|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

| Economics of Peak Energy | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

|

|

Bloomberg Business

... ... ...

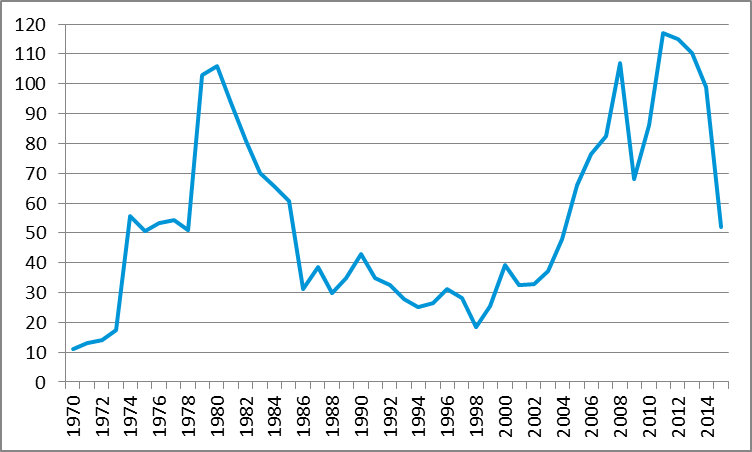

Goldman cut its crude forecasts this month, saying the global surplus of oil is bigger than it previously thought and that failure to reduce production fast enough may require prices to fall near $20 a barrel to clear the glut. Prices may touch that level when stockpiles are filled to capacity, forcing producers in some areas to cut output, Currie said Wednesday.

"The last time we saw a period that was similar to today was 1986, 29 years ago," he said. "We waited 15 years" for oil to start rising again.

Lower iron ore, copper and steel prices as well as weaker currencies in commodity-producing countries have reduced costs for oil companies, according to Currie. The world is shifting from an "investment phase" of a 30-year commodity cycle to an "exploitation phase," with shale fields as an important source of output, he said. While Goldman's official forecasts extend to 2020, there is a "very high probability" prices will stay depressed until the end of next decade, he said.

U.S. benchmark West Texas Intermediate crude futures fell 25 cents to settle at $46.90 on the New York Mercantile Exchange. Prices are down 12 percent this year and 50 percent over the past 12 months.

Should oil fall to $20, it would be "one touch," he said. Inventories would top out in parts of the world, some producers would shut production and the market would come into balance.

Aug 30, 2015 | peakoilbarrel.com

The Saudi miscalculation has several sources. One is the negative feedback loop between oil production, GDP, and national budgets that plagues many non-Western oil producers. Their GDP and national budgets depend significantly on the revenues from their oil exports. As a result, the revenue shortfalls incentivize them to produce as much oil as possible to mitigate the shortfall.According to the IEA , daily output in June 2015 increased 3.1 million barrels over 2014, with 60 percent (1.8 million barrels) coming from OPEC. At 31.7 million barrels per day, OPEC output reached a three-year high.

This increase in output occurs with the context of a narrow global demand opportunity. Growth in demand in 2015, which the IEA forecasts to average around 1.4 million barrels per day, comes primarily from Asia and North America. In other major export markets, demand is stagnant. That has oil exporting countries, including OPEC members, Russia and others, focusing their sales on Asia, particularly China. North American demand is growing now that oil prices are low, but due to high levels of domestic production, the U.S. is no longer a growth market for oil exporters.

Each producer, therefore, is incentivized to undercut other producers directly (price per barrel) or indirectly (absorbing shipping cost or delivery risk) to win sales in Asia (or displace incumbent suppliers in other major markets). National oil producers can and are shifting the cost of the lowered prices to other sectors of the economy. The U.A.E., for example, has ended fuel subsidies, thereby essentially, increasing its budget revenues, while Saudi Arabia recently floated a $4 billion domestic bond offering to help finance its budget.

Asian customers are taking advantage of the competition. They are reducing the share of long-term contracts in favor of spot purchases. For example, as the Wall Street Journal reported , some Japanese refiners are cutting the proportion of oil purchased through long-term contracts to around 70 percent from more than 90 percent, while some South Korean refiners are reducing the proportion from 75 to 50 percent. Furthermore, several national oil companies, Venezuela's among them, are building refineries with local partners in Asia, which will use their crude.

Given this environment, it is not surprising that the revenue elasticity of production is highly sensitive, and negative. Saudi Arabia increased production by 6.8 percent in the first quarter of 2015 but saw export revenues shrink by 42 percent.

Any Saudi Victory Will Be Pyrrhic

Saudi confidence in their financial wherewithal is proving misplaced.

Their need for revenue is intensifying rather than moderating. They are fighting a multi-front war with Iran directly (in Yemen) and indirectly (in Syria, Lebanon, and Iraq). ISIS, Al Qaeda, and disaffected Shias present a significant domestic security threat. Countering external and internal threats demands increased spending (including, perhaps, a very expensive future nuclear weapons program), as does placating the fast growing male and female youth demographic, which requires substantial spending on education, training, employment, and support. Hence, the budget deficit equal to 20 percent of GDP, noted above.

Increased production does not offer a solution. Saudi Arabia doesn't have the capacity to increase production sufficiently to reduce the shortfall significantly in any meaningful timeframe. They currently do not have the spare capacity-to make up for the $291 million in export revenue lost in Q1 , 5.4 million more barrels a day would have been necessary at $53.92 a barrel. Of course, such a drastic increase in output would have driven prices even lower. It is doubtful they can increase capacity substantially even in the medium- to long term. They won't be able to spend significantly more than other major national oil companies. First, low prices reduce Aramco's cash flow and therefore its ability to fund investment. Second, the Saudi government likely will increase its draw from this cash flow to fund higher priority national security and domestic security needs.

Third, Saudi refusal to act as price guarantor undercuts the confidence foreigners need to invest in, or loan to, oil projects. What might be attractive at $75 per barrel oil isn't at $50 oil, and even less attractive if the price of oil is thoroughly unpredictable.

Fourth, in terms of political risk, Saudi Arabia with its Gulf allies, Iran, and Iraq, and the Middle East in general, is at the epicenter of global tension, turmoil, and tumult.

Fifth, its influence within OPEC, and therefore its ability to manage OPEC output and prices, is diminished . Their underestimate of the impact of their policy change on prices, their indifference vis-à-vis the financial damage to other OPEC members, and their willingness to take market share at the expense of other OPEC members undercut their credibility within OPEC (particularly since it derived from Saudi willingness to protect the interests of all members (and sometimes to endure disproportionately).While Saudi financial reserves are substantial ( circa $672 billion in May ), drawing on them is little more than a stop-gap measure. If its major competitors (Russia, Iraq, Iran, and North America) maintain or even increase output (and they have the incentive to do so), prices could stay lower far longer than the Saudis anticipated.

Saudi reserves have decreased some $65 billion since prices started to fall (in November), so ~$100 billion to ~$130 billion at an annual rate. The longer prices stay low, the faster their reserves fall, and, as reserves plummet, the greater the pressure to prioritize spending, to the disadvantage of some Saudis.

Saudi Arabia Caused The Problem, Can It Engineer A Solution?

Saudi officials apparently viewed $90 or even $80 per barrel oil for "one or two years" with equanimity. Can they maintain the composure they have displayed thus far as they incur in a single year the revenue losses they expected to take four years (at $90 oil) or two years (at $80 oil)?

And if they can't-and surely, though they are loath to admit it, they can't - can they engineer a durable increase in prices - i.e., a durable decrease in output? At first glance, it seems impossible. Daily output from Saudi Arabia (10.5 million), and its allies, UAE (2.87), Kuwait (2.8), and Qatar (.67), is roughly equal to the daily output from countries with which it is in conflict, directly or indirectly, Russia (11.2), Iran (2.88), and Iraq (3.75), and therefore have an incentive to take advantage of any unilateral Saudi output concessions.

Yet, in effect, these countries are engaged in the oil equivalent of mutually assured destruction. The sharp drop in oil revenue damages each of these countries economically and financially, while the wars they wage directly and indirectly against each other drain resources from vital domestic projects.

Moreover, given the sensitivity of prices to changes in volume, it is possible, if not likely, that holding output steady or matching a Saudi

Aug 30, 2015 | peakoilbarrel.com

The Saudi miscalculation has several sources. One is the negative feedback loop between oil production, GDP, and national budgets that plagues many non-Western oil producers. Their GDP and national budgets depend significantly on the revenues from their oil exports. As a result, the revenue shortfalls incentivize them to produce as much oil as possible to mitigate the shortfall.According to the IEA , daily output in June 2015 increased 3.1 million barrels over 2014, with 60 percent (1.8 million barrels) coming from OPEC. At 31.7 million barrels per day, OPEC output reached a three-year high.

