Bad Samaritans The Myth of Free Trade and the Secret History of Capitalism Ha-Joon Chang

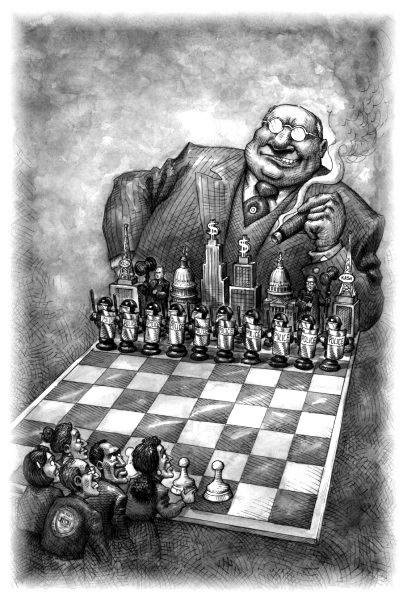

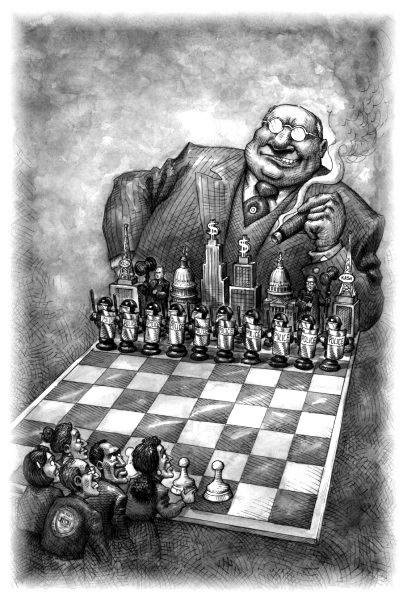

Bad Samaritans was an introduction to open-minded economists and political free-thinkers to Ha-Joon Chang's theories of the dangers of free-trade. With irreverent wit, an engagingly personal style, and a keen grasp of history, Chang blasts holes in the "World Is Flat" orthodoxy of Thomas Friedman and others who argue that only unfettered capitalism and wide-open international trade can lift struggling nations out of poverty. On the contrary, Chang shows, today's economic superpowers-from the U.S. to Britain to his native Korea-all attained prosperity by shameless protectionism and government intervention in industry, a fact conveniently forgotten now that they want to compete in foreign markets. Chang's cage-rattling, contrarian history of global capital appeals to readers new to economic theory as well as members of the old school looking for a fresh take.

Richard Schafferon June 22, 2015

Strong factual argument against economic austerity and free trade.

An argument against the acceptance of free trade as a panacea and the IMF GATT etc. imposing it on the less developed nation. Rather than a comprehensive economic history of trade policies and their effects. Documents numerous examples of: The use of trade restrictions by the wealth nations to get wealthy, Il effects of imposition of free trade on the poorer nations, the problems caused by economic austerity and the non use of the preceding by the wealthy nations. ( although the author doesn't address the negative impacts of economic austerity during the euro zone crisis and the Great Recession.). The author takes a definet position and argues it. A more comprehensive viewpoint would have been more persuasive. Not so strong on what should be done, rather illustrates that tariff protection of nascent industry works and austerity often fails and always inflicts pain on the poor.

Dick_Burkharton October 12, 2013

Pragmatism vs IdeologyThis book is the best attack yet on the dogmas of "free markets" and "free trade". It is a fun and informative read, full of trenchant satire of the kind you'd expect to come from a best selling muckracker, not a Cambridge (UK) professor. What's most unusual for an economist, is that he is pragmatic rather than ideological. He simply asks, "What trade practices have actually worked for developing countries?"

Yet Professor Chang not only lampoons the obvious failures of Chicago School orthodoxy, he explains in simple terms where it goes wrong. One comes away with a solid understanding of why many activists from developing countries regard the present world order as "neo-colonial". That is, while the IMF, World Bank, and WTO preach that free markets and free trade will be a "golden straightjacket" leading to rapid development, the results have been the opposite. Instead successful countries like the Asian Tigers have used strongly protectionistic measures to build their "infant industries" (the term coined by Alexander Hamilton, the architect of US protectionism). These results expose a hidden neo-colonial agenda, designed to benefit first world mega-corporations and speculators.

