the very

stuff that got us into such a jam is back. Alas.”

Hence, the expectation that the rally may have run its course, and

is heading south.

That seems to be too pat for Mr. Market, who delights in confounding

everyone. A more frustrating course of action would be to back and fill

— but not collapse –and keep going up (albeit at a slower

pace) after some digestion over the summer months. Sucker some

more people in, only to retest the lows in September / October period.

That’s just my guess . . .

Selected Comments

constantnormal Says:

June 20th, 2009 at 10:26 am “…only to retest the lows in September

/ October period”

Not in the October-November period?

That seems to be more the norm for fall excitement.

Of course, it will happen once the last bear has thrown in the

towel and there are no more people to serve as buyers … so it could

be September / October … of 2010.

dead hobo Says:

June 20th, 2009 at 10:34 am And exactly who is going to be buying?

Computers will continue daytrading with each other and some hedgies

will try to live up to the image of their talking head personnas.

Rumored Fed backed financial programs might add more liquidity via

helpful iBanks in an effort to jump start the economy via the wealth

effect. A few risk chasers who prefer the stock market over Vegas

will stay at it.

Ma and Pa aren’t coming back. Most people who had money just

hope to get more of it back. It would take a special kind of stupid

to lose 40% of your life savings and then withdraw from the bank

account to replenish the brokerage account.

The pumpers are now probably in a maintenance mode. They likely

hope green shoots propaganda will bring out the stupid again. Maybe

if some magic charts can be jazzed up, people will think they control

the world and wealth is assured if they only buy another ticket.

I’ll buy the next big big dip, but not before. Maybe the pumper

can run it past S&P 1000 next time. (I bet they’re too chicken shit

to manufacturer some ranges to trade). Meanwhile, I am hearing stories

of affluent people taking their cash and paying off major debts.

Pundits who are waiting for the mobs to return are disconnected

with reality.

Chief Tomahawk Says:

June 20th, 2009 at 10:40 am EJ over at Itulip believes the Fed

will cause a market selloff on their first attempt to remove liquidity

from the system. But yet feels the averages will end the year more

or less where we are now.

cvienne Says:

June 20th, 2009 at 10:53 am The bears certainly see excessive

valuations in equities at the moment…(and I think the S&P has most

likely put in an interim top - or very close to it)…

But when I consider the “nature” of the sell-offs during the

‘08 - early March ‘09 time periods…Much of it was liquidation from

over leveraged positions…Which was why the velocity was so high…

Right now, if the system is simply OVERBOUGHT (as opposed to

overbought & over levered) - we may not see the severity of declines

on pullbacks the way we have in the past year…Although I believe

the market will trend lower (and for a long time) from here…

There may be instances where someone gets in trouble (and/or)

if there’s an EVENT which prompts a steep selloff, but I see the

possibility of opportunistic buying coming in on those events…It’ll

most likely be a TRADERS market for the next two years with a downward

glidepath…

The other part is going to be the bond market…I

see that any time the 10 year gets above 4% (and perhaps on occasion

they’ll let it go to 4.5%), then you’ll see money shift there while

equities correct, then maybe reverse…

ON PAPER - What I describe above may seem smooth & orderly…The

fly in the ointment is going to be how long the economy can actually

hang on before a huge crisis in DEFAULTS (on everything - credit

cards - CRE - munis - ARM resets) causes the next liquidity squeeze…

So the markets may operate in a fashion that attempts to DENY

those problems until they actually start hitting OPERATIONS in the

gonads…

some_guy_in_a_cube Says:

June 20th, 2009 at 11:22 am

The market can be expected to fool nearly all of the people nearly

all of the time. This is a game where the many losers fund the outsized

gains of the few winners.