This increase in output occurs with the context of a narrow global demand opportunity. Growth in demand in 2015, which the IEA forecasts to average around 1.4 million barrels per day, comes primarily from Asia and North America. In other major export markets, demand is stagnant. That has oil exporting countries, including OPEC members, Russia and others, focusing their sales on Asia, particularly China. North American demand is growing now that oil prices are low, but due to high levels of domestic production, the U.S. is no longer a growth market for oil exporters.

Each producer, therefore, is incentivized to undercut other producers directly (price per barrel) or indirectly (absorbing shipping cost or delivery risk) to win sales in Asia (or displace incumbent suppliers in other major markets). National oil producers can and are shifting the cost of the lowered prices to other sectors of the economy. The U.A.E., for example, has ended fuel subsidies, thereby essentially, increasing its budget revenues, while Saudi Arabia recently floated a $4 billion domestic bond offering to help finance its budget.

Asian customers are taking advantage of the competition. They are reducing the share of long-term contracts in favor of spot purchases. For example, as the Wall Street Journal reported , some Japanese refiners are cutting the proportion of oil purchased through long-term contracts to around 70 percent from more than 90 percent, while some South Korean refiners are reducing the proportion from 75 to 50 percent. Furthermore, several national oil companies, Venezuela's among them, are building refineries with local partners in Asia, which will use their crude.

Given this environment, it is not surprising that the revenue elasticity of production is highly sensitive, and negative. Saudi Arabia increased production by 6.8 percent in the first quarter of 2015 but saw export revenues shrink by 42 percent.

Any Saudi Victory Will Be Pyrrhic

Saudi confidence in their financial wherewithal is proving misplaced.

Their need for revenue is intensifying rather than moderating. They are fighting a multi-front war with Iran directly (in Yemen) and indirectly (in Syria, Lebanon, and Iraq). ISIS, Al Qaeda, and disaffected Shias present a significant domestic security threat. Countering external and internal threats demands increased spending (including, perhaps, a very expensive future nuclear weapons program), as does placating the fast growing male and female youth demographic, which requires substantial spending on education, training, employment, and support. Hence, the budget deficit equal to 20 percent of GDP, noted above.

Increased production does not offer a solution. Saudi Arabia doesn't have the capacity to increase production sufficiently to reduce the shortfall significantly in any meaningful timeframe. They currently do not have the spare capacity-to make up for the $291 million in export revenue lost in Q1 , 5.4 million more barrels a day would have been necessary at $53.92 a barrel. Of course, such a drastic increase in output would have driven prices even lower. It is doubtful they can increase capacity substantially even in the medium- to long term. They won't be able to spend significantly more than other major national oil companies. First, low prices reduce Aramco's cash flow and therefore its ability to fund investment. Second, the Saudi government likely will increase its draw from this cash flow to fund higher priority national security and domestic security needs.

Third, Saudi refusal to act as price guarantor undercuts the confidence foreigners need to invest in, or loan to, oil projects. What might be attractive at $75 per barrel oil isn't at $50 oil, and even less attractive if the price of oil is thoroughly unpredictable.

Fourth, in terms of political risk, Saudi Arabia with its Gulf allies, Iran, and Iraq, and the Middle East in general, is at the epicenter of global tension, turmoil, and tumult.

Fifth, its influence within OPEC, and therefore its ability to manage OPEC output and prices, is diminished . Their underestimate of the impact of their policy change on prices, their indifference vis-à-vis the financial damage to other OPEC members, and their willingness to take market share at the expense of other OPEC members undercut their credibility within OPEC (particularly since it derived from Saudi willingness to protect the interests of all members (and sometimes to endure disproportionately).While Saudi financial reserves are substantial ( circa $672 billion in May ), drawing on them is little more than a stop-gap measure. If its major competitors (Russia, Iraq, Iran, and North America) maintain or even increase output (and they have the incentive to do so), prices could stay lower far longer than the Saudis anticipated.

Saudi reserves have decreased some $65 billion since prices started to fall (in November), so ~$100 billion to ~$130 billion at an annual rate. The longer prices stay low, the faster their reserves fall, and, as reserves plummet, the greater the pressure to prioritize spending, to the disadvantage of some Saudis.

Saudi Arabia Caused The Problem, Can It Engineer A Solution?

Saudi officials apparently viewed $90 or even $80 per barrel oil for "one or two years" with equanimity. Can they maintain the composure they have displayed thus far as they incur in a single year the revenue losses they expected to take four years (at $90 oil) or two years (at $80 oil)?

And if they can't-and surely, though they are loath to admit it, they can't - can they engineer a durable increase in prices - i.e., a durable decrease in output? At first glance, it seems impossible. Daily output from Saudi Arabia (10.5 million), and its allies, UAE (2.87), Kuwait (2.8), and Qatar (.67), is roughly equal to the daily output from countries with which it is in conflict, directly or indirectly, Russia (11.2), Iran (2.88), and Iraq (3.75), and therefore have an incentive to take advantage of any unilateral Saudi output concessions.

Yet, in effect, these countries are engaged in the oil equivalent of mutually assured destruction. The sharp drop in oil revenue damages each of these countries economically and financially, while the wars they wage directly and indirectly against each other drain resources from vital domestic projects.

Moreover, given the sensitivity of prices to changes in volume, it is possible, if not likely, that holding output steady or matching a Saudi

The National Interest

The rise of technologies such as 3-D printing and advanced robotics means that the next few decades for Asia's economies will not be as easy or promising as the previous five.

OWEN HARRIES, the first editor, together with Robert Tucker, of The National Interest, once reminded me that experts-economists, strategists, business leaders and academics alike-tend to be relentless followers of intellectual fashion, and the learned, as Harold Rosenberg famously put it, a "herd of independent minds." Nowhere is this observation more apparent than in the prediction that we are already into the second decade of what will inevitably be an "Asian Century"-a widely held but rarely examined view that Asia's continued economic rise will decisively shift global power from the Atlantic to the western Pacific Ocean.

No doubt the numbers appear quite compelling. In 1960, East Asia accounted for a mere 14 percent of global GDP; today that figure is about 27 percent. If linear trends continue, the region could account for about 36 percent of global GDP by 2030 and over half of all output by the middle of the century. As if symbolic of a handover of economic preeminence, China, which only accounted for about 5 percent of global GDP in 1960, will likely surpass the United States as the largest economy in the world over the next decade. If past record is an indicator of future performance, then the "Asian Century" prediction is close to a sure thing.

marknesop.wordpress.com

Northern Star, December 30, 2015 at 3:11 pmhttp://www.ndtv.com/world-news/moscow-demands-arrest-of-rebel-for-murder-of-russian-warplane-pilot-1260805yalensis , December 30, 2015 at 5:53 pm"Revenge is the most natural right," Celik said in the interview, while refraining from claiming the pilot's death"

Absolutely Mr. Celik Absolutely! ..

Ooo, this explains a mystery to me. I noticed on my own blog today there was an unusual spike of views for an older story, from November 29, which happened to be about this particular guy, Alparslan Çelik.

People must have googled his name, and maybe my story came up in the search results.

marknesop.wordpress.com

Northern Star, December 30, 2015 at 3:11 pmhttp://www.ndtv.com/world-news/moscow-demands-arrest-of-rebel-for-murder-of-russian-warplane-pilot-1260805yalensis , December 30, 2015 at 5:53 pm"Revenge is the most natural right," Celik said in the interview, while refraining from claiming the pilot's death"

Absolutely Mr. Celik Absolutely! ..

Ooo, this explains a mystery to me. I noticed on my own blog today there was an unusual spike of views for an older story, from November 29, which happened to be about this particular guy, Alparslan Çelik.

People must have googled his name, and maybe my story came up in the search results.

marknesop.wordpress.com

Northern Star, December 30, 2015 at 3:11 pmhttp://www.ndtv.com/world-news/moscow-demands-arrest-of-rebel-for-murder-of-russian-warplane-pilot-1260805yalensis , December 30, 2015 at 5:53 pm"Revenge is the most natural right," Celik said in the interview, while refraining from claiming the pilot's death"

Absolutely Mr. Celik Absolutely! ..

Ooo, this explains a mystery to me. I noticed on my own blog today there was an unusual spike of views for an older story, from November 29, which happened to be about this particular guy, Alparslan Çelik.