However Chang's book totally misses the most fundamental economic issue of our times, namely, limits to growth. Mainstream economic theory is based not only on "greed is good" but also "growth is good". Yet resource and environmental limits to growth are bearing down hard, threatening global "ecological overshoot and collapse" over the coming decades. The kind of economic growth that would bring all developing countries up to current first world standards is simply impossible, no matter what the trade or industrial policies. Instead a determined attempt to achieve that growth will simply hasten the collapse. How to do justice in this situation, let alone survive, is a tall order.

Ben Hillon August 24, 2013

Easy to read rational attack on globalizationHa-Joon Chang has the gift of making difficult subjects easy to laypeople to understand.

He makes a rational spirited attack on what he feels is the hypocrisy of the developed countries, the ridged ideology of the free market economists which drive agencies like the IMF.

Most chapters are filled with history lessons on how developed countries in the early days engaged in tariffs, capital controls, intellectual property theft and hard limits on foreign ownership. At least until their industries had matured to level of competing in the global market. Then changed the tune, started lecturing all the developing countries through the IMF and other agencies not to do any of those things. Usually, the countries that followed the IMF advice had more negative results than positive. The author states the trade offs between political economy and the free market, in a detailed section on the rise of South Korea, his home.

Two chapters in the book were particularly eye opening, My six-year old should get a job and Lazy Japanese and Thieving Germans. The first chapter points out the problems with not protecting an industry while it gains technical expertise and capacity. Give the child time to go to school and get bigger. The second chapter is about how some developed countries were considered basket cases, their people are not capable of achieving developed status, a claim I have heard used against developing countries that have listened to the IMF, then fallen on hard times.

The book is good ammo for having a rational discussion about the trade offs and short comings of unfettered free market ideology.

Neoliberalism's Myth on Benefits of Free Trade

Monthly Review magazine, founded in 1949. The Leading economic & political journal without a pro-capitalism spin.

Its lead article in 1949 was Why Socialism by Albert Einstein.

http://www.monthlyreview.org/0406hart-landsberg.htm

Neoliberalism: Myths and Reality by Martin Hart-Landsberg

Agreements like the North American Free Trade Agreement (NAFTA) and the World Trade Organization (WTO) have enhanced transnational capitalist power and profits at the cost of growing economic instability and deteriorating working and living conditions. Despite this reality, neoliberal claims that liberalization, deregulation, and privatization produce unrivaled benefits have been repeated so often that many working people accept them as unchallengeable truths. Thus, business and political leaders in the

United States and other developed capitalist countries routinely defend their efforts to expand the WTO and secure new agreements like the Free Trade Area of the

Americas (FTAA) as necessary to ensure a brighter future for the world’s people, especially those living in poverty.

For example, Renato Ruggiero, the first Director-General of the WTO, declared that WTO liberalization efforts have “the potential for eradicating global poverty in the early part of the next [twenty-first] century—a utopian notion even a few decades ago, but a real possibility today.”1 Similarly, writing shortly before the December 2005 WTO ministerial meeting in Hong Kong, William Cline, a senior fellow for the Institute for International Economics, claimed that “if all global trade barriers were eliminated, approximately 500 million people could be lifted out of poverty over 15 years....The current Doha Round of multilateral trade negotiations in the World Trade Organization provides the best single chance for the international community to achieve these gains.”2

Therefore, if we are going to mount an effective challenge to the neoliberal globalization project, we must redouble our efforts to win the “battle of ideas.” Winning this battle requires, among other things, demonstrating that neoliberalism functions as an ideological cover for the promotion of capitalist interests, not as a scientific framework for illuminating the economic and social consequences of capitalist dynamics. It also requires showing the processes by which capitalism, as an international system, undermines rather than promotes working class interests in both third world and developed capitalist countries.

The Myth of the Superiority of ‘Free Trade’: Theoretical Arguments

According to supporters of the WTO and agreements such as the FTAA, these institutions/agreements seek to promote free trade in order to enhance efficiency and maximize economic well being. This focus on trade hides what is in fact a much broader political-economic agenda: the expansion and enhancement of corporate profit making opportunities. In the case of the WTO, this agenda has been pursued through a variety of agreements that are explicitly designed to limit or actually block public regulation of economic activity in contexts that have little to do with trade as normally understood.