And the winners have nothing going for them other than dumb,

stupid luck.

~~~

BR: Gee, that Jim Simons of Renaissance is pretty lucky — 40%

returns for 30 years.

call me ahab Says:

June 20th, 2009 at 11:22 am

dh-

however- commodities will be dependent on a weakening $ and heavy

inflation expectations- when it is realized that it is deflation-

the air will blow out of commodities- I don’t foresee Americans

being able to continue with their excessive ways- and all the the

junk that is made has to be bought by someone-

also- I honestly believe that markets are manipulated by the

Fed and market players to create bubbles with approval from the

USG- if only for the reason to forestall total implosion

Partnoy is a skilled and often very funny writer, and he sets forth

in detail that a layperson can understand how some of the products worked

and what the economics to the firm were. But the centerpiece is the

lurid, shameless, but prized for its productivity culture.

... ... ...

Even though Partnoy's book is now more than a decade old, I'd assume

things have not changed very much. The internal banter may more civil,

the predatory imagery less open, but I'd suspect that

customers are still viewed as sheep to be

sheared. Or worse.

“If another decline in the market is going to bankrupt you or put

you out of business or destroy your retirement account, you should not

go back into the stock market,” said

John C. Bogle, the founder of Vanguard and viewed by many as the

father of index investing. “It’s not complicated. The stock market can

go up and down a lot and nobody really knows how much and when.”

What’s worked for Mr. Bogle may not work for you, but his method

isn’t a bad place to start. “I have this threadbare rule that has worked

very well for me,” he said in an interview this week. “Your bond position

should equal your age.” Mr. Bogle, by the way, is 80 years old.

... ... ...

As to those investors who got out of stocks, Mr. Bogle said it might

be time for some of them to get back in. “But I would take two years

to do it,” he said. “Maybe average in over eight quarters, and do an

eighth each quarter. I am just not in favor of doing things in a hurry

or emotionally.”

And then? “Don’t touch it,” he said, emphatically. “One of my rules

is don’t do something. Just stand there.”

... ... ...

There are different ways to invest your cash and bond holdings.

Rick Rodgers, a financial planner in Lancaster, Pa., invests 10 years

of annual expenses in a bond ladder, with an equal amount coming due

every six months. The ladder can include high-quality corporate bonds,

Treasury notes, certificates of deposit or

municipal bonds, depending on the retiree’s tax bracket. Mr. Simon

takes a similar approach using a 15-year ladder of zero-coupon bonds.

He says that investors can start building the ladder in their 50s, with

the first rung coming due the year they retire.

MrM ()

MLM -

Thanks for taking a stab at the estimates. Based on your back of

the envelope, states will need to raise more $200 Bil in tax to plug

holes in their budgets. This is actually quite close to the total amount

of 2009-10 tax refunds to individuals in

the stimulus package.

Then there is also the shortfall of real estate taxes hitting municipalities.

I think of this as yet another reason why people like Krugman and

Roubini view the stimulus packages as inadequate.

Then again - where can the government take all this money short of

the printing press?..

Jun 10, 2009 | Asia Times

Productivity growth, the most mysterious

of economic statistics, was announced on Thursday for the first quarter

of 2009 - revised upwards from 0.8% to 1.6%.

After a quarter century of stellar growth from 1948 to 1973, productivity

growth suddenly collapsed and remained low for the next decade.

Then after 1982, it recovered somewhat, accelerating further slightly

in the middle 1990s, although still not to its 1948-73 level.

6/20/2009 | CalculatedRisk

From Bloomberg:

GE Vice Chair Rice Sees No ‘Green Shoots’ in Orders (ht Comrade

de Chaos)

shoots group yet,” [General Electric Co. Vice Chairman John] Rice

said ... “I have not seen it in our order patterns yet. At the macro

level, there may be statistics suggesting the economy is starting

to turn. I am not seeing it yet.”... ... ...

“We see a world where good companies and good consumers can’t

get all the credit we would like,” Rice said. “Companies with lots

of cash on their balance sheet are worried about whether they will

get what they need for working capital” and are cutting spending.

“Until that changes I don’t think you will see a significant

rebound,” Rice said. “We are preparing for 12 or 18 months of tough

sledding.”

Maybe the cliff diving is over, but no green shoots ....

Personal income fell in 37 states in the first quarter, according

to estimates released today by the U.S. Bureau of Economic Analysis.

Most of the states where income rose were in the Southeast.