People must have googled his name, and maybe my story came up in the search results.

marknesop.wordpress.com

Northern Star, December 30, 2015 at 3:11 pmhttp://www.ndtv.com/world-news/moscow-demands-arrest-of-rebel-for-murder-of-russian-warplane-pilot-1260805yalensis , December 30, 2015 at 5:53 pm"Revenge is the most natural right," Celik said in the interview, while refraining from claiming the pilot's death"

Absolutely Mr. Celik Absolutely! ..

Ooo, this explains a mystery to me. I noticed on my own blog today there was an unusual spike of views for an older story, from November 29, which happened to be about this particular guy, Alparslan Çelik.

People must have googled his name, and maybe my story came up in the search results.

marknesop.wordpress.com

Northern Star, December 30, 2015 at 3:11 pmhttp://www.ndtv.com/world-news/moscow-demands-arrest-of-rebel-for-murder-of-russian-warplane-pilot-1260805yalensis , December 30, 2015 at 5:53 pm"Revenge is the most natural right," Celik said in the interview, while refraining from claiming the pilot's death"

Absolutely Mr. Celik…Absolutely!……..

Ooo, this explains a mystery to me. I noticed on my own blog today there was an unusual spike of views for an older story, from November 29, which happened to be about this particular guy, Alparslan Çelik.

People must have googled his name, and maybe my story came up in the search results.

finance.yahoo.com

While cheaper fuel is a boost to consumer spending power in much of the developed world, it is also a disinflationary force that reinforces bets on loose monetary policy in Europe, Japan and China, even as the Federal Reserve proceeds with glacial tightening.

Oil prices are ending the year how they began - under pressure.

peakoilbarrel.com

Dean , 12/31/2015 at 1:13 pmPetroleum Supply Monthly is out:

- US #crudeoil production down to 9.347mbpd in Oct15 from an upward revised 9.460 in Sep15

- Texas #crude production down to 3391000 b/day in Oct15 from a revised down 3417000 b/day in Sep15

TechGuy , 12/31/2015 at 2:20 pm

http://trib.com/business/energy/top-wyoming-oil-companies-write-off-billion-in-assets/article_d380f763-962e-587d-9d9a-2af39b1e166d.html

Top Wyoming oil companies write off $41 billion in assets" The write-offs, known officially as impairments, represent a recognition that many wells will have shorter productive lives than initially anticipated, analysts said. It also reflects an acknowledgement that companies may have to pay for the cost of plugging and abandoning wells sooner than they expected, they noted. "

" Chesapeake Energy, Wyoming's fourth-largest oil producer, reported impairments of $15.4 billion through the first three quarters of 2015. The Oklahoma City-based producer's woes are primarily tied to natural gas. "

" Oil patch bankruptcies have accelerated in the fourth quarter of 2015 as a supply glut keeps prices stuck below $40 a barrel. Ten firms, with more than $2 billion in debt, have closed their doors since October, according to the Federal Reserve Bank of Dallas.

Capital spending has fallen 51 percent since the third quarter, the bank said . And the global supply glut may linger into 2017, it noted, pointing to estimates that production will outpace demand by 600,000 barrels per day through 2016."

Peak Oil Barrel

Jeffrey J. Brown, 12/30/2015 at 4:16 pm

I suspect that we actually have a condensate glut, at least in the US, and perhaps globally.

Javier, 12/30/2015 at 4:33 pm

The possibility of a global recession in 2016 must be taken into account in any scenario, given how weak is the economic situation of the world.

A global recession in 2016 probably means the peak [reached in] oil [ production] in 2015 will last for at least 10 years, and probably forever.

Stavros Hadjiyiannis, 12/30/2015 at 5:23 pm

Is this the 545289658th time that someone has claimed that Russian oil production has peaked?

In any case, oil production is a function of primarily price. If the price is right, then there will be oil for many decades ahead. Oil production is also a function of geopolitics. Also a function of technology and also a function of alternatives. Ron seems to be missing the point that for decades, oil rich countries have no choice but to defer to a great extent to Western oil production. Those that are included in the Western security and financial system (GCC) have an extra incentive to do so, saving their oil for the future.

Ron Patterson, 12/30/2015 at 6:31 pm

Is this the 545289658th time that someone has claimed that Russian oil production has peaked?

Don't be a fucking smart ass. Make your point without stupid exaggerations.

In any case, oil production is a function of primarily price.

Really? Look at the chart above marked "The Rest of the World". Now tell me, at what point did very expensive oil increase production.

Oil production is also a function of geopolitics.

Bullshit! Oil production is affected by geopolitics. But it is not a function of geopolitics. Oil production is a function of the cost of production versus the price of oil… but the most important function is the availability of oil in the ground to produce. If the oil is not there then geopolitics or the price of oil counts for nothing. And that is what Stavros fails to understand.

Ron seems to be missing the point that for decades, oil rich countries have no choice but to defer to a great extent to Western oil production.

What in the hell are you talking about? Since when has Saudi Arabia deferred to Western oil production?

Those that are included in the Western security and financial system (GCC) have an extra incentive to do so, saving their oil for the future.

Give me a break. Every country is producing every barrel they possibly can. Which country was holding back when oil was over $100 a barrel? Saving oil for the future? They are in recession right now. Most of them anyway. No one is hording oil. A lot of oil is not being produced because of the very low price of oil but everyone is still trying desperately to meet their budgets by producing every barrel they possibly can at the cost they can afford.

Dec. 30, 2015 | WSJ

The price rout has caused oil companies to cut deeply into investment. With the world awash in crude, the oil industry is contemplating a new problem the oversupply could tee up: an oil shortage.

oilprice.com

08 December 2014 | OilPrice.com

Not long ago, I wrote Ten Reasons Why High Oil Prices are a Problem. If high oil prices can be a problem, how can low oil prices also be a problem? In particular, how can the steep drop in oil prices we have recently been experiencing also be a problem?Let me explain some of the issues:

Issue 1. If the price of oil is too low, it will simply be left in the ground.

The world badly needs oil for many purposes: to power its cars, to plant its fields, to operate its oil-powered irrigation pumps, and to act as a raw material for making many kinds of products, including medicines and fabrics.

If the price of oil is too low, it will be left in the ground. With low oil prices, production may drop off rapidly. High price encourages more production and more substitutes; low price leads to a whole series of secondary effects (debt defaults resulting from deflation, job loss, collapse of oil exporters, loss of letters of credit needed for exports, bank failures) that indirectly lead to a much quicker decline in oil production.

The view is sometimes expressed that once 50% of oil is extracted, the amount of oil we can extract will gradually begin to decline, for geological reasons. This view is only true if high prices prevail, as we hit limits. If our problem is low oil prices because of debt problems or other issues, then the decline is likely to be far more rapid. With low oil prices, even what we consider to be proved oil reserves today may be left in the ground.

Issue 2. The drop in oil prices is already having an impact on shale extraction and offshore drilling.

While many claims have been made that US shale drilling can be profitable at low prices, actions speak louder than words. (The problem may be a cash flow problem rather than profitability, but either problem cuts off drilling.) Reuters indicates that new oil and gas well permits tumbled by 40% in November.

Related: Who Comes Out On Top After Oil Pandemonium?

Offshore drilling is also being affected. Transocean, the owner of the biggest fleet of deep water drilling rigs, recently took a $2.76 billion charge, among a "drilling rig glut."

3. Shale operations have a huge impact on US employment.

Zero Hedge posted the following chart of employment growth, in states with and without current drilling from shale formations:

Figure 1. Jobs in States with and without Shale Formations, from Zero Hedge.

Clearly, the shale states are doing much better, job-wise. According to the article, since December 2007, shale states have added 1.36 million jobs, while non-shale states have lost 424,000 jobs. The growth in jobs includes all types of employment, including jobs only indirectly related to oil and gas production, such as jobs involved with the construction of a new supermarket to serve the growing population.

It might be noted that even the "Non-Shale" states have benefited to some extent from shale drilling. Some support jobs related to shale extraction, such as extraction of sand used in fracking, college courses to educate new engineers, and manufacturing of parts for drilling equipment, are in states other than those with shale formations. Also, all states benefit from the lower oil imports required.

Issue 4. Low oil prices tend to cause debt defaults that have wide ranging consequences. If defaults become widespread, they could affect bank deposits and international trade.