For example, the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) limits the ability of states to deny patents on certain products (including over living organisms) or control the use of products patented in their respective nations (including the use of compulsory licensing to ensure affordability of critical medicines). It also forces states to accept a significant increase in the length of time during which patents remain in force. The Agreement on Trade Related Investment Measures (TRIMS) restricts the ability of states to put performance requirements on foreign direct investment (FDI), encompassing those that would require the use of local inputs (including labor) or technology transfer. A proposed expansion of the General Agreement on Trade in Services (GATS) would force states to open their national service markets (which include everything from health care and education to public utilities and retail trade) to foreign providers as well as limit public regulation of their activity. Similarly, a proposed Government Procurement Agreement would deny states the ability to use non-economic criteria, such as labor and environmental practices, in awarding contracts.

These agreements are rarely discussed in the mainstream media precisely because they directly raise issues of private versus public power and are not easily defended. This is one of the most important reasons why those who support the capitalist globalization project prefer to describe the institutional arrangements that help underpin it as trade agreements and defend them on the basis of the alleged virtues of free trade. This is a defense that unfortunately and undeservedly holds enormous sway among working people, especially in the developed capitalist countries. And, using it as a theoretical foundation, capitalist globalization advocates find it relatively easy to encourage popular acceptance of the broader proposition that market determined outcomes are superior to socially determined ones in all spheres of activity. Therefore, it is critical that we develop an effective and accessible critique of this myth of the superiority of free trade. In fact, this is an easier task than generally assumed.

Arguments promoting free trade generally rest on the theory of comparative advantage. David Ricardo introduced this theory in 1821 in his Principles of Political Economy and Taxation. It is commonly misunderstood to assert the obvious, that countries have or can create different comparative advantages or that trade can be helpful. In fact, it supports a very specific policy conclusion: a country’s best economic policy is to allow unregulated international market activity to determine its comparative advantage and national patterns of production.3 {The logic behind Ricardo’s argument was that when ever government intervened in trade it was for the benefit of a special interest, and the increased prices of the good effected was a harsh burden upon the downtrodden masses. The masses would be better off without such intervention—jk}.

Ricardo “proved” his theory of comparative advantage using a two country, static

model of the world, in which

Mainstream economists, while continuing to accept the basic outlines of Ricardo’s theory, have developed refinements to it. The most important are the Hecksher-Olin theory which argues that since a country’s comparative advantage is shaped by its resource base, capital-poor third world countries should specialize in labor intensive products; the factor-price equalization theory which argues that free trade will raise the price of the intensively used factor (which will be unskilled labor in the third world) until all factor prices are equalized worldwide; and the Stopler-Samuleson theory which argues that the incomes of the scarce factor (labor in rich countries; capital in poor countries) will suffer the most from free trade. None of these refinements challenge the basic conclusion of Ricardo’s theory of comparative advantage. In fact they offer additional support for the argument that workers in the third world will be the greatest beneficiaries of free trade.

Like all theories, the theory of comparative advantage (and its conclusion) is based on a number of assumptions. Among the most important are:

Even a quick consideration of these assumptions reveals that they are extensive and unrealistic. Moreover, if they are not satisfied, there is no basis for accepting the theory’s conclusion that free-market policies will promote international well being. For example, the assumption of full employment of all factors of production, including labor, is obviously false. Equally problematic is the theory’s implied restructuring process, which assumes that (but never explains how) workers who lose their jobs as a result of free-trade generated imports will quickly find new employment in the expanding export sector of the economy. In reality, workers (and other factors of production) may not be equally productive in alternative uses. Even if we ignore this problem, if their reallocation is not sufficiently fast, the newly liberalized economy will likely suffer an increase in unemployment, leading to a reduction in aggregate demand and perhaps recession. Thus, even if all factors of production eventually become fully employed, it is quite possible that the cost of adjustment would outweigh the alleged efficiency gains from the trade induced restructuring.

The assumption that prices reflect social costs is also problematic. Many product markets are dominated by monopolies, many firms receive substantial government subsidies that influence their production and pricing decisions, and many production activities generate significant negative externalities (especially environmental ones). Therefore, trade specialization based on existing market prices could easily produce a structure of international economic activity with lower overall efficiency, leading to a reduction in social well being.

There is also reason to challenge the assumption that external trade will remain in balance. This assumption depends on another, that exchange rate movements will automatically and quickly correct trade imbalances. However, exchange rates can easily be influenced by speculative financial activity, causing them to move in destabilizing rather than equilibrating directions. In addition, as trade increasingly takes place through transnational corporate controlled production networks, it is far less likely that exchange rate movements will generate the desired new production patterns. To the extent that exchange rate movements fail to produce the necessary trade adjustments in a reasonably short period, imports will have to be reduced (and the trade balance restored) through a forced reduction in aggregate demand, and perhaps recession.