June 16, 2009 | Sudden Debt

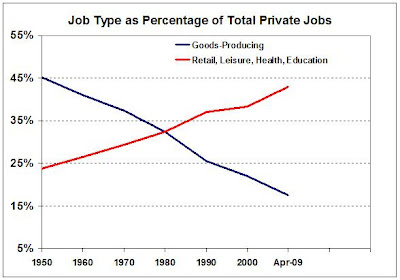

This blog's position has always been that the US economy's performance

post-2000 has been due to ever-increasing assumption of debt, particularly

by households to finance real estate purchases and personal consumption.

I don't think anyone can dispute this any more: just look at the chart

below.

(...deleted...)

Debt kept accelerating while GDP remained "stuck" at around 5% annually

(these are nominal figures). In the end, the debt boom created its own

bust and dragged down the entire economy. Cement shoes come to mind...

So, now what? What does the future hold? In particular, I am referring

to corporate profits, the fundamental driver of stock market performance.

We can analyse markets using a multitude of perspectives from astrological

to psychological but, when it's all said and done, what matters is profits.

Since 1997, or so, households assumed ever more debt in order to

consume and, thus, increase corporate profits. At the top in 2006 it

took an additional $1.3 trillion in household debt to generate an additional

$300 billion in profits, i.e. a ratio of 4.3 times

(see chart below).

The debt intensity of corporate profitability

was huge, but it weren't corporations themselves that were going into

debt; it was their customers.

Annual Increases

In Household Debt and Corporate Profits ($ Billion)

We are now deep in a debt-bust crisis and it is

the first time since at least 1953

that household debt is decreasing in absolute numbers, year on

year. What does this mean for corporate profits? Based on the relationship

above, I expect they have quite a bit more to drop, perhaps after a

(very) brief period of stabilization due to cost cutting

(see chart below).

Corporate Profits After Tax

I would thus not be at all surprised to see after-tax profits go

back to around $300 billion/year, where they were in 1992 at the beginning

of the debt acceleration cycle. What does this mean for stocks? Look

at the chart of S&P 500 below (click

to enlarge).

S&P 500 Share Index

In 1992 S&P 500 was around 400, or 57%

lower than current levels. Of course, this is a pretty

simplistic and one-faceted approach to corporate profits and the market,

dealing as it does only with debt. (But then again... KISS has always

been pretty good guidance.)

Posted by Hellasious at

Tuesday, June

16, 2009

16 comments:

specularbage said...

Hellasious said...

Hellasious said...

Jun 18, 2009 | The Big Picture

[Jun 18, 2009] Senator Shelby Calls Fed's Expertise "Grossly Inflated"

as Geithner Attempts to Defends the Indefensible

Mish's Global Economic Trend Analysis

Like every bloated bureaucracy, the Fed wants still

more power. Secretary of Treasury Tim Geithner, a former Fed Governor,

is all too happy to give it to them.

Mish's Global Economic Trend Analysis

The Nelson A. Rockefeller Institute of Government has issued a

State Revenue Flash Report discussing an across the board enormous

drop in personal income tax revenues.

Total personal income tax collections in January-April 2009 were

26 percent, or about $28.8 billion below the level of a year ago

in states for which we have data. In April 2009 alone (April being

the month when many states receive the bulk of their balance due

or final payments), personal income tax receipts fell by 36.5 percent,

or $18.2 billion.

Personal income tax receipts in the first four months of calendar

year 2009 were greater than in 2008 in only three states — Alabama,

North Dakota, and Utah.

In FY 2008, personal income tax revenue made up over 50 percent

of total tax collections in six states — Colorado, Connecticut,

Massachusetts, New York, Oregon, and Virginia. Personal income tax

revenue declined dramatically in all six of these states for the

months of January-April of 2009 compared to the same period of 2008.

Among all 37 early-reporting states, the largest decline was in

Arizona, where collections declined by nearly 55 percent.

In the month of April alone, 37 early reporting states collected

about $18.2 billion less in personal income tax revenues compared

to the same month of 2008.

States most dependent on Personal Income Taxes

68.5% of Oregon's Tax Revenue from PIT. Collections off 27.0%

57.2% of Massachusetts' Tax Revenue from PIT. Collections off 28.5%

55.9% of New York's Tax Revenue from PIT. Collections off 31.8%

47.5% of California's' Tax Revenue from PIT. Collections off 33.8%

52.4% of Connecticut's Tax Revenue from PIT. Collections off 25.9%

52.7% of Colorado's Tax Revenue from PIT. Collections off 25.4%

Arizona's collections were down a whopping 54.9% depending 25.3%

on Personal Income Taxes. South Carolina, Michigan, Vermont, Rhode Island,

New Jersey, Idaho, and Ohio are also in deep trouble.

20 states depending on personal incomes taxes for > 25% of total

taxes were down 20% or more on collections.