With low oil prices, it becomes much more difficult for shale drillers to pay back the loans they have taken out. Cash flow is much lower, and interest rates on new loans are likely much higher. The huge amount of debt that shale drillers have taken on suddenly becomes at-risk. Energy debt currently accounts for 16% of the US junk bond market , so the amount at risk is substantial.

Dropping oil prices affect international debt as well. The value of Venezuelan bonds recently fell to 51 cents on the dollar , because of the high default risk with low oil prices. Russia's Rosneft is also reported to be having difficulty with its loans .

There are many ways banks might be adversely affected by defaults, including

- Directly by defaults on loans held by a bank

- Indirectly, by defaults on securities the bank owns that relate to loans elsewhere

- By derivative defaults made more likely by sharp changes in interest rates or in currency levels

- By liquidity problems, relating to the need to quickly sell or buy securities related to ETFs

After the many bank bailouts in 2008, there has been discussion of changing the system so that there is no longer a need to bail out "too big to fail" banks. One proposal that has been discussed is to force bank depositors and pension funds to cover part of the losses, using Cyprus-style bail-ins. According to some reports , such an approach has been approved by the G20 at a meeting the weekend of November 16, 2014. If this is true, our bank accounts and pension plans could already be at risk.1

Another bank-related issue if debt defaults become widespread, is the possibility that junk bonds and Letters of Credit2 will become outrageously expensive for companies that have poor credit ratings. Supply chains often include some businesses with poor credit ratings. Thus, even businesses with good credit ratings may find their supply chains broken by companies that can no longer afford high-priced credit. This was one of the issues in the 2008 credit crisis.

Issue 5. Low oil prices can lead to collapses of oil exporters, and loss of virtually all of the oil they export.

The collapse of the Former Soviet Union in 1991 seems to be related to a drop in oil prices .

Figure 2. Oil production and price of the Former Soviet Union, based on BP Statistical Review of World Energy 2013.

Oil prices dropped dramatically in the 1980s after the issues that gave rise to the earlier spike were mitigated. The Soviet Union was dependent on oil for its export revenue. With low oil prices, its ability to invest in new production was impaired, and its export revenue dried up. The Soviet Union collapsed for a number of reasons, some of them financial, in late 1991, after several years of low oil prices had had a chance to affect its economy.

Many oil-exporting countries are at risk of collapse if oil prices stay very low very long. Venezuela is a clear risk, with its big debt problem. Nigeria's economy is reported to be "tanking." Russia even has a possibility of collapse, although probably not in the near future.

Even apart from collapse, there is the possibility of increased unrest in the Middle East, as oil-exporting nations find it necessary to cut back on their food and oil subsidies. There is also more possibility of warfare among groups, including new groups such as ISIL. When everyone is prosperous, there is little reason to fight, but when oil-related funds dry up, fighting among neighbors increases, as does unrest among those with lower subsidies.

Issue 6. The benefits to consumers of a drop in oil prices are likely to be much smaller than the adverse impact on consumers of an oil price rise.

When oil prices rose, businesses were quick to add fuel surcharges. They are less quick to offer fuel rebates when oil prices go down. They will try to keep the benefit of the oil price drop for themselves for as long as possible.

Airlines seem to be more interested in adding flights than reducing ticket prices in response to lower oil prices, perhaps because additional planes are already available. Their intent is to increase profits, through an increase in ticket sales, not to give consumers the benefit of lower prices.

In some cases, governments will take advantage of the lower oil prices to increase their revenue. China recently raised its oil products consumption tax, so that the government gets part of the benefit of lower prices. Malaysia is using the low oil prices as a time to reduce oil subsidies .

Most businesses recognize that the oil price drop is at most a temporary situation, since the cost of extraction continues to rise (because we are getting oil from more difficult-to-extract locations). Because the price drop is only temporary, few business people are saying to themselves, "Wow, oil is cheap again! I am going to invest a huge amount of money in a new road building company [or other business that depends on cheap oil]." Instead, they are cautious, making changes that require little capital investment and that can easily be reversed. While there may be some jobs added, those added will tend to be ones that can easily be dropped if oil prices rise again.

Issue 7. Hoped-for crude and LNG sales abroad are likely to disappear, with low oil prices.

There has been a great deal of publicity about the desire of US oil and gas producers to sell both crude oil and LNG abroad, so as to be able to take advantage of higher oil and gas prices outside the US. With a big drop in oil prices, these hopes are likely to be dashed. Already, we are seeing the story, Asia stops buying US crude oil . According to this story, "There's so much oversupply that Middle East crudes are now trading at discounts and it is not economical to bring over crudes from the US anymore."

LNG prices tend to drop if oil prices drop. (Some LNG prices are linked to oil prices, but even those that are not directly linked are likely to be affected by the lower demand for energy products.) At these lower prices, the financial incentive to export LNG becomes much less. Even fluctuating LNG prices become a problem for those considering investment in infrastructure such as ships to transport LNG.

$80 Oil By Christmas – Do NOT Be Fooled By The Mainstream MediaThe current market turmoil has created a once in a generation opportunity for savvy energy investors.

Whilst the mainstream media prints scare stories of oil prices falling through the floor smart investors are setting up their next winning oil plays.Click here for more info on successful oil investing

Issue 8. Hoped-for increases in renewables will become more difficult, if oil prices are low.

Many people believe that renewables can eventually take over the role of fossil fuels. ( I am not of the view that this is possible. ) For those with this view, low oil prices are a problem, because they discourage the hoped-for transition to renewables.

Despite all of the statements made about renewables, they don't really substitute for oil. Biofuels come closest, but they are simply oil-extenders. We add ethanol made from corn to gasoline to extend its quantity. But it still takes oil to operate the farm equipment to grow the corn, and oil to transport the corn to the ethanol plant. If oil isn't around, the biofuel production system comes to a screeching halt.

Issue 9. A major drop in oil prices tends to lead to deflation, and because of this, difficulty in repaying debts.

If oil prices rise, so do food prices, and the price of making most goods. Thus rising oil prices contribute to inflation. The reverse of this is true as well. Falling oil prices tend to lead to a lower price for growing food and a lower price for making most goods. The net result can be deflation. Not all countries are affected equally; some experience this result to a greater extent than others.

Those countries experiencing deflation are likely to eventually have problems with debt defaults, because it will become more difficult for workers to repay loans, if wages are drifting downward. These same countries are likely to experience an outflow of investment funds because investors realize that funds invested these countries will not earn an adequate return. This outflow of funds will tend to push their currencies down, relative to other currencies. This is at least part of what has been happening in recent months.

The value of the dollar has been rising rapidly, relative to many other currencies. Debt repayment is likely to especially be a problem for those countries where substantial debt is denominated in US dollars, but whose local currency has recently fallen in value relative to the US dollar.

Figure 3. US Dollar Index from Intercontinental Exchange

The big increase in the US dollar index came since June 2014 (Figure 3), which coincides with the drop in oil prices. Those countries with low currency prices, including Japan, Europe, Brazil, Argentina, and South Africa, find it expensive to import goods of all kinds, including those made with oil products. This is part of what reduces demand for oil products.

China's yuan is relatively closely tied to the dollar. The collapse of other currencies relative to the US dollar makes Chinese exports more expensive, and is part of the reason why the Chinese economy has been doing less well recently. There are, no doubt, other reasons why China's growth is lower recently, and thus its growth in debt. China is now trying to lower the level of its currency .

Issue 10. The drop in oil prices seems to reflect a basic underlying problem: the world is reaching the limits of its debt expansion.

There is a natural limit to the amount of debt that a government, or business, or individual can borrow. At some point, interest payments become so high, that it becomes difficult to cover other needed expenses. The obvious way around this problem is to lower interest rates to practically zero, through Quantitative Easing (QE) and other techniques.

(Increasing debt is a big part of pumped up "demand" for oil, and because of this, oil prices. If this is confusing, think of buying a car. It is much easier to buy a car with a loan than without one. So adding debt allows goods to be more affordable. Reducing debt levels has the opposite effect).

QE doesn't work as a long-term technique, because it tends to create bubbles in asset prices, such as stock market prices and prices of farmland. It also tends to encourage investment in enterprises that have questionable chance of success. Arguably, investment in shale oil and gas operations are in this category.

As it turns out, it looks very much as if the presence or absence of QE may have an impact on oil prices as well (Figure 4), providing the "uplift" needed to keep oil prices high enough to cover production costs.

Figure 4. World "liquids production" (that is oil and oil substitutes) based on EIA data, plus OPEC estimates and judgment of author for August to October 2014. Oil price is monthly average Brent oil spot price, based on EIA data.