Also worthy of challenge is the assumption that capital is not highly mobile across national borders. This assumption helps to underpin others, including the assumptions of full employment and balanced trade. If capital is highly mobile, then free-market/free-trade policies could produce capital flight leading to deindustrialization, unbalanced trade, unemployment, and economic crisis. In short, the free-trade supporting policy recommendations that flow from the theory of comparative advantage rest on a series of very dubious assumptions.4

The Myth of the Superiority of ‘Free Trade’: Empirical Arguments

Proponents of neoliberal policies often cite the results of highly sophisticated simulation studies to buttress their arguments. However, these studies are themselves seriously flawed, in large part because they rely on many of the same assumptions as the theory of comparative advantage. The following examination of two prominent studies reveals how reliance on these assumptions undermines the credibility of their results.

In 2001, Drusilla Brown, Alan Deardoff, and Robert Stern published a study that

claimed that a WTO-sponsored elimination of all trade barriers would add $1.9 trillion

to the world’s gross economic product by 2005.5 Their study was widely

showcased in media stories that appeared before the November 2001 start of WTO negotiations

in

The World Bank has also attempted to calculate, as part of its Global Economic Prospects series, the expected benefits from trade liberalization. In Global Economic Prospects 2002, it concluded that “faster integration through lowering barriers to merchandise trade would increase growth and provide some $1.5 trillion of additional cumulative income to developing countries over the period 2005–2015. Liberalization of services in developing countries could provide even greater gains—perhaps as much as four times larger than this amount. [The results also] show that labor’s share of national income would rise throughout the developing world.”6

The studies by Brown, Deardoff, and Stern, and the World Bank are based on computable general equilibrium models, in which economies are defined by a set of interconnected markets. When prices change—in this case because of a change in tariffs—national product markets are assumed to adjust to restore equilibrium. Since economies are themselves connected through trade, price changes are also assumed to generate more complex global adjustments before a new equilibrium outcome is achieved. It is on the basis of such modeling that the authors of these studies try to determine the economic consequences of trade liberalization.

This type of modeling is very challenging. Specific assumptions must be made about consumer and producer behavior in different markets and in different nations, including their speed of adjustment. Detailed national input-output tables are also required. But even more is required. For example, in order to ensure that their model will be solvable, Brown, Deardoff, and Stern assume that there is only one unique equilibrium outcome for each trade liberalization scenario. They also assume there are just two inputs, capital and labor, which are perfectly mobile across sectors in each country, but bound by national borders. In addition, they assume total aggregate expenditure in each economy is sufficient, and will automatically adjust, to ensure full employment of all resources. Finally, they also assume that flexible exchange rates will prevent tariff changes from causing changes in trade balances.

Said differently, the authors created a model in which liberalization cannot, by assumption, cause or worsen unemployment, capital flight, or trade imbalances. Thanks to these assumptions, if a country drops its trade restrictions, market forces will quickly and effortlessly encourage capital and labor to shift into new, more productive uses. And, since trade always remains in balance, this restructuring will, by definition, generate a dollar’s worth of new exports for every dollar’s worth of new imports. As Peter Dorman notes in his critique of this study: “Of course, workers and governments would have little to worry about in such a world—provided they could shift readily between expanding and contracting sectors of the economy.”7

World Bank economists also use computable general equilibrium modeling in their work. In Global Economic Prospects 2002, they begin their simulation study with “a baseline view about the likely evolution of developing countries, based upon best guesses about generally stable parameters—savings, investment, population growth, trade and productivity growth.”8 This baseline view incorporates only those changes in the “global trading regime” that occurred up through 1997 and uses these best guesses to estimate economic outcomes for the years 2005 to 2015. Next, they assume the removal of all trade restrictions in the period 2005 to 2010, with the restrictions reduced by one-sixth in each year.9 Finally, they compare the estimated economic outcomes from this liberalization scenario with those from the initial baseline scenario to determine the gains from liberalization.

This modeling effort also depends on several critical and unrealistic assumptions. One is that tariff reductions will have no effect on government deficits; they will remain unchanged from what they were in the baseline projection. This assumption claims that governments will automatically be able to replace lost tariff revenue with new revenue from other sources. Another assumption is that tariff reductions will have no effect on trade balances; they will remain the same as in the baseline projection. The final one is the existence of full employment. Once again, a powerful free-trade bias is built into the heart of the model by assumption, thereby ensuring a pro-liberalization outcome.