This is a very grim report on state finances.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

The stock rally after 9/11 lasted more then three months. S&P500 rallied

more then 20% from lows.

The problem of “too much money” (read US dollars)

will continue to influence financial markets. Any increase in risk appetite

will see dollars leaving the US (thus falling) and flowing back to asset

markets, and vice versa. An abundance of money will make markets over-react,

resulting in big swings. The recent upsurge in asset prices also seems

to be an over-reaction helped by liquidity flowing back rather than

by a change in the fundamental picture. Several analysts feel that many

asset classes, especially commodities, have run too far ahead.

A sharp run-up in commodity prices and a jump in US

bond yields have done some damage to reviving sentiments and business

activities; this could show up in coming months. Besides, after having

re-stocked at record volumes, Chinese appetite for commodities in H2

may remain low key. A revival in economic activities could take a pause

here rather than continuing to improve at the same pace as shown in

last few months. The combined effect of these may help markets to slide

in next 2 quarters, slowly and quietly.

Similar to IMF, several analysts expect recovery to

start in H1 2010. Expecting the next bull market to price these probabilities

3-5 months in advance, the new-year could mark the turn at the earliest.

However, at the moment, the world seems to have entered

into a twilight zone where most of us are waiting for the first ray

of dawn while being worried about the length of night. The sky is black

now, but will be blue quite soon.

Republicans "tricked" working class voters to go against their economic

self-interest by mobilizing them on social "value" issues like abortion

and gay rights.

Simon’s

weekend summary included this sentence on the macroeconomic situation:

“The real economy begins to bottom out, although unemployment will not

peak for a while and could stay high for several years.”

We are now in that phase of the crisis when there is a lot of arguing

about whether things are going well or poorly, and that largely comes

down to whether the current slowdown in the rate at which things are

getting worse (that’s all it is so far) will be followed by a healthy

recovery, a prolonged period of stagnation, or an accelerated contraction

brought on by higher oil prices, a new bank panic caused by defaults

in credit cards and commercial mortgage-backed securities, or one of

any number of other factors. I discussed this topic

somewhat impressionistically a month ago; this time I’m going to

highlight some analyses done by other people around the Internet.

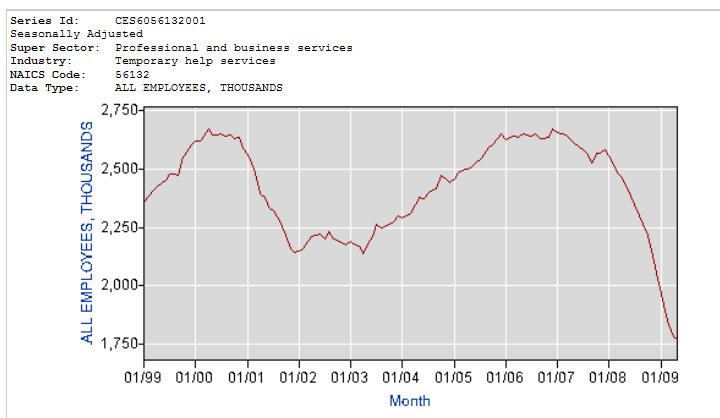

Last time I cited

James Hamilton and

Calculated Risk, both of whom thought that a peak in the four-week

moving average of new unemployment claims was a good predictor of the

end of a recession. Hamilton in particular has been following this closely,

and while we may have passed the peak, the number isn’t falling like

it should. Here’s Hamilton’s picture from

last week’s post:

Selected Comments

- strike three

Repent? as in beam me up Scottie? I agree with Bill Maher

last night. Obama, get off the TV

and start toughening up …..

- The “World Trade: YoY” chart is telling us something

– namely that nothing post-WWII is comparable to what is happening

now. Not surprisingly you have to go back to the ’30s to find anything

comparable.Also look at “Investment grade spread” and “BAA spread”

that shout the message: this is far from over.

Actually Mr. Swartz buries the lede. The most important chart

of all is the last one – “Real Home Price”. How many people realize

that the fall in home prices is dramatically worse now than in the

’30s?

I repeat – this is far, far from over.

-

I can across these charts yestarday – frightening…

http://www.voxeu.org/index.php?q=node/3421

…though not unexpected. While the credit/banking crisis may

be over (for now), the real economy is still falling pretty

fast and at some point that could feed back into the banking

system causing another crisis. I think people forget it took

the GD 3.5 years or so to become as bad as it was, and the monetary

crunch caused by the FED really didn’t happen until 1931 – over

a year after the crash. There is still way too much to play

out before this can be called over with.

-

These Paul Swartz charts are so depressing. It definitely doesn’t

compare well historically. The only

good to see there is industrial production didn’t collapse as

severely as during the Depression, and the percentage

of unemployed is not nearly as high as during the Depression.

And the spread on debt now really punches you in the face on

those charts.

Ya, I definitely don’t see things improving in the next 18

months, that makes a difference in people’s everyday lives.