The sharp drop in price in 2008 was credit-related , and was only solved when the US initiated its program of QE started in late November 2008 . Oil prices began to rise in December 2008. The US has had three periods of QE, with the last of these, QE3, finally tapering down and ending in October 2014. Since QE seems to have been part of the solution that stopped the drop in oil prices in 2008, we should not be surprised if discontinuing QE is contributing to the drop in oil prices now.

Part of the problem seems to be the differential effect that happens when other countries are continuing to use QE, but the US not. The US dollar tends to rise, relative to other currencies. This situation contributes to the situation shown in Figure 3.

QE allows more borrowing from the future than would be possible if market interest rates really had to be paid. This allows financiers to temporarily disguise a growing problem of un-affordability of oil and other commodities.

The problem we have is that, because we live in a finite world, we reach a point where it becomes more expensive to produce commodities of many kinds: oil (deeper wells, fracking), coal (farther from markets, so more transport costs), metals (poorer ore quality), fresh water (desalination needed), and food (more irrigation needed). Wages don't rise correspondingly, because more and more labor is needed to provide less and less actual benefit, in terms of the commodities produced and goods made from those commodities. Thus, workers find themselves becoming poorer and poorer, in terms of what they can afford to purchase.

QE allows financiers to disguise the growing mismatch between what it costs to produce commodities, and what customers can really afford . Thus, QE allows commodity prices to rise to levels that are unaffordable by customers, unless customers' lack of income is disguised by a continued growth in debt.

Once commodity prices (including oil prices) fall to levels that are affordable based on the incomes of customers, they fall to levels that cut out a large share of production of these commodities. As commodity production drops to levels that can be produced at affordable prices, so does the world's ability to make goods and services. Unfortunately, the goods whose production is likely to be cut back if commodity production is cut back are those of every kind, including houses, cars, food, and electrical transmission equipment.

Conclusion

There are really two different problems that a person can be concerned about:

1. Peak oil : the possibility that oil prices will rise, and because of this production will fall in a rounded curve. Substitutes that are possible because of high prices will perhaps take over.

2. Debt related collapse : oil limits will play out in a very different way than most have imagined, through lower oil prices as limits to growth in debt are reached, and thus a collapse in oil "demand" (really affordability). The collapse in production, when it comes, will be sharper and will affect the entire economy, not just oil.

In my view, a rapid drop in oil prices is likely a symptom that we are approaching a debt-related collapse–in other words, the second of these two problems. Underlying this debt-related collapse is the fact that we seem to be reaching the limits of a finite world. There is a growing mismatch between what workers in oil importing countries can afford, and the rising real costs of extraction, including associated governmental costs. This has been covered up to date by rising debt, but at some point, it will not be possible to keep increasing the debt sufficiently.

Related: A Glimmer Of Hope In Current Oil Price Slide?

The timing of collapse may not be immediate. Low oil prices take a while to work their way through the system. It is also possible that the world's financiers will put off a major collapse for a while longer, through more QE, or more programs related to QE. For example, actually getting money into the hands of customers would seem to be temporarily helpful.

At some point the debt situation will eventually reach a breaking point. One way this could happen is through an increase in interest rates. If this happens, world economic growth is likely to slow greatly. Oil and commodity prices will fall further. Debt defaults will skyrocket. Not only will oil production drop, but production of many other commodities will drop, including natural gas and coal. In such a scenario, the downslope of all energy use is likely to be quite steep, perhaps similar to what is shown in the following chart.

Figure 5. Estimate of future energy production by author. Historical data based on BP adjusted to IEA groupings.

Notes:

[1] There is of course insurance by the FDIC and the PBGC , but the actual funding for these two insurance programs is tiny in relationship to the kind of risk that would occur if there were widespread debt defaults and derivative defaults affecting many banks and many pension plans at once. While depositors and pension holders might try to collect this insurance, there wouldn't be enough money to actually cover these demands. This problem would be similar to the issue that arose in Iceland in 2008 . Insurance would seem to be available, but in practice, would not pay out much.

[2] LOCs are required when goods are shipped internationally, before payment has actually been made. They offer a guarantee that a buyer will be able to "make good" on his promise to pay for goods when they arrive.

By Gail Tverberg

Source - http://ourfiniteworld.com/

More Top Reads From Oilprice.com:

peakoilbarrel.com

Heinrich Leopold , 12/31/2015 at 4:10 am

... condensate has one of the steepest decline rates – at least in Texas. As November and December 2014 production has been very high, the rates are very likely much steeper in November and December 2015, reaching record decline rates of 50% (see chart below).

peakoilbarrel.com

Ves , 12/25/2015 at 2:23 pmSteve,Cacerolo , 12/10/2015 at 12:00 am

I agree with your post about market dynamics between customers having to pay through their purchasing power in order to retire loans created by financial industry for oil companies. But there are a few things that make this oil crash little bit "strange" to say at least:1) OPEC (and mainly Saudis + GCC) did actually something by not doing anything and that is refusing to cut their production. Well that is "man made" decision as Oman oil minister said and not decision by invisible hand of market. I interpret this mainly as political decision and not economical.

2) Second. Wall Street was pretty much shocked if not pissed by that Saudi decision. I interpret that to be political reaction as well.

3) There is no worldwide collapse of demand that justify 65-70% fall of the oil price. I am sorry but Wall Street is creating ninja loans for cars, student loans, mortgages from the thin air with the same speed in the US. I would say that is political decision as well. Worldwide collapse is not happening as of now either that would justify 65-70% drop of price. Contraction is happening in Europe but very very gradually except in some marginal countries like Greece, and war torn countries in ME and Africa. But these marginal countries did not even have any big consumption to begin with.

4) Shale oil producer based on their balance sheet were bankrupt from Day 1. Why LTO even got the loans to begin with? That is also political decision and not an economic. Why are we waiting even a year after low prices for any major mergers, buyouts or bankruptcies? I am sorry but 100% of LTO are bankrupt so why Wall Street is extending and pretending and keeping them on a life support? Well it is again political decision.

So yes there are some market dynamics around this oil crash but there are a lot of political dynamics as well.

This is my first post in this blog.Clueless , 12/10/2015 at 5:13 amThere has been a lot of talk regarding the oil glut, but according to EIA crude inventories there is only 105.1 million more barrels of crude than a year ago. That is just 6.4 days of refineries inputs. It does not seem a lot, even less to justify a 60% decrease in the oil price. Oil must be the only commodity industry where one week of extra inventory produce such a price correction.

It is even worse if we consider that gasoline inventories are just 0.4% higher than a year ago. The most important product which represents 46% of the refineries output is at 2014 level. Where is the glut?

There is a glut in distilite fuel oil, residual fuel oil, propane/propylene and fuel ethanol. It seems that there is a big problem in the industrial part of the demand or maybe there is a big unbalance between what refineries can produce and what the market needs.

Warm weather promotes more driving, so we could start spring 2016 with gasoline inventories quite reduced and we could face a high gasoline price environment while we still have this huge oil glut that the media talks all day long.

I have no idea if what eia states in its inventory report as crude and other oils ( the two mayor inventory items by quantity) can be completely used as inputs to produce gasoline or if there are some technical limitations ( not any type of crude can be used to product any type of output). Maybe, and just maybe we have a glut of some types of oil and condensate that nobody needs in the quantities it has been produced since the shale boom.

It is basic economics when it comes to any commodity. If there is a shortage, the price can rise rapidly to the amount that the most critical user will pay. Ask yourself "at what price would the hospitals, ambulances, fire trucks, police cars, offshore drilling rigs [which are being leased for up to $600,000/day], say the price is too high, we will just shut down?" With a small surplus, the price of a commodity will drop like a rock, as buyers see no need to have high inventories and shop around for the lowest price, looking for a seller that has to sell at any price.oldfarmermac , 12/10/2015 at 7:56 amA game analogy. Musical chairs with 20 players and only 19 chairs (only short by 1), and two other rules: The person without a chair gets killed, but there is one chair for sale and anyone can buy it to guarantee their safety. How high would the bidding go? Up to the point of the person with the most money.

Same game with 20 players and 21 chairs (only 1 extra). How high would the bidding go? Zero, as everyone can see that there is more than enough for everybody.

You can easily see this play out even more frequently by looking at charts for agricultural products such as: wheat, corn, soybeans, etc.Prices can double quickly if there is a crop surplus, and fall by over 50% just as quickly if the next crop has a surplus.

