|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

| Financial Humor | News | Casino Capitalism Dictionary | Famous quotes of John Kenneth Galbraith | Lord Keynes | The Roads We Take | Humor | Quotes | Etc |

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

Due to the size financial skeptic dictionary is now converted to a separate page

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | |

| Jan | Feb | Mar | Apr | May | June | July | Aug | Sep | Oct | Nov | Dec |

A quick calculation… The 2010 Wall Street bonuses

were equal to 2.88 million $50,000 jobs.

Dear Americans,

On our annual Dec 24 meeting we decided to launch Santa Claus Rally in 2012-2013. And no retail sales data can interfere with out mission to provide Americans with the illusion of prosperity...

The term was used in the title of Ambrose Evans-Pritchard article (Nov 08, 2012): Who will stop the Sado-Monetarists as jobless youth hits 58pc in Greece?

[Oct 27, 2012] Lord Bichard Old People Need To Work For Their Pensions (Even If They Already Have)

Jesse's Café Américain

Baron Bichard has been selected as first recipient of the Dolores Jane Umbridge Award for a lifetime achievement in bureaucratic vindictiveness and petty hypocrisy.

[Oct 25, 2012] Charles Ferguson -- Behind Every Great Con Artist Is a Man Like Glenn Hubbard

Hubbard ... co-authored an article with William Dudley, then the chief economist of Goldman Sachs, entitled "How Capital Markets Enhance Economic Performance and Job Creation."

It was published by the Goldman Sachs Global Markets Institute in 2004, just as the housing bubble was getting seriously crazy.

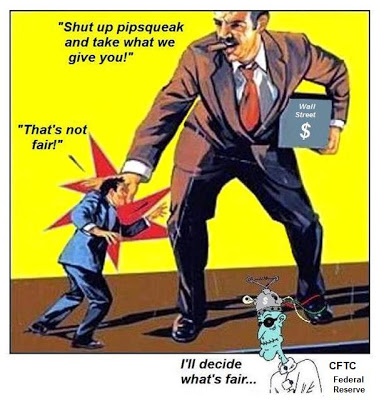

[Sep 16, 2012] PRICELESS

12 Comments

Zarathustra says: The revolution will be french. Now who will be our Napoleon? Well-loved. Like or Dislike: 7 0 8th August 2012 at 5:18 pm

No Field Five says: Yikes. The truth hurts for many people out there who really don't understand the scope of the problem.

[Sep 16, 2012] Group Occupy Protester Accused Of Bank Robbery For Holding 'You're Being Robbed' Sign

August 8, 2012 | CBS Philly

An Occupy Easton protester faces an attempted bank robbery charge following an arrest at an organized event at a bank – during which the "Occupier" was holding a sign that reportedly read "You're being robbed."

According to The Express-Times, Dave Gorczynski allegedly held cardboard signs outside a Wells Fargo Branch that read, "You're being robbed," while the other said, "Give a man a gun, he can rob a bank. Give a man a bank, and he can rob a country."

Occupy Easton reports on their Facebook page that Gorczynski "was at the bank protesting the theft of our tax dollars, our homes, and our economy by the criminal banksters."

Gorczynski allegedly did the same thing a short time later inside a Bank of America, prompting an employee to activate the panic alarm – reports The Express Times.

Police reportedly responded and located Gorczynski with the signs in question and arrested him.

"He is not the criminal. If the police were truly there to protect and serve the taxpayers, the banksters would be arrested and this man would be called a hero," posted the Occupy Easton group.

[Aug 25, 2012] Romney Tax Files: Converting Management Fees Into Carried Interest

August 24, 2012 | Jesse's Café Américain

Romney was being particular aggressive (euphemism for engaging in extra-legal activity) in misstating not trivial income for the purpose of avoiding taxes.

One can only wonder what those undisclosed personal returns might contain.

I don't want to pick on Mitt in particular, although he is starting to look like a setup to make the other guy look good. And what he had done with his income from Bain is certainly open to interpretation as the author admits.

But rather, this speaks to the 'rule of law' issue and how there is a duality in the US, and some animals are more equal than others. And strangely enough, the barnyard hoots its approval.

....

Current law on carried interest is already a sweetheart tax deal for private equity, but why not make it better? Private equity folks are not the type to walk past a twenty-dollar bill lying on the sidewalk.

In the 2000s it became common for private equity fund managers to "convert" their management fees into carried interest.

[Aug 15, 2012] Sorry always seems the hardest thing to say.

Sorry always seems the hardest thing to say.

But isn't a big apology exactly what we owe Wall Street today?

We've foolishly given the financial industry a trillion dollars in support of its balance sheets and markets. We did so even though the big banks and brokerages clearly didn't need or want our help. Things were just fine in September 2008, but then we had to go and stick our noses into the world of high finance.

Now, we're making matters worse by trying to tell them how much to pay their people, how much risk they can take and what businesses are kosher. Suddenly, we feel we're better bankers than the bankers. We know to whom they should be lending. We have strong opinions about what they do with our money.

We're sorry about that.

We're sorry that we want strong control of our money supply. We regret that we want to have government protection of our deposits, our checking accounts, mortgages and credit cards. Maybe it's our simpleton ways. We get nervous when we lose our jobs and have to sell our homes at a discount to eat.

That's our bad.

The fact is Wall Street has done as masterful job of handling these accounts. And we should acknowledge that the overdraft fees, escalating interest rates and calamity in the mortgage market are really our fault, not the banks'.

It's funny that Lloyd Blankfein, the chief executive of Goldman Sachs Group (GS) should have to keep apologizing for his firm's success. He said that given hindsight Goldman would have done things a lot differently. Goldman engaged in "improper" behavior, he said. But when he made those comments Jan. 14, he wasn't talking about the bets Goldman made against toxic mortgage securities it was selling clients. That's the lord's work after all.

I think I speak for everyone when I write, sorry Lloyd, I don't know how we got that one confused. I guess that's why they pay you the big bucks ($68.5 million in 2007).

But please understand, we only had the best of intentions with our meddling.

Taxpayer Help

When your balance sheets looked like they were in trouble we forced the $700 billion Troubled Asset Relief Program on you.

We only wanted to prop you up with the Term Asset-Backed Securities Loan Facility, a program designed to give the industry $200 billion in loans against "top-rated" credit-card, small business, student and auto loan debt.