I think the best we can hope for in these next 18 months is

stagnation which gives people time to tighten their belts, time

to move into growing fields, time for the government to put

some controls on excessive risk-taking in the banking sector.

There will be those fools (like our boy Posner) who say there

is no need to put in risk-taking controls NOW because the banks

will be gun shy, or the banks “have learned their lesson”. But

anyone who reads this site knows that’s garbage talk.

We need to put these risk controls (example 1: making credit

default swaps illegal, example 2: separating commercial banks

from investment banks) as soon as can possibly be done.

Also just the basic step of increasing capital requirements

for all banking institutions would be a great move in the right

direction. IF YOU LOOK AT CANADA, THEIR BANKS HAVE BEEN MUCH

MUCH LESS AFFECTED THAN AMERICAN BANKS. WHY??? This is a question

Geithner should be delving into deeply. Here is a link to an

NYT blog article which explores some of the differences between

Canadian banks regulation, and American banks regulation.

Many answers in here for Geithner and his cohorts.

http://economix.blogs.nytimes.com/2009/06/08/canadas-way-how-our-northern-neighbors-do-banking/

Jun 12, 2009 | FT.com

In response to my previous blog,

“The fiscal black hole in the US”, ‘Peter’ makes the comment

that much of the unfunded ‘liabilities’ under social security and

Medicare are index-linked and cannot be inflated away. This

is an important point.

Inflation reduces the real value of nominal liabilities. If these

nominal liabilities are interest-bearing, and have fixed market-determined

interest rates that mas or menos reflect the rate of inflation

expected at the date of issuance of these liabilities over the maturity

of the liability, then only actual inflation higher than the inflation

expected at the time of issuance actually reduces the real value

servicing that liability.

If longer-maturity nominal debt instruments

are floating rate securities, whose variable interest rate is linked

to some short-term nominal rate benchmark, it becomes very difficult

to inflate the real burden of that liability away.

If the liability is index-linked, it is impossible to inflate

its real value away. The same

holds if the liability or the commitment is denominated in foreign

currency, something that is uncommon in the US, but common elsewhere.

Only a change in the real exchange rate can affect the real burden

of foreign-currency-denominated liabilities.

- Matlock

"to the extent that any liabilities, whether they

are formal contractual obligations or political promises

or commitments are de-facto index-linked, they cannot be

inflated away."

I think that Governments have one more trick up their

sleeves. That is they control

the calculation methodology and publication of the inflation

index. Governments can inflate away index linked obligations

to the extent that the real rate of inflation exceeds the

indexed linked rate.

The greater the rate of real inflation the greater the

scope for these differences to be significant. I think

that this is a real risk for holders of inflation linked

US Treasuries.

By way of an example - Shadow Stats has charts comparing

the official US CPI rate since 1980 and with the CPI rate

as it would have been had the US Govt continued to use the

CPI methodology from 1980 (i.e. not continually tinkered

with the methodology).

The difference has been increasing

and is now over 6%. No surprises for guessing

that changes in the methodology for calculating inflation

always tend to lead to inflation being less than it would

have been under the prior methodology.

- Ming

I want to echo Post5 (Matlock) about how inflation measures

can be "adjusted" to flatter supposedly inflation-indexed

government liabilities.

By miscalculating inflation,

ie making inflation lower than it should be, government

liabilities can too be wriggled out of.

Well spotted, Matlock (Post 5)

- The Goldwatcher

'If' , or perhaps better to say 'when' unfunded social

security obligations are acknowledged as a solvency issue

the debt burden will probably be reduced by restructuring.

This will involve reneging on political obligations as you

indicate. But compared to a solvency crisis it will be seen

as the lesser of two evils. The effects will be the same

as inflating debt away.

- Don the libertarian Democrat

If Structural Imbalances are the problem, as Martin Wolf

says, I think, shouldn't the Saver/Export Countries now

begin buying from the Spender Countries? Why should it all

be a US matter? If these countries won't do that, what's

wrong with a bit of default? As Dr.Johnson said:

"Those who made the laws have apparently supposed, that

every deficiency of payment is the crime of the debtor.

But the truth is, that the creditor always shares the act,

and often more than shares the guilt, of improper trust.