Clueless, you are not when it comes to commodity prices. I wish I had thought of the musical chairs analogy myself. But you got in a little bit of a hurry in his last sentence and should have said prices can double quickly if there is a crop SHORTAGE.Clueless , 12/10/2015 at 4:35 pmCommodity food prices are not nearly so inelastic as oil prices, because there are generally plenty of substitutes for any GIVEN food that might be in short supply. But the price can still double in the event of a short crop, it happens.

There are NO short term substitutes for oil.

Thanks OFM. However, my error was not due to being in a hurry, it was due to being 4:13 am my time, and I was still half asleep.Nick G , 12/10/2015 at 4:44 pmThere are NO short term substitutes for oil.Patrick R , 12/10/2015 at 5:11 pmI know what you mean, but that's a little strong. Driving slower, driving your small car instead of your SUV, mass transit, carpooling: there are a lot of short term substitutes.

None of them are perfect substitutes for dirt cheap oil…but that's different (and, of course, dirt cheap oil doesn't really exist if we take into account externalities).

The US just needs to price driving accurately and a huge amount of low value wasteful trips would suddenly become understood as unnecessary. Furthermore the uplift this would give to all alternatives; not just EVs (you guys are so stuck in autodependency), but Transit, active modes, and, most importantly of all; the rise of the local, would huge. And please note, this is not subsidy, simply user pays, just price driving for all its costs, direct and external. Sorted.Also always remember that proximity trumps mobility; that's why cities exist!

Sprawl topia is doomed, but I guess that's hard to grasp when it's all people have ever known. And getting real about actual cost allocation is the mechanism to get North America out of the current stuck pattern. Climate change and all other pollution mitigation isn't about personal choice it's about rational cost allocation; by all means choose to stink, just actually pay the whole cost and there will be more rational actors than old contrarians.

Jeffrey J. Brown , 12/10/2015 at 7:40 amThe craziest thing is that otherwise libertarian freemarketers are violently committed to the Soviet style socialism that is your taxpayer funded driving amenity and no-price driving system. What kind of crisis will it take for reality to be grasped in this area? Cos I suspect you'll get it sooner or later.

Meantime: Keep on truckin'…

Dennis Coyne , 12/10/2015 at 9:06 amThere has been a lot of talk regarding the oil glut, but according to eia crude inventories there is only 105.1 million more barrils of crude than a year ago

What the EIA calls "Crude oil" is actually Crude + Condensate (C+C).

I suspect that most of the 2015 build in US and global C+C inventories consists of condensate, and I frequently cite a Reuters article earlier this year that documented case histories of refiners increasingly rejecting blends of heavy crude and condensate that technically meet the upper API limit for WTI crude (42 API gravity*), but that are deficient in distillates.

In any case, based on the most recent four week running average data, US refineries were dependent on net crude oil imports for 43% of the C+C processed in US refineries (7.1/16.5) versus 44% a year ago (7.1/16.2). If we had so much (generally cheaper than imported) actual crude oil on hand in the US, why are refiners importing the same amount of crude oil as they did last year?

*Most common overall dividing line between crude & condensate is 45 API

The market for oil is a World market, look at IEA reports for a better look at the International market. Last time I checked, st0rage levels in the OECD were about 250 million barrels above the 5 year average level. There is a limited number of places to put the oil that has been produced, and storing oil costs money, so when there is an excess prices fall. In theory this should increase demand at any given level of World GDP and it should reduce supply as higher cost production is less profitable at lower prices. It takes some time for this adjustment to take place (people don't go out and buy a gas guzzler right away and oil producers try to outlast their competitors, hoping the other guy stops producing as much). So far it has been about 12 months since oil prices dropped sharply, it may take another 12 months, maybe more for production to slow down and excess inventories to be used up.Heinrich Leopold , 12/10/2015 at 4:17 amIf there is not a severe recession worldwide in the next 24 months, I would be surprised if oil prices are not above $60/b, 18 months to 36 months from now, possibly they will be much higher.

It depends on how quickly the oil business can ramp back up after the downturn over the next 1 to 2 years. The longer it takes, the higher oil prices will go, but at some point there may be a major recession, due in part to inadequate oil supply two or three years in the future.

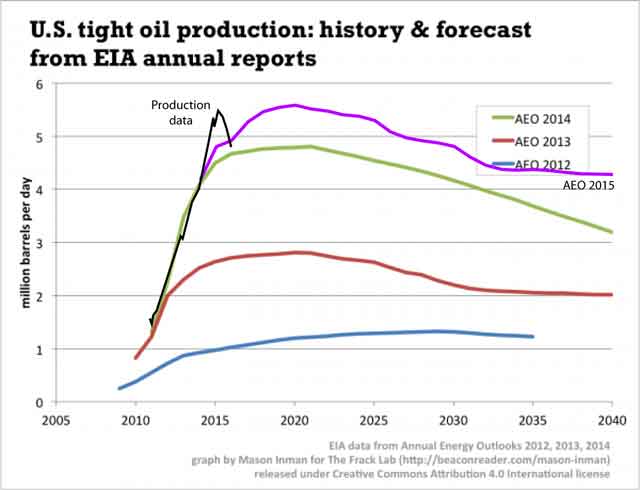

Chart below with the Reference Oil Price case for Brent Oil in 2013$ from the EIA's Annual Energy Outlook published in April 2015.

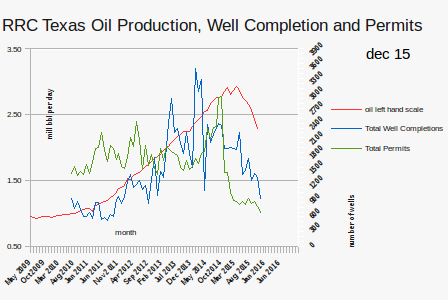

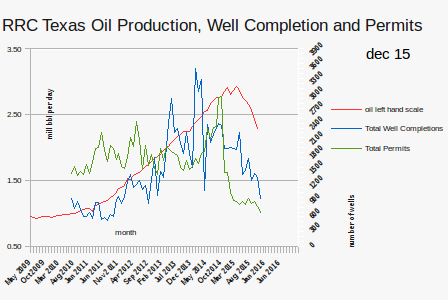

Given the recent discussions about where US oil and gas production is headed, I have tried to find some forward looking indicators. Well permits and well completions seem to give reasonable indicators for future production. Below chart indicates that at least Texan oil and gas production will steeply slump over the next months. Well permits declined fivefold to a six year low and well completions are not far behind. It will be interesting to see the consequences of this trend.Dennis Coyne , 12/10/2015 at 9:10 am

Given the recent discussions about where US oil and gas production is headed, I have tried to find some forward looking indicators. Well permits and well completions seem to give reasonable indicators for future production. Below chart indicates that at least Texan oil and gas production will steeply slump over the next months. Well permits declined fivefold to a six year low and well completions are not far behind. It will be interesting to see the consequences of this trend.Dennis Coyne , 12/10/2015 at 9:10 am

The RRC Production data is very bad for the most recent 18 months. Texas output has in fact been relatively flat from Nov 2014 to Sept 2015. Perhaps the completion data suffers from the same reporting problems. Permit data is just not very useful.

The RRC Production data is very bad for the most recent 18 months. Texas output has in fact been relatively flat from Nov 2014 to Sept 2015. Perhaps the completion data suffers from the same reporting problems. Permit data is just not very useful.

peakoilbarrel.com

likbez , 12/30/2015 at 9:50 pm

Glenn Stehle , 12/31/2015 at 9:43 amRon,

OK. Let's assume there is no geopolitics here. But then why Saudis are damping oil at such a low price.

In 2015 they exported over 7.3 Mb/d and got 118 Billions. In 2012 they exported something between 7.658 Mb/d (CIA, probably crude only) and 8.42 mb/d (Bloomberg, probably crude and refined products) and got 336.1 billion.

http://www.bloomberg.com/news/articles/2013-07-29/saudi-arabian-2012-oil-export-revenue-gained-5-as-iran-fell-12-If they just cut 1 Mb/d and that allows to preserve 2014 average price of oil (not even 2013 average price) they would get 125 billions (and preserve 12 Mb from their depleting wells for moment of higher prices which will eventually come.)

In any case they managed to achieve almost 3 times drop of revenue from 2012. Three times --

Now they have almost $100 billion budget deficit in 2015 (and almost the same, 86 billions estimate of deficit for 2016) and only around 600 billions in reserves.