The $30 billion Public-Private Investment Program was intended to only lighten the load of bad assets on your books. When that program didn't look promising we just tried to let you wipe it away yourselves by eliminating accounting rules that made you value the junk for what it's worth.

When you couldn't issue debt, we told the Federal Deposit Insurance Corp., the institution in charge of our nest eggs, to back your bonds. Reluctantly you took us up on it. Eighty-four bond issues for $309 billion were made under the program. Citigroup (C) issued $64 billion. Goldman issued $21 billion. Bank of America (BAC) issued $44 billion.

We know, you did it just to make us feel better.

And when all of that didn't work, we simply told the Federal Reserve to step up to buy an unlimited amount of mortgages and hand one of your trading partners, American International Group (AIG) a $182 billion lifeline.

How any of this stuff would be interpreted as backing banks while they continued to take bets "with their own money" on proprietary trading desks, hedge funds and private equity, is a mystery.

Bonus Bungle

Compared to our squeeze on your bonuses, this stuff was just kids' play. At Goldman, the average bonus worked out to just $460,000 per employee -- just a little more than nine-times the U.S. median income. Sorry, there's no way anyone can buy a Bugatti Veyron, even used, for those peanuts. So much for stimulating the auto industry.

In retrospect, all of that bailout money should have been earmarked for Wall Street bonuses. Without deep cash, your bankers are probably considering jumping to more lucrative jobs elsewhere, perhaps in Major League Baseball or playing the lottery. They're not focused on stabilizing the financial system, and the resulting problems are our fault for questioning you. Understand that we don't get paid the big bucks for a reason.

No, we just have our shrinking 401(k)s, our individual retirement accounts and maybe, if we're lucky, our homes. We're too dense to see how bulletproof the financial system is and really no amount of taxpayer support could ever pay you back for all of the good times we've had during the last two years.

So, Wall Street, forgive us for our meddlesome ways. Forgive us, and Paul Volcker, for wanting a return to boring old banking. Forgive us for the sarcasm.

Most of all, forgive us for ever trusting you in the first place.

[Jul 30, 2012] Oops: What Bernanke Said Five Years Ago Today

Real Time EconomicsOn the economic outlook:

"Overall, the U.S. economy appears likely to expand at a moderate pace over the second half of 2007 with growth then strengthening a bit in 2008 to a rate close to the economy's underlying trend. Such an assessment was made around the time of the June meeting of the Federal Open Market Committee… The central tendency of the growth forecast… is for real GDP to expand roughly 2.25% to 2.5% this year and 2.5% to 2.75% in 2008. ….The unemployment rate is anticipated to edge up between 4.5% and 4.75% over the balance of this year and about 4.75% percent in 2008."

Financial Armageddon Good Skill Set

[Jul 18, 2012] I HAVE A DRONE

[Jul 18, 2012] Jesus to JP Morgan

by Colonel Flick

[Jul 18, 2012] Looks like some Fed staffers have urgent need to release an excessive sexual energy

June 16, 2012

poic:

They were contacting people on Wall Street?black dog:pavel.chichikov1.If you obtain gratification from killing neighbourhood pets, you could be a good investment banker.

........... or a senator (frist) ...

The employee from the Office of the Comptroller of the Currency said he was always objective and professional and that his supervision of the unnamed bank was never influenced by the golf outings. It is unclear whether the examiner is still working for the OCC.Handed pick and shovel and sent to dig at the Belomor Canal - if lucky. Otherwise, to Kolyma to dig gold at 50 below zero on a diet of kasha and dried fish...

[Jul 15, 2012] Even Dilbert Gets It ZeroHedge

Bananamerican

"we plan to waste it on complicated hedging strategies that even we don't understand"

no, i don't think Dilbert "gets it"...

Bankers understand their own cons completely...

Too many still believe the Diamond lies of " I wasn't informed...I don't know what happened or how. I am SHOCKED etc" and believe that B.S.

Incredibly, there is still institutional respect and credibility across the land for these criminals (i.e. Jamie Dimon is a savvy investor who "earned" his millions)

veyron:

In all fairness Dimon did earn his money. In the same way that mob bosses earn money.

DOOMSDAY SURVIVAL KITS

The WilliamBanzai7 Blog

[Jul 02, 2012] A Big Joke...

...in honor of yet another hopium-fueled stock market rally (via Capitalists@Work):

Once upon a time, in a place overrun with monkeys, a man appeared and announced to the villagers that he would buy monkeys for $10 each.

The villagers, seeing that there were many monkeys around, went out to the forest, and started catching them.

The man bought thousands at $10 and as supply started to diminish, they became harder to catch, so the villagers stopped their effort.

The man then announced that he would now pay $20 for each one. This renewed the efforts of the villagers and they started catching monkeys again. But soon the supply diminished even further and they were ever harder to catch, so people started going back to their farms and forgot about monkey catching.

The man increased his price to $25 each and the supply of monkeys became so sparse that it was an effort to even see a monkey, much less catch one.

The man now announced that he would buy monkeys for $50! However, since he had to go to the city on some business, his assistant would now buy on his behalf.

While the man was away the assistant told the villagers, "Look at all these monkeys in the big cage that the man has bought. I will sell them to you at $35 each and when the man returns from the city, you can sell them to him for $50 each."

The villagers rounded up all their savings and bought all the monkeys.

They never saw the man nor his assistant again, and once again there were monkeys everywhere.

Now you have a better understanding of how the stock market works.

[Jul 01, 2012] A New Babylon or the Rhyme of History

[Jul 01, 2012] Gold Daily and Silver Weekly Charts - Sitting on the Metals and Painting the Tape Into the Close

Most traders' empathy, outlook, and interests end around their belly buttons. and their attention spans and planning horizons are shorter than that. Sociopaths are considered insufficiently ruthless for the more sophisticated firms, who ripen them over time into utterly self absorbed narcissim, if not borderline psychosis.

[Jun 27, 2012] Jon Stewart on the GOP Field 'Extremely Loud and Incredibly Wealthy'

"We are 99% of 1%" ;-)

STEWART: Oh, it's not fair. He's using unlimited money to buy influence. Rigging the system in some way. Interesting. I can't imagine how frustrated and helpless you Newt Gingrich must feel. Hey, how did guys like Mitt Romney come to be anyway? [...]