It seldom happens that any man imprisons another but for

debts which he suffered to be contracted in hope of advantage

to himself, and for bargains in which proportioned his own

profit to his own opinion of the hazard; and there is no

reason, why one should punish the other for a contract in

which both concurred."

Johnson: Idler #22 (September 16, 1758)

Surely the Saver/Export Countries deserve to pay a penalty

for Improper Trust. Don't they?

High yield bonds were probably overbought by speculators betting of

quick recovery. As quick recovery is nowhere in sight some retrenchment

is probably overdue...

June 4 2009 |

FT.com

The strong rally in US credit over recent months has only driven spreads

back to levels seen prior to the collapse of Lehman Brothers, still

leaving the market facing a long road back to normality.

“The proper characterisation of the market

is that two months ago, credit spreads were distressed, while now they

are just stressed,” said Tad Rivelle, chief investment

officer at Metropolitan West Asset Management.

As other parts of the financial system normalise, thanks mainly to

the Federal Reserve’s efforts to improve liquidity,

investors are faced with credit spreads,

by many measures, at levels that exceed the wides posted in 2002.

This previous and notable episode of extreme risk aversion was sparked

by the bankruptcies and accounting scandals of Enron and Worldcom and

the bursting of the technology bubble.

This has investors asking not just how far can credit rally from

current levels, but where does fair value exist in a post-credit bubble

environment.

“There is a new normal, but it is not

near what we saw in 2007,” said Jack Ablin, chief investment

officer at Harris Private Bank.

Jim Turner, head of debt capital markets North America at BNP Paribas

said: “There are still good returns in the market, but as things ratchet

tighter and tighter

Mr Rivelle said investment grade credit spreads were formerly

characterised as being normal in a range of 100 to 125 basis points

over Treasuries.

Investment grade [bonds] spreads are about 350bps, while in 2002

spreads widened out to 270bps.

“Investment grade credit [spreads] is

still far wider than historic levels and also wider than the bottom

seen in 2002,” Mr Rivelle said.

[ But what are historic levels he is talking about

-- Great Depression is probably the only comparable historic period

-- NNB]

High yield spreads still trade at what are considered distressed

levels at about 1,100 basis points, but they have halved since peaking

at 2,200bps last year.

Martin Fridson, chief executive of Fridson Investment Advisors, believes

the new normal for high-yield bond spreads

should be a risk premium of roughly 600bps.

“It may take a year for that to happen,

but it is a realistic target,” Mr Fridson said.

Other investors agree time will heal risk appetite for high yield

as the corporate default rate peaks this year.

Scott Minerd, chief investment officer at Guggenheim Partners, said:

“The return of corporate credit spreads

to their historical averages will take time, 12 to 24 months if things

hold together.”

One of the reasons for the much bigger spike in spreads last year,

versus what occurred in 2002, was the degree of leverage within the

overall financial system.

“The major dislocation we saw in credit spreads was not just about

specific economic and company issues, it was also a function of forced

selling as investors were forced to deleverage their holdings,” said

Ashish Shah, co-head of global credit strategy at Barclays Capital.

Last December, Barclays’ US Credit Index widened to its all-time

wide of 545 basis points. The index has subsequently narrowed to 299bps,

near the 259bps wide posted in 2002.

From 2002 to 2007, accelerating demand

from hedge funds using carry trades also pushed high yield spreads to

levels that were narrower than they should have been.

“They would buy the lowest quality and highest yielding paper,” Mr

Fridson said. “Spreads weren’t really adequate, but the returns looked

good versus their cost of capital.”

For now, financials, which were at the epicentre of the credit bust,

still lag the overall rally in credit, but they have started to recover

since the passage of the stress tests in May.

Barclays’ US financials index hit a record wide of 792bp in March

this year and the index has pulled back to 440bps, whereas in 2002 financials

only widened to 242bps.

“Financial spreads are still trading at one of the highest ratios

to industrial spreads since the 1930’s,” Mr Shah said.

“There is plenty of room for credit to

rally further and the cash is there,” he added. “You can’t have financial

paper trading around 440bps, there is further upside.”

Much depends on the path of the eventual recovery in the economy

and how the expected rise in corporate bankruptcies plays out in the

months ahead.

Mr Rivelle said that since March markets had recognised that