Questions:

1. Why they rocked the boat?

2. Where is the logic in their actions, unless we assume that they want to destroy Iran (and hurt Russia) ?

3. Why MSM spread all this BS about Saudis defending their market share ? Does it look like they are defending something else ?

One theory afloat is that the US and Saudi Arabia are allies in an economic and political war against their enemies. According to this narrative, the intent of Saudi Arabia dramatically increasing oil production during a world oil glut, and sending oil prices into a tailspin, is to shipwreck the economies (and the polities) of US and/or Saudi enemies - e.g., Venezuela, Iran, and Russia.

"Obama's foreign policy goals get a boost from plunging oil prices"

https://www.washingtonpost.com/business/economy/as-crude-oil-prices-plunge-so-do-oil-exporters-revenue-hopes/2015/12/23/ed552372-a900-11e5-8058-480b572b4aae_story.htmlThe war, however, is not being conducted without inflicting significant damages on US allies - e.g., Mexico, Canada, Saudi Arabia, Colombia - and domestic US production as well.

Ambrose Evans-Pritchard, for instance, published an article a couple of days ago about the immense economic damage being inflicted on Saudi Arabia's economy and polity:

"Saudi riyal in danger as oil war escalates"

http://www.telegraph.co.uk/finance/economics/12071761/Saudi-riyal-in-danger-as-oil-war-escalates.htmlWe'll see who blinks first, or who is left standing after all the bloodletting takes place.

Peak Signs , 12/31/2015 at 10:32 am

"According to this theory, the intent of Saudi Arabia dramatically increasing oil production during a world oil glut…"

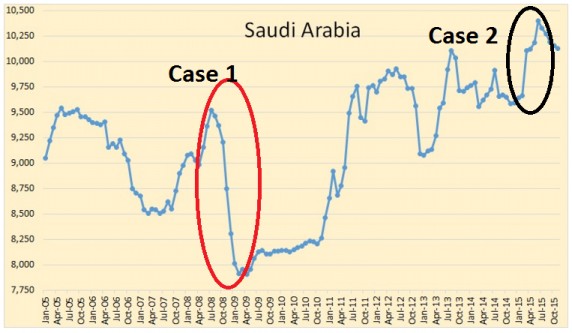

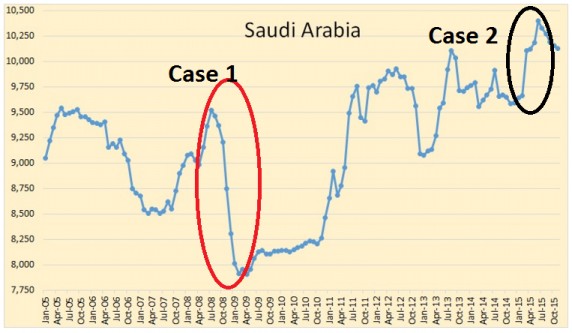

Saudi Arabia hasn't dramatically increased oil production. Their most recent peak in June of 2015 was only a couple hundred thousand barrels per day more than the previous peak back in mid-2013. That's about 2-3% increase over two years. I wouldn't call that, dramatic.

Glenn Stehle , 12/31/2015 at 11:00 am

I think you're arguing semantics.

Would you also argue that the Saudi response to the glut in 2009 was the same to its response to the glut in 2015?

Ablokeimet , 12/31/2015 at 3:07 am

oldfarmermac , 12/30/2015 at 11:23 pmRon is basically correct. The people who think that oil production is a function of the price are assuming that the oil is there to produce. Now, unless there are a few supergiant fields out there, already discovered and waiting for some State Oil Company or some multi-national oil company to make a Final Investment Decision, that assumption is incorrect. There is a handful of locations which could potentially have supergiant oil fields that are so far undiscovered, I'm not that confident that they are there to find, since discovery in the last couple of decades has been a long way short of consumption, even after the price went sky high and everybody and their dog was spending big on exploration.

What interests me is the bit from the previous post, where OPEC projected prices based on their estimate of what it cost to produce the marginal barrel. I think that is a good line to take, until it reaches the point where governments of OPEC countries decide that, with Peak Oil passed and production in irreversable decline, they are going to start hoarding production and make the rest of the world go short.

The thing to realise with projecting prices based on the cost of production of the marginal barrel is that it should be taken as a tendency working on a 5 year or even decadal scale. In time periods short of that, you can get price wars sending prices down below the marginal cost and price spikes producing windfall profits even for the highest cost producers. The price wars lead to national and multi-national oil companies cutting back on capital expenditure, which eventually leads to stagnating or declining production and a recovery in prices. Price spikes lead to huge resources being spent on exploration and development as everybody wants to cash in.

OPEC's production assumptions are a lot less sensible than their price projections. They assume two things:

(a) That the oil is there to increase global production; and

(b) Most of that oil, from 2020 to 2040, will come from OPEC countries.

Conventional crude oil production is flat out right now and, as I said above, unless someone is hiding a few undeveloped supergiant fields somewhere, it's got nowhere to go but down. Let's look at unconventional sources, then.

1. Polar and deepwater oil. A huge amount has been spent exploring for this and the results have been underwhelming. Sure, they've found oil, but not in anywhere near the quantities needed. Shell recently pulled out of the Arctic because of the combination of environmental protests and poor exploration results. If they were discovering heaps, they'd just tough out the protests – as anybody who knows the first thing about corporate capitalism could tell you.

2. Canadian tar sands. Production of these has been expanding, but it hasn't been to the rate that one might imagine from the published resource data. This is because the rate of production is subject to certain limits, due to inputs. The relevant inputs in this situation are water and natural gas – and it is water which is the harder limit. Basically, they can't produce more oil from the tar sands than the rivers of the region can support. These limits will sooner or later, and I believe sooner, put a ceiling on Canadian production. Absent a huge shift in consumption caused by climate change mitigation action, it will keep at that limit for many decades to come, but it won't exceed it.

3. Venezuelan extra heavy. This is the factor about which I know least, but there doesn't appear to be a lot of it on the market yet. There seem to be a lot of obstacles in the road of high production.

4. Tight oil. One thing that everybody who is knowledgeable admits is that there is a lot of "oil in place" in this category. The question is how much of this is recoverable in a practical sense. This industry has developed in the US, primarily because it brings a number of environmental hazards with it and, outside the US, landholders are blocking exploitation because of environmental concerns. In the US, landholders have a financial interest in ignoring these concerns, because mineral royalties are vested in the landowner.

Tight oil has been developed in the US on the basis of unrealistic projections of ongoing production, due to depletion rates being vastly higher than admitted when spruiking to investors. Sooner or later, it was bound to run into problems. These problems have arrived sooner, as opposed to later, due to OPEC's price war, which is aimed at sending the tight oil industry broke. Producers have cut back on drilling and concentrated with increased intensity on "sweet spots", where production is likely to be highest. They have also introduced technological progress that has cut the price of drilling substantially and thus cut the break-even price for a well of a given production level, but the industry is still losing money. A loss-making industry is unsustainable and, therefore, will not be sustained. Something has to give.

Eventually, the price of oil will recover to be equal to or greater than the marginal cost of production. At this point, what will be relevant is just how extensive the sweet spots in the tight oil formations are. Having been burnt once, investors will be working on much more careful examination of likely decline rates and won't support drilling wells just to keep production up, if those wells won't recover their costs within the time frame of the investment horizon.

The $64 thousand dollar question, therefore, is how long the US tight oil industry is going to be able to keep finding sweet spots where they can extract sufficient tight oil to pay back the cost of drilling.

What's going to happen in other countries? Not a great deal, I predict. Opposition from the local population, led by local landholders, will delay and minimise production from tight oil reservoirs. It won't completely prevent a tight oil industry developing in many other countries, but it will ensure that it never develops the dimensions of the current oil industry. Tight oil production will be a buffer for production on the way down, but it won't counteract the declines caused by the depletion of conventional oil fields.

In summary, the price of production of the marginal barrel of oil is going to go higher – a lot higher, but the marginal barrels won't be additional ones. Rather, rising prices will cause demand destruction. It is already doing so in OECD countries, and it will start doing it in Third World countries too, as existing fields deplete and have to be replaced by new and extraordinarily expensive oil.

Door number two looks damned good from where I sit in the audience, lol.In addition to putting a hurting on Russia and Iran, the Saudis are also no doubt getting the message across to other exporters, in and out of OPEC, that they will not carry the load alone, if and when they eventually decide to cut.

There is little doubt in my mind that secret negotiations about cuts are going on every day, day after day, between diplomats from other oil exporters and the Saudis. When the Saudi government gets what it wants, iron clad promises of cooperation, THEN they might be more inclined to cut.Maybe.