You're mad at Mitt Romney? But that's like saying... it's like saying Mitt Romney answered the eHarmony ad and now you're saying it's unfair. That it's not what you meant and you don't mean it that much. Mitt Romney is the pure distillation of conservative economic policies. But now that you have to go up against him, now it's unfair? Republicans, you can't say, release the kraken and then when the kraken turns on you, be all like... that's a very scary kraken.

Stephen Colbert on GOP Candidate Richard Mourdock

HA! Four racoons in a plastic garbage bag.

Economist's View Trouble Ahead, Trouble Behind

Goldilocksisableachblonde

Trouble Ahead, Trouble Behind

If you're in the middle class , it's the trouble behind that you should worry about.

Especially when you bend over.

[Jun 13, 2012] Retail Sales decline 0.2% in May

Yancey Ward:

Rob Dawg wrote:

Firemane wrote:

This is normal recovery ... minus housing.

And jobs. And interest rates. And prices.

And recovery.

[Jun 04, 2012] Banks And The Whole Democracy Thing In 90 Seconds Or Less

ZeroHedge

Reality 90 seconds that describes the sad reality of US banking and politics - in Dr.Seuss style prose.

"Now cabbies and crop-pickers will pick up the slack; your taxes will bring the bankers right back;

where we'll keep spreading our good news, of deregulation and free market views - 'We know what we're doing, just stop with the rules!'"

"Now we're buying both sides to do our good bidding; That whole Democracy thing? Surely You're Kidding"

[Jun 01, 2012] New meaning of the old symbol

[May 23, 2012] FB's doin' great!

"Morgan Stanley cut its revenue outlook on Facebook just before the IPO and discussed it with select institutional investors."

And it's a race to unload ahead of the 6mo lockout expiration.

Principals bailin' so fast the mouse buttons getting worn out - SELL FASTER PUSSYCAT!

Mike in Long Island:

dryfly wrote:

What no "Knowledge Condom"?

Dammit - who put pinholes in my Knowledge Condom!

dryfly:

Mike in Long Island wrote:

Dammit - who put pinholes in my Knowledge Condom!

And the possibilities! Pregnant with opportunity!

EngineerJim:

Why is everyone so negative today? Don't tell me everyone on here is long FB?!?!?

I have 200 shares of FB. My wife egged me into buying it -- so I'll blame it on her. I told her -- well look at the bright side, we can only lose about $8K.

Outsider:

I told her -- well look at the bright side, we can only lose about $8K.

This is why I have an imaginary trading account.

Which reminds me, VXX, which was up 35% for the month, is now only up 25%.

bearly:

Jail - fagetaboutit.

The worst federal criminals wind up behind bars in U.S. penitentiaries. But there are also medium-, low-, and minimum-security prisons. Of those minimum-security facilities, known as federal prison camps, some are adjacent to higher-security prisons and others stand alone. It's the stand-alone ones that Ellis believes are most preferable.

"The staff is less stressed out," he said. "As I like to say, happy staff makes happy inmates."

Federal prison camps also have limited or no fencing, and "zero" violence. Ellis cautioned, however, that these are no country-club - or "Club Fed" - facilities. The inmates are still in prison and away from their loved ones.

It's not just the camp accommodations that made Ellis' list. For the low- to medium-security inmate, there are choice assignments, as well.

[May 21, 2012] A Letter from Mark Zuckerberg

Borowitz Report

Tomorrow is Facebook's IPO, and I know what some of you are thinking. How will Facebook be any different from the dot-com bubble of the early 2000's?

For one thing, those bad dot-com stocks were all speculation and hype, and weren't based on real businesses. Facebook, on the other hand, is based on a solid foundation of angry birds and imaginary sheep.

... ... ...

With your help, if all goes as planned tomorrow, Facebook's IPO will net $100 billion. To put that number in context, it would take JP Morgan four or five trades to lose that much money.

[Apr 28, 2012] Why Obama's JOBS Act Couldn't Suck Worse Matt Taibbi Rolling Stone

We needed Barack Obama and the congress to compromise the entire U.S. stock market because it's too expensive for a publicly-listed company with billion-dollar ambitions to hire an accountant? That almost sounds like a comedy routine:

SILICON VALLEY EXECUTIVE: Listen, IJustThoughtOfSomething.com is the hottest thing on the internet. We're so huge it hurts... I can't even walk to my corner bodega without women throwing me their phone numbers!

INVESTOR: I'd love to invest. Can I see your numbers from last year?

SILICON VALLEY EXECUTIVE: Well, that's just the thing. We painted the bathrooms last March, and then we also had that Vitamin Water machine put in the lounge. You know, the one next to the ping-pong table? So we just didn't have any money left over for an accountant. But I estimate our revenues for 2014 to be $4.2 billion.

INVESTOR: Sounds hot! Where do I send the check?

San Francisco Rents On a tear

ac:

the average rental price in San Francisco shot up by 15.8% from a year ago.

That will get people screaming about inflation real fast!

GDD9000

Anyone paying that for 600sq ft is a complete moron, in that if they dont care about money, why rent?

Lobbyist Ben Dover:

Crazifornia never learns.

Weeping Williow:

Rents on a tear, eh? Sounds pretty consistent with upward pressure on salaries.

Meantime, another (second-hand, this time) acquaintance looking for talent...

"I need outstanding Graduates, PhD preferred to work in a Algorithmic Trading Analyst role in London. Great training provided, great role and great culture. Great Salaries and Bonuses."

Shit's rolling out there. How long it lasts, no way to tell, and really, why should it matter, make hay while the sun shines...

Obladi oblada....

Lobbyist Ben Dover:

They need a new mortgage scam for renters.

steelhead:

Watching the PBS Frontline program. This is a French Kiss to Jamie and Blyth as well as Lloyd...

[Apr 25, 2012] To pretend that firms like Goldman don't prey on gullability is naive.

"He's such a bad actor, literally."

naked capitalism

But Blankfein tries to pass off the idea that Goldman is misunderstood, as opposed to all together too well understood:

I think the average American probably had no contact and had never heard of Goldman Sachs before three years ago. Shame on us in a way for not anticipating how important that would be. We're an institutional business with no consumers. It turns out, another name for consumers are citizens and taxpayers. They became important for reasons that are obvious. They always should have been important, but it wasn't part of our audience as we thought about it. Now we will have to develop those muscles a little better than we have. Shame on us.

Translation: We should have been buying more retail advertising, like JP Morgan does, so all those financial section editors would have to think twice before dumping on us.

[Apr 22, 2012] Open Letter to the Chief Confidence Officer of the United States of America

I protected an insignificant fool with my own money, while you took my money and protected a behemoth - a massive, corrupt, and systemically dangerous juggernaut - in a way that ultimately imperils me, my family, and my community... That is not central banking, Dr. Bernanke; that is centralized criminality.

Capitalism Without Failure

Dear Dr. Bernanke,

My nephew is a bad kid. He's into drugs, engages in high-risk sex, and has a steady stream of brushes with the law. But he always manages to avoid prosecution- probably because he is smart and good looking... and he has a rich uncle.

Recently he got into trouble. He was involved in some illegal gambling and had resorted to the Martingale strategy - right up until he ran out of money. Just as he lost that last hand, the hall was raided and he was arrested. I had, in the past, told him that if he ever needed help, he should call. But this time was tough for me. I knew that I could throw money at the situation and the problem would disappear; the gamblers would go away, the police would go away, and there would be no court case. I would basically restore public confidence in this boy by buying his way out of scrutiny. He would then go on to screw up another day - probably in a much bigger way.

The alternative was for me to let him collect his lumps, and watch as he got a taste of where he would end up if uncle was not around to bail him out - or if uncle chose not to bail him out because he was the cause of all his trouble.

I had to decide what the moral thing was for me to do: Shower the situation with money and make it go away; or let him learn a hard lesson - replete with bruises and a likely criminal record.

From the public's point of view, the answer was obvious; society would be better off if I let him take his lumps. He might be scared straight. And a criminal record would constitute a public record - a warning to anyone who took the time to find out about his proclivities.

But personal morality is a different beast. I have a certain loyalty to my brother to think about. And I did promise my nephew that if he ever got into trouble, I would be there for him. At the time, I did not include any contingencies in that promise. And it would break my mother's heart if my nephew went to jail - or if he was beaten up for not paying his debt.

I had to side with my posse, Dr. Bernanke. I bailed out my nephew. I paid off his gambling debt. And I found a lawyer who knows the DA - and the whole problem disappeared. It cost me a few dollars - but my brother is forever grateful. And my mother remains happy and ignorant. The cost to society, on the other hand, is going to be higher; this kid now thinks he's untouchable. Watch out, world.

On the face of it, your and my decision-making processes seem similar. Faced with a moral question of how best to restore confidence following a crisis, you too decided not to let your nephew-equivalents take their lumps; you shoveled money, just like I did, to protect those bad apples... to restore confidence in them... to restore confidence in the system.

There are a few differences in terms of the decision you made and the decision I made. For example, who, for you, is the equivalent of my brother? And who, for you, is the equivalent of my mother? And I was using my own money - thus the money was used in a way that would benefit me and my interests. Whose money were you using?

I am playing with you, Dr. Bernanke. I know where your allegiances lie, and whose money you used; you used my money. And your brothers and nephew are bankers - bad bankers. You took my money, and you funded your posse so that they would not have to face the repercussions of their dangerous ways. That is not moral, Dr. Bernanke. And it is a lot more dangerous than me letting my no-good nephew continue down his self-destructive path. I protected an insignificant fool with my own money, while you took my money and protected a behemoth - a massive, corrupt, and systemically dangerous juggernaut - in a way that ultimately imperils me, my family, and my community.

I may have done something unseemly from a public perspective, but it was my prerogative and I did what I had to do to protect my family. You did something obscene from a public perspective; you used the public's money to protect a corrupt core of powerful criminals who had imperiled our entire economy - and who, thanks to your largess, will eventually do so again. That is not central banking, Dr. Bernanke; that is centralized criminality.

You had a choice when it came to how you were going to restore confidence in our economy. You could have done it in a way that eliminated many of the industry people and practices that led to the crisis - in which case our confidence would arguably be based on having a more sound financial sector; or you could have sought to restore confidence by reinforcing the status quo - systemically dangerous institutions and people who pose a threat to our well-being - by flooding the financial sector with no-strings-attached money. You, somehow, chose the latter approach. You chose to protect the wrongdoers at the expense of the victims, you did it with the victims' money, and you did it in such a way so as to guarantee a future threat to those same victims. That is downright diabolical.

Is there something wrong with you, Dr. Bernanke?

Uncle.

[Apr 22, 2012] Links 4-21-12

naked capitalism

Skippy:

My other all-time favorite is a 3-day prediction by Irving Fisher, a Yale economics professor, who on October 21, 1929, stated:

"Stocks have reached what looks like a permanently high plateau."

Three days later, Black Thursday ushered the United States into the Great Depression. Recently, another genius economist from Princeton declared that oil was irrelevant to modern economies.

[Apr 20, 2012] The Big Picture "Quote of the Day"

"I'm sorry Professor, I missed the question -- but the answer is increase the money supply..."

Scene: U of Chicago economics class taught by Milton Friedman. After a late night of studying, a student falls asleep in class. This sent Friedman into a tizzy and he came over and pounded on the desk, demanding an answer to a question he had just posed.

The student, shaken but now awake says "I'm sorry Professor, I missed the question -- but the answer is increase the money supply..."

[Apr 19, 2012] In Conversation- Barney Frank by Jason Zengerle,

New York Magazine

TARP was basically being administered by Hank Paulson as the last man home in a lame-duck presidency. I tried to get them to use the TARP to put some leverage on the banks to do more about mortgages, and Paulson at first resisted-he just wanted to get the money out. And after he got the first chunk of money out, he said, "All right, I'll tell you what, I'll ask for a second chunk, and I'll use some of that as leverage on mortgages, but I'm not going to do that unless Obama asks for it."

This is now December, so we tried to get the Obama people to ask him, and they wouldn't do it. During the critical period when the TARP was being administered, there was a vacuum of political leadership.

At one point, Obama said, "Well, we only have one president at a time." I said I was afraid that overstated the number of presidents. We had no president.

[Apr 18, 2012] This, my friends, is Globalization! One Stop Thought Shop

January 13, 2008 by Brian

Question:

What is the truest definition of Globalization?

Answer:

Princess Diana's death.