Sometimes something that walks like a duck, and quacks like a duck , and looks like a duck, is never the less not a duck .. Sometimes the resemblance is merely coincidental. Sometimes coincidences are highly advantageous to two or more parties involved.

Consider for instance that many or most well informed people consider that the House of Saud has managed to accumulate and hang onto the biggest fortune in the world only because the country is a client state of the American empire.

Otherwise all those princes and princesses would be dead, or in dungeons, or refugees.

I am NOT saying the Obama administration is colluding with the Saudis, secretly, to keep the price of oil down. I AM saying Uncle Sam is no doubt perfectly happy about oil selling for peanuts, because peanut oil prices are a damned good economic tonic. There must be fifty people happy about cheap gasoline for every one person hurting because he lost his ass or his job in the oil business. Fifty to one. No politician in his right mind can afford to overlook that sort of thing.

I'm ready to bet the farm that no documentation ever comes to light proving Uncle Sam is trying to force oil prices up at this time. OTOH, Uncle Sam and the Saudis share some very heavy duty common interests when it comes to Iran and Russia.

Hey guys, it ain't nothing but zero's in computers, in the last critical analysis, to the House of Saud. They have more than they can spend (on themselves ) anyway.

Suppose any one of you happened to have a personal fortune of say ten million bucks, and you discover you are at high risk of having a fatal heart attack. I doubt any of you would hesitate to spend a third or even half of that fortune to avoid that heart attack. You will never have eat beans and rice unless LIKE beans and rice, so long as you still have five million bucks. ( Unless maybe your physician insists!)

In the minds of the Saudis, the Russians and the Iranians may well represent a literal existential threat .

Telegraph

Saudi Arabia is burning through foreign reserves at an unsustainable rate and may be forced to give up its prized dollar exchange peg as the oil slump drags on, the country's former reserve chief has warned.

"If anything happens to the riyal exchange peg, the consequences will be dramatic. There will be a serious loss of confidence," said Khalid Alsweilem, the former head of asset management at the Saudi central bank (SAMA).

"But if the reserves keep going down as they are now, they will not be able to keep the peg," he told The Telegraph.

His warning came as the Saudi finance ministry revealed that the country's deficit leapt to 367bn riyals (Ł66bn) this year , up from 54bn riyals the previous year. The International Monetary Fund has suggested Saudi Arabia could be running a deficit of around $140bn (Ł94bn).

Remittances by foreign workers in Saudi Arabia are draining a further $36bn a year, and capital outflows were picking up even before the oil price crash. Bank of America estimates that the deficit could rise to nearer $180bn if oil prices settle near $30 a barrel, testing the riyal peg to breaking point.

Dr Alsweilem said the country does not have deep enough pockets to wage a long war of attrition in the global crude markets, whatever the superficial appearances.

Concern has become acute after 12-month forward contracts on the Saudi Riyal reached 730 basis points over recent days, the highest since the worst days of last oil crisis in February 1999.

The contracts are watched closely by traders for signs of currency stress. The latest spike suggests that the riyal is under concerted attack by hedge funds and speculators in the region, risking a surge of capital flight.

A string of oil states have had to abandon their currency pegs over recent weeks. The Azerbaijani manat crashed by a third last Monday after the authorities finally admitted defeat.

The dollar peg has been the anchor of Saudi economic policy and credibility for over three decades. A forced devaluation would heighten fears that the crisis is spinning out of political control, further enflaming disputes within the royal family.

Foreign reserves and assets have fallen to $647bn from a peak of $746bn in August 2014, but headline figures often mean little in the complex world of central bank finances and derivative contracts.

See also

Black Swan

""He is drawing on a McKinsey study – 'Beyond Oil' -

that sketches how the country can break its unhealthy dependence on

crude, and double GDP by 2030 with a $4 trillion investment blitz across

eight industries, from petrochemicals to metals, steel, aluminium

smelting, cars, electrical manufacturing, tourism, and healthcare""McKinsey's advice to the Saudi suckers proves that global financial companies are crooks. Pray tell from where will Saudi Arabia get people to run the industries recommended by Mckinsey ? There is already global excess in the industries.

finance.yahoo.com

While cheaper fuel is a boost to consumer spending power in much of the developed world, it is also a disinflationary force that reinforces bets on loose monetary policy in Europe, Japan and China, even as the Federal Reserve proceeds with glacial tightening.

Oil prices are ending the year how they began - under pressure.

peakoilbarrel.com

Dean , 12/31/2015 at 1:13 pmPetroleum Supply Monthly is out:

- US #crudeoil production down to 9.347mbpd in Oct15 from an upward revised 9.460 in Sep15

- Texas #crude production down to 3391000 b/day in Oct15 from a revised down 3417000 b/day in Sep15

TechGuy , 12/31/2015 at 2:20 pm

http://trib.com/business/energy/top-wyoming-oil-companies-write-off-billion-in-assets/article_d380f763-962e-587d-9d9a-2af39b1e166d.html

Top Wyoming oil companies write off $41 billion in assets" The write-offs, known officially as impairments, represent a recognition that many wells will have shorter productive lives than initially anticipated, analysts said. It also reflects an acknowledgement that companies may have to pay for the cost of plugging and abandoning wells sooner than they expected, they noted. "

" Chesapeake Energy, Wyoming's fourth-largest oil producer, reported impairments of $15.4 billion through the first three quarters of 2015. The Oklahoma City-based producer's woes are primarily tied to natural gas. "

" Oil patch bankruptcies have accelerated in the fourth quarter of 2015 as a supply glut keeps prices stuck below $40 a barrel. Ten firms, with more than $2 billion in debt, have closed their doors since October, according to the Federal Reserve Bank of Dallas.

Capital spending has fallen 51 percent since the third quarter, the bank said . And the global supply glut may linger into 2017, it noted, pointing to estimates that production will outpace demand by 600,000 barrels per day through 2016."

Zero Hedge

Submitted by David Stockman via Contra Corner blog,

...Already, investment is estimated to have dropped by 20% in 2015, and that is just the beginning.This unfolding collapse of oil and gas investments, of course, will ricochet through the capital goods and heavy construction sectors with gale force. Eventually, annual investment may decline by $250 to $400 billion before balance is restored, meaning that what were windfall profits and surging wages and bonuses in these sectors just a year or two back will evaporate in the years ahead.

... ... ...

... as the credit bubble begins to shrink it means that profits, incomes, balance sheets and credit-worthiness are all shrinking, too. So is the related GDP.

But now the days of heady accumulation of "sovereign wealth" in Saudi Arabia, Norway, Kazakhstan and dozens of commodity producers in between is over and done. What is happening is that these funds are entering a cycle of liquidation which is unprecedented in financial history.

Indeed, the data for Saudi Arabia, Qatar, Kuwait, the UAE and other members of the Gulf Cooperation Council (GCC) is stunning. During the global credit boom they amassed sovereign wealth funds totaling $2.3 trillion. But with deficits now estimated at 13% of GDP and rising, the level of asset liquidation is soaring.

Thus, if crude oil prices recover to $56 per barrel next year, the GCC states will need to liquidate $208 billion of investments.

... ... ...

In a word, the unnatural Big Fat Bid of the sovereign wealth funds is going All Offers as oil and commodity producers struggle to fund their budgets.

... ... ...

Jack Burton

ENERGY Sector "what were windfall profits and surging wages and bonuses in these sectors just a year or two back will evaporate in the years ahead."

This is already crushing Canada and North Dakota, whose actual oil field cut backs are only now beginning as they tried to produce their way out of the debt crisis. But the hedges have run out, prices seem glued to the basement and NOW the time has come to eliminate the expeditures. That mean people losing jobs all up and down the line.

Stockman is brilliant here, as always.

I was watching "The Big Short" last night too. Excellent film. Very historic and everyone should watch it.

Peak Oil Barrel

Jeffrey J. Brown, 12/30/2015 at 4:16 pm

I suspect that we actually have a condensate glut, at least in the US, and perhaps globally.

Javier, 12/30/2015 at 4:33 pm

The possibility of a global recession in 2016 must be taken into account in any scenario, given how weak is the economic situation of the world.

A global recession in 2016 probably means the peak [reached in] oil [ production] in 2015 will last for at least 10 years, and probably forever.

Stavros Hadjiyiannis, 12/30/2015 at 5:23 pm

Is this the 545289658th time that someone has claimed that Russian oil production has peaked?