Question:

How come?

Answer:

An English princess

with an Egyptian boyfriend

crashes in a French tunnel,

driving a German car

with a Dutch engine,

driven by a Belgian

drunk on Scottish whisky,

followed by Italian Paparazzi

on Japanese motorcycles;

treated by an American doctor

using Brazilian medicines.This is written by a Canadian,

using American patents

with Taiwanese chips,

a Korean monitor,

assembled by Bangladeshi workers

in a Singapore plant,

transported by Indian truckers,

hijacked by Indonesians,

unloaded by Sicilian longshoremen,

and delivered downtown by Mexican illegals.That, my friends, is Globalization!

[Apr 17, 2012] Comments on the Housing Recovery and Starts and Completions

KarmaPolice wrote on Tue, 4/17/2012 - 12:21 pmExcuse my language, but HOLY SHIT.

"Among the attributes I most envy in a public man (or woman) is the ability to lie. If that ability is coupled with no sense of humor, you have the sort of man who can be a successful football coach, a CEO or, when you come right down to it, a presidential candidate. Such a man is Mitt Romney."

Mitt Romney's enviable ability to ignore the truth - The Washington Post

[Apr 17, 2012] Europe- Sarkozy calls on ECB to support growth

Elvis:

Time to get a tattoo of Ben Bernanke on my ass. It makes sense, because I think of him all of the time when I am on the toilet. That miserable piece of sh&t. I might also get a tattoo of January Jones. But that will be on the front side of my anatomy. Later.

Bad Dawg Bobby:

convexity:Elvis, " That miserable piece of sh&t. "

The Asshat did exactly what he was told , Take care of the Bankers and Wall Street.

Humorous piece on Professor Krugman; he won't like it! Krugman's Depression

"So here's Krugman now, almost 60, looking around, asking where time has gone, and just itching to be remembered as this generation's Keynes, the guy who saved the planet in the '30s by convincing Germany and Japan to start the war that brought the Allies back to full employment. And, unlike bankers, whom Krugman hates more than the Guardian hates the Murdochs, there's only room for one economist per generation to be remembered."

[Apr 17, 2012] "The Migration Myth"

This clown Mankiw (his last name can be translated as slaker) managed to smoke something really strong... He forgot that top 1% is too interconnected with state to make a move and paupers (aka 99%) has no money or opportunities to make it.

Greg Mankiw argues that:

If people feel that their taxes exceed the value of their public services, they can go elsewhere. They can, as economists put it, vote with their feet.

[Apr 16, 2012] Clever Is as Clever Does

Barrons.com

For-profit colleges are contributing mightily to the country's $1 trillion in student-loan debt. When it comes to defaults, ITT Educational Services is doing much more than its share.

[Apr 16, 2012] Percent Job Losses- Great Recession and Great Depression

violingineer:

I'm on a comment spree today after more than 6 months:

Financial "derivatives" or d/dt type derivatives? One type is math, engineering or otherwise; the other is called BS. If you summed all the financial derivatives up you wouldn't get the higher more meaningful function, you'd just get a laughing banker.

[Apr 16, 2012] McClatchy Cartoons

[Apr 14, 2012] Fix income inequality with $10 million loans for everyone!

Also referenced at Fed Access for All -- The Big Picture

April 13, 2012 | The Washington Post

"Under my plan, each American household could borrow $10 million from the Fed at zero interest. The more conservative among us can take that money and buy 10-year Treasury bonds. At the current 2 percent annual interest rate, we can pocket a nice $200,000 a year to live on. The more adventuresome can buy 10-year Greek debt at 21 percent, for an annual income of $2.1 million. Or if Greece is a little too risky for you, go with Portugal, at about 12 percent, or $1.2 million dollars a year. (No sense in getting greedy.)

Think of what we can do with all that money. We can pay off our underwater mortgages and replenish our retirement accounts without spending one day schlepping into the office. With a few quick keystrokes, we'll be golden for the next 10 years."

Of course, we will have to persuade Congress to pass a law authorizing all this Fed lending, but that shouldn't be hard. Congress is really good at spending money, so long as lawmakers don't have to come up with a way to pay for it. Just look at the way the Democrats agreed to extend the Bush tax cuts if the Republicans agreed to cut Social Security taxes and extend unemployment benefits. Who says bipartisanship is dead?

And while that deal blew bigger holes in the deficit, my proposal won't cost taxpayers anything because the Fed is just going to print the money. All we need is about $1,200 trillion, or $10 million for 120 million households. We will all cross our hearts and promise to pay the money back in full after 10 years so the Fed won't lose any dough. It can hold our Portuguese debt as collateral just to make sure.

Because we will be making money in basically the same way as hedge fund managers, we should have to pay only 15 percent in taxes, just like they do. And since we will be earning money through investments, not work, we won't have to pay Social Security taxes or Medicare premiums. That means no more money will go into these programs, but so what? No one will need them anymore, with all the cash we'll be raking in thanks to our cheap loans from the Fed.

Come to think of it, by getting rid of work, we can eliminate a lot of government programs. For instance, who needs unemployment benefits and job retraining when everyone has joined the investor class? And forget the trade deficit. Heck, we want those foreign workers to keep providing us with goods and services.

e can stop worrying about education, too. Who needs to understand the value of pi or the history of civilization when all you have to do to make a living is order up a few trades? Let the kids stay home with us. They can play video games while we pop bonbons and watch the soaps and talk shows. The liberals will love this plan because it reduces income inequality; the conservatives will love it because it promotes family time.

I'm really excited! This is the best American financial innovation since liar loans and pick-a-payment mortgages. I can't wait to get my super PAC started to help candidates who support this important cause. I think I will call my proposal the "Get Rid of Employment and Education Directive."

Some may worry about inflation and long-term stability under my proposal. I say they lack faith in our country. So what if it cost 50 billion marks to mail a letter when the German central bank tried printing money to pay idle workers in 1923?

That couldn't happen here. This is America. Why should hedge funds and big financial institutions get all the goodies?

Look out 1 percent, here we come.

Sheila Bair is a former chairman of the Federal Deposit Insurance Corp. and a regular contributor to Fortune Magazine.

Mark E Hoffer:

April 13th, 2012 at 5:26 pm "…Kidding aside, she has a point…why are banks entitled to my tax money at 0%, only to lend it back to me at 4% or more, then take the proceeds for use in bribing my government to keep it that way?…"

whskyjack:

I found the Blair piece very funny but I think the reaction in the comments may top it on the humor scale.

Thanks for the entertainment after a rough day.

Market Panic:

This is brilliant use of sarcasm to underline how corrupt our society is.

Why only banksters like Jamie Dimon (JPM) and Lloyd Blankfein (Goldman), or crony capitalists like Jeff Immelt (GE) can borrow taxpayer money at zero percent interest from Bernanke (Fed) and to pay themselves multimillion dollar bonuses?!

Jamie Dimon has been awarded a $23 million bonus this year for borrowing from the Fed taxpayer money at zero interest to speculate in stocks, mark up commodity prices, and to "invest" in treasuries (anyone can do his job when the system is so rigged to benefit the banksters, so if President Obama really wants to be fair, he should give everybody in America the same $23 million bonus or the same access to the Fed as Jamie Dimon gets).

Doofus:

I'm really excited! This is the best American financial innovation since liar loans and pick-a-payment mortgages. I can't wait to get my super PAC started to help candidates who support this important cause. I think I will call my proposal the "Get Rid of Employment and Education Directive."

"Get Rid of Employment and Education Directive" – GREED

b_thunder

There must have been no love lost between Sheila Bair and the Fed! Can you imagine what kind of discussions the FDIC and the Fed chiefs were having when "negotiating" whether or not to allow JPMorgan re-institute dividends?

The organizers of 99% movement should consider making someone the "face" of the movement – Sheila Bair is a perfect candidate. At the very least that Wall St. shill Erin Burnett won't be able to tell her with straight face that the Gov't made money from TARP.

[Apr 10, 2012] "'The Recovery Is Here,' Reports Underemployed Man Making $20,000 Less Than He Used To"

March 27, 2012 | Onion

CARBONDALE, IL-Citing the fact that he's now able to make the minimum payment on his credit cards each month and is back in the workforce making $20,000 less than when he was laid off in 2009, 43-year-old Tom Baker declared Tuesday that the economy was recovering by leaps and bounds. "The tide is turning!" said the man who had to sell his four-bedroom home for less than what he owed on it and move his wife and three children to a cramped apartment 800 miles away. "My company just hired 50 skilled contract employees with a guaranteed eight months of paid employment. America is back!" Baker said that if the economic turnaround continues, he may be able to save enough money to send at least one of his children in for a dental checkup.

[Apr 07, 2012] The Financial Market as a Vengeful God

mainly macro

Of course city pundits have no reason to be honest. When asked 'why has the dollar appreciated', I would like them to reply 'well no one really knows, but one possible factor might be...'. They never do. If I wanted to be unkind, I might suggest that these pundits want to appear like high priests, with a unique ability to understand the mysterious mind of the market. As high priests have discovered over and over again, if you can convince people that you have a direct line to an otherwise mysterious but powerful deity, you can do rather well for yourself. And sometimes financial markets can appear a bit like vengeful gods, capable of sudden acts of destructive anger that appear to come from nowhere.

If I wanted to ratchet up the unkindness I could go on as follows. It is in the priest's interest to tell the faithful that the god is indeed quite fickle in its mood, and while placid at the moment, it could turn nasty at the slightest provocation. Keep those offerings coming, to make sure that the god stays happy (and don't think about where those offerings go). If you are particularly generous, the priest will promise to give you the heads up if any changes in mood are imminent. If you cannot be a priest yourself, you can always set up as an advisor (HT DeLong), who will tell people which priests have a better line to the financial market god.

[Apr 06, 2012] Too pig to fail

[Apr 02, 2012] Construction Spending declines in February

ResistanceIsFeudal :

poic wrote:

Fundamental change will not occur until there is a change in the revolving door between the financial industry and Treasury/SEC.

A bigger revolving door?

arthur_dent:

ResistanceIsFeudal wrote:

If only the two could be combined, somehow...

reminds me of the joke making the rounds in post-soviet Russia, paraphrasing....

Everything Marx told us about Communism was wrong. Unfortunately, everything he told us about Capitalism was right.

poic:

"The top 1% captured 93% of the income gains in 2010. "

Still another 7% to go towards reaching their goal.

Cinco-X:

ResistanceIsFeudal wrote:

Communism was a great way to have a lot of people under consume.

Capitalism is a great way to have a lot of workers over produce.

If only the two could be combined, somehow...

Then we could get the worst of both! You may not have to wait too long...

Comrade Kristina:

I think the saddest most ironic part of the debacle was while it was being touted as a chance at "unimaginable" wealth for the peons it was only a seventh of what the leading hedge fund manager made...just in one year. Hahahaha suckers.

shill:

In light of further nuclear risks, economic growth should not be priority - The Mainichi Daily News

Outsider:

The 99% exist simply to to make the elite more comfortable.

The ones on this site (and others like it) must be a big disappointment.

[Mar 31, 2012] Financers and Sex Trafficking By NICHOLAS D. KRISTOF

"Goldman Sachs with a 16 percent stake. " Lloyd Blankfein as a pimp is really rich... Money doesn't smell as Vespasian put it.

March 31, 2012 | NYTimes.com

THE biggest forum for sex trafficking of under-age girls in the United States appears to be a Web site called Backpage.com.

Damon Winter/The New York Times Nicholas D. Kristof On the Ground Share Your Comments About This Column Nicholas Kristof addresses reader feedback and posts short takes from his travels.

This emporium for girls and women - some under age or forced into prostitution - is in turn owned by an opaque private company called Village Voice Media. Until now it has been unclear who the ultimate owners are.

That mystery is solved. The owners turn out to include private equity financiers, including Goldman Sachs with a 16 percent stake.

[Mar 31, 2012] Something about Facebook IPO

Log in to Facebook now to see what your so-called friends are reading and watching, and to let them see every f**king thing you're reading and watching.

[Mar 31, 2012] Congressman Hurt To Discover Lobbyist Not Really His Friend The Onion

February 4, 2012 | Onion ISSUE 48•05

Rep. Schilling said he was even considering asking Fischer (inset) to be godfather to his youngest son.

WASHINGTON-According to Capitol Hill sources, Rep. Bobby Schilling (R-IL) came to the painful realization this week that agribusiness lobbyist Stephen Fischer, who had been kind and generous toward him for months and had often met up with him for drinks after work, was not, in fact, his friend.

"Steve used to call all the time to catch up and ask about my family and chat about the genetically modified feedstock industry, but now, nothing," said Schilling, who admitted he was still struggling to accept that all their "good times" together at Washington steak houses and nightclubs had not been part of a sincere friendship. "He was such a likable guy-sociable, funny, and he always somehow managed to find great seats to sold-out concerts."

"I thought we were really tight," Schilling added. "But now I can't help but think he was just using me to get stricter seed-patent protections."

According to Schilling, the two first met at a Republican Party fundraiser last spring and "hit it off" immediately. The congressman was surprised to discover Fischer seemed to share his interests in deep-sea fishing, soybean crop insurance, and Big Ten basketball, and recalled in particular how the lobbyist was impressed by Schilling's position on the House Agriculture Committee.

From there, Schilling said, the high-paid employee of Cargill and Archer Daniels Midland began frequently taking him out to exclusive Washington restaurants and to his private luxury box at Baltimore Orioles games, leading Schilling to believe he had found a genuine, affable buddy.

"Sure, I found it unusual that Steve always asked me about the progress of alfalfa silage tax credits and would casually suggest potato-crop insect-management earmarks, but I never thought twice about it," the congressman said. "I just assumed he was curious about my work. Maybe it sounds na•ve, but when a guy does something really nice, like fly you out to Pebble Beach for 18 holes, you just assume he's your friend."

In the weeks since, Fischer reportedly claimed to be too busy to go out with the congressman and eventually stopped answering Schilling's calls altogether. Once he suspected manipulative behavior on Fischer's part, Schilling said he grew despondent, saddened that what he believed had been a promising friendship had vanished so suddenly and left him with nothing but a few boxes of ultra-premium cigars and $47,000 in campaign contributions.

The crestfallen legislator said he now felt unsure who his true friends were, and had begun to question whether fellow congressmen, prominent donors, and even his constituents actually cared about him as a person-or whether they all just wanted something from him.

Summary for Week ending March 30th

Mar 31, 2012 | CalculatedRisk

Rajesh:

KarmaPolice wrote:

dire warnings about runaway inflation for more than three years

In Japan, the dire warnings have been for seventeen years, we have another fourteen years to catch up with them.

Outsider:

as Fukushima is blasting the entire west coast

Glad it's stopping there...

justaskin :

volker the viking wrote:

volker never kidder

California Slammed With Fukushima Radiationfunny, in a sick, twisted way, that the only comment so far is "Has anyone checked for "put options" on Jetblue stock?"

RayOnTheFarm:

KarmaPolice wrote:

10 Lottery Winners Who Lost It All.

The number of people willing to throw perfectly good at a game of chance is another example of the success of QE1 and QE2.

A few TBTF banks going down would have changed that psychology very quickly.

Rob Dawg wrote on Sat, 3/31/2012 - 8:16 am (in reply to...)

skk wrote:

. so then I checked the LAN and sure enough some neighborhood kid( assumption, no data for that ) was logged into my router. so I just deleted him.. the bugger pops back in again.. I toyed with the idea of playing with this ( meeee nevah.. but you know how it is new job, new location new country Kali ), overwhelmed with "stuff to do " so I just "banned" his|her particular MAC address and bob's yer uncle.

Rename "Wireless Virus Seed" and then tunnel him with a message demanding $50 to "remove" the tracking software root kit or else you tell his parents and provide a log of the sites he's visited. Include a link to the RIAA site.

GAO Almost Half of Bailed Banks Repaid the Government With Money "From Other Federal Programs"

Banks: the biggest "welfare queens" in the whole corporate jungle, which says quite a lot!

naked capitalism

Here's the GAO, with a report out today.

john jackson:As of January 31, 2012, 341 institutions had exited CPP, almost half by repaying CPP with funds from other federal programs. Institutions continue to exit CPP, but the number of institutions missing scheduled dividend or interest payments has increased.

Banksters, Banksters everywhere!

They're in your pocket! They're in your hair!

They'll steal your house! They'll steal your car!

Where are the feathers? Where is the tar?

[Mar 09, 2012] Trade Deficit increased in January to $52.6 Billion

black dog:

hoovers wealth to the top ... will continue ...

see if you concentrate enough wealth at the very top, then really really big crumbs will fall from their plates to sate the masses. It's not that trickle down doesn't work it's just that not enough has trickled up before it can trickle down.

~splatLarge trade deficits are a good thing. They are a reflection of our excess amounts of spendable income.

Large debt is also a good thing. It shows we Americans have faith in the future of our economy.

Greenshoots galore.

(from now on, for mental health purposes, I am putting a positive spin on everything)

Mel:

It is amazing that we have not found a way to eliminate the petroleum trade deficit--

Nixon tried - he was promptly impeached.

Carter tried - he was booted after one term.

Voters demanded unicorns and rainbows - Reagan promised them exactly that - it's all been running backwards on this issue ever since.

Weeping Willow wrote:

Voters demanded unicorns and rainbows - Reagan promised them exactly that - it's all been running backwards on this issue ever since.

Someday there'll be a lot of dead unicorns washing up on the beaches of the Persian Gulf. Some of them will wear Army green and Navy blue.

Black smoke from oilfield fires will blot out the rainbows.

Daily darkness!

Prick your finger, it is done.

Goldman owns your firstborn son.

[Jan 24, 2012] Paul Krugman Makes Housing Call He Will Likely Come to Regret

naked capitalism

brian:

wait a minute

didn't this guy get a nobel for economics?

you know from the same people that gave obama a nobel for peace

[Jan 23, 2012] Their bread, our circus

Recently, in the course of one evening in the Big Apple, President Barack Obama "hosted" three fundraisers ranging from $35,800 a head to $1,000 a head and raised $2.4 million - and that wasn't even close to 1% of the funds he will need for this election season. This reflects the power, needs, fears and desires of America's 1%, and how it has turned the rest of us from citizens into viewers. - Tom Engelhardt (Dec 15, '11)

[Jan 23, 2012] United Welfare States of America- In 2011 Nearly Half The Population Received Some Form Of Government Benefit

in 2011 nearly half of the population lived in a household that receives some form of government benefit, which in turn accounted for 65% of total federal spending, or $2.5 trillion, and amount to 15% of GDP.

GhordiusConfusing? Just *TRY* to have a normal conversation with my UK and US relatives and you will find out that they think they live in the land of the free and that the eurozone is a socialist overregulated hellhole where half of the population is on some kind of government support.

Etc

Society

Groupthink : Two Party System as Polyarchy : Corruption of Regulators : Bureaucracies : Understanding Micromanagers and Control Freaks : Toxic Managers : Harvard Mafia : Diplomatic Communication : Surviving a Bad Performance Review : Insufficient Retirement Funds as Immanent Problem of Neoliberal Regime : PseudoScience : Who Rules America : Neoliberalism : The Iron Law of Oligarchy : Libertarian Philosophy

Quotes

War and Peace : Skeptical Finance : John Kenneth Galbraith :Talleyrand : Oscar Wilde : Otto Von Bismarck : Keynes : George Carlin : Skeptics : Propaganda : SE quotes : Language Design and Programming Quotes : Random IT-related quotes : Somerset Maugham : Marcus Aurelius : Kurt Vonnegut : Eric Hoffer : Winston Churchill : Napoleon Bonaparte : Ambrose Bierce : Bernard Shaw : Mark Twain Quotes

Bulletin:

Vol 25, No.12 (December, 2013) Rational Fools vs. Efficient Crooks The efficient markets hypothesis : Political Skeptic Bulletin, 2013 : Unemployment Bulletin, 2010 : Vol 23, No.10 (October, 2011) An observation about corporate security departments : Slightly Skeptical Euromaydan Chronicles, June 2014 : Greenspan legacy bulletin, 2008 : Vol 25, No.10 (October, 2013) Cryptolocker Trojan (Win32/Crilock.A) : Vol 25, No.08 (August, 2013) Cloud providers as intelligence collection hubs : Financial Humor Bulletin, 2010 : Inequality Bulletin, 2009 : Financial Humor Bulletin, 2008 : Copyleft Problems Bulletin, 2004 : Financial Humor Bulletin, 2011 : Energy Bulletin, 2010 : Malware Protection Bulletin, 2010 : Vol 26, No.1 (January, 2013) Object-Oriented Cult : Political Skeptic Bulletin, 2011 : Vol 23, No.11 (November, 2011) Softpanorama classification of sysadmin horror stories : Vol 25, No.05 (May, 2013) Corporate bullshit as a communication method : Vol 25, No.06 (June, 2013) A Note on the Relationship of Brooks Law and Conway Law

History:

Fifty glorious years (1950-2000): the triumph of the US computer engineering : Donald Knuth : TAoCP and its Influence of Computer Science : Richard Stallman : Linus Torvalds : Larry Wall : John K. Ousterhout : CTSS : Multix OS Unix History : Unix shell history : VI editor : History of pipes concept : Solaris : MS DOS : Programming Languages History : PL/1 : Simula 67 : C : History of GCC development : Scripting Languages : Perl history : OS History : Mail : DNS : SSH : CPU Instruction Sets : SPARC systems 1987-2006 : Norton Commander : Norton Utilities : Norton Ghost : Frontpage history : Malware Defense History : GNU Screen : OSS early history

Classic books:

The Peter Principle : Parkinson Law : 1984 : The Mythical Man-Month : How to Solve It by George Polya : The Art of Computer Programming : The Elements of Programming Style : The Unix Hater’s Handbook : The Jargon file : The True Believer : Programming Pearls : The Good Soldier Svejk : The Power Elite

Most popular humor pages:

Manifest of the Softpanorama IT Slacker Society : Ten Commandments of the IT Slackers Society : Computer Humor Collection : BSD Logo Story : The Cuckoo's Egg : IT Slang : C++ Humor : ARE YOU A BBS ADDICT? : The Perl Purity Test : Object oriented programmers of all nations : Financial Humor : Financial Humor Bulletin, 2008 : Financial Humor Bulletin, 2010 : The Most Comprehensive Collection of Editor-related Humor : Programming Language Humor : Goldman Sachs related humor : Greenspan humor : C Humor : Scripting Humor : Real Programmers Humor : Web Humor : GPL-related Humor : OFM Humor : Politically Incorrect Humor : IDS Humor : "Linux Sucks" Humor : Russian Musical Humor : Best Russian Programmer Humor : Microsoft plans to buy Catholic Church : Richard Stallman Related Humor : Admin Humor : Perl-related Humor : Linus Torvalds Related humor : PseudoScience Related Humor : Networking Humor : Shell Humor : Financial Humor Bulletin, 2011 : Financial Humor Bulletin, 2012 : Financial Humor Bulletin, 2013 : Java Humor : Software Engineering Humor : Sun Solaris Related Humor : Education Humor : IBM Humor : Assembler-related Humor : VIM Humor : Computer Viruses Humor : Bright tomorrow is rescheduled to a day after tomorrow : Classic Computer Humor

The Last but not Least Technology is dominated by two types of people: those who understand what they do not manage and those who manage what they do not understand ~Archibald Putt. Ph.D

Copyright © 1996-2021 by Softpanorama Society. www.softpanorama.org was initially created as a service to the (now defunct) UN Sustainable Development Networking Programme (SDNP) without any remuneration. This document is an industrial compilation designed and created exclusively for educational use and is distributed under the Softpanorama Content License. Original materials copyright belong to respective owners. Quotes are made for educational purposes only in compliance with the fair use doctrine.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to advance understanding of computer science, IT technology, economic, scientific, and social issues. We believe this constitutes a 'fair use' of any such copyrighted material as provided by section 107 of the US Copyright Law according to which such material can be distributed without profit exclusively for research and educational purposes.

This is a Spartan WHYFF (We Help You For Free) site written by people for whom English is not a native language. Grammar and spelling errors should be expected. The site contain some broken links as it develops like a living tree...

You can use PayPal to to buy a cup of coffee for authors of this site Disclaimer:

The statements, views and opinions presented on this web page are those of the author (or referenced source) and are not endorsed by, nor do they necessarily reflect, the opinions of the Softpanorama society. We do not warrant the correctness of the information provided or its fitness for any purpose. The site uses AdSense so you need to be aware of Google privacy policy. You you do not want to be tracked by Google please disable Javascript for this site. This site is perfectly usable without Javascript.

Last modified: March 12, 2019