Although this bias is sufficient to dismiss the study’s usefulness as a guide to policy, its results are still worth examining for two reasons: First, the projected benefits are smaller than one might imagine given the World Bank’s unqualified support for liberalization. Second, later World Bank studies have revealed significantly smaller benefits. In its 2002 study, the World Bank concluded that “measured in static terms, world income in 2015 would be $355 billion more with [merchandise] trade liberalization than in the baseline.”10 Third world countries as a group would receive $184 billion, or approximately 52 percent of these total benefits. Significantly, $142 billion of this third world gain is projected to come from the liberalization of trade in agricultural goods. Even more noteworthy, $114 billion is estimated to come from third world liberalization of its own agricultural sector.11 Liberalization of trade in manufactures turns out to be a minor affair. Total estimated third world gains from a complete liberalization of world trade in manufactures amount to only $44 billion.

If we were to take these numbers seriously, they certainly suggest that the third world has little to gain from an actual WTO agreement. As Mark Weisbrot and Dean Baker note in their critique of this study, “the removal of all of the rich countries’ barriers to the merchandise exports of developing countries—including agriculture, textiles, and other manufactured goods—would...when such changes were fully implemented by 2015...add 0.6 percent to the GDP of low and middle-income countries. This means that a country in Sub-Saharan Africa that would, under present trade arrangements have a per capita income of $500 per year in 2015, would instead have a per capita income of $503.”12 Moreover, as they also point out, these meager gains would be far outweighed by losses incurred from compliance with other associated WTO agreements.

More recent World Bank estimates show even smaller gains from liberalization. In Global Economic Prospects 2005, the World Bank incorporated new data sets, which allowed it to “capture the considerable reform between 1997 and 2001 (e.g., continued implementation of the Uruguay Round and China’s progress toward WTO accession), and an improved treatment of preferential trade agreements.”13 As a result, total projected static gains from merchandise trade liberalization fell to $260 billion (in 2015 relative to the baseline scenario), with only 41 percent of the gains accruing to the third world.

Although working people have been ill-served by capitalist globalization, many are reluctant to challenge it because they have been intimidated by the “scholarly” arguments of those who support it. However, as we have seen, these arguments are based on theories and highly artificial simulations that deliberately misrepresent the workings of capitalism. They can and should be challenged and rejected.

Neoliberalism: The Reality

The post-1980 neoliberal era has been marked by slower growth, greater trade imbalances, and deteriorating social conditions. The United Nations Conference on Trade and Development (UNCTAD) reports that, “for developing countries as a whole (excluding China), the average trade deficit in the 1990s is higher than in the 1970s by almost 3 percentage points of GDP, while the average growth rate is lower by 2 percent per annum.”14 Moreover,

The pattern is broadly similar in all developing regions. In Latin America the average growth rate is lower by 3 percent per annum in the 1990s than in the 1970s, while trade deficits as a proportion of GDP are much the same. In sub-Saharan Africa growth fell, but deficits rose. The Asian countries managed to grow faster in the 1980s, while reducing their payments deficits, but in the 1990s they have run greater deficits without achieving faster growth.15

A study by Mark Weisbrot, Dean Baker, and David Rosnick on the consequences of neoliberal policies on third world development comes to similar conclusions. The authors note that “contrary to popular belief, the past 25 years (1980–2005) have seen a sharply slower rate of economic growth and reduced progress on social indicators for the vast majority of low- and middle-income countries [compared with the prior two decades].”16

For those that reject the major assumptions underlying mainstream arguments for the “freeing” of international economic activity, this outcome is not surprising. In broad brush, trade liberalization contributed to the deindustrialization of many third world countries, thereby increasing their import dependence. By making them cheaper and easier to obtain, it also encouraged an increase in the importation of luxury goods. And finally, by attracting transnational corporate production to the third world, it also increased the import intensity of most third world exports. Export earnings could not keep pace largely because growing third world export activity and competition (prompted by the need to offset the rise in imports) tended to drive down export earnings. Exports were also limited by slower growth and protectionism in most developed capitalist countries.

In an effort to keep growing trade and current account deficits manageable, third world states, often pressured by the IMF and World Bank, used austerity measures (especially draconian cuts in social programs) to slow economic growth (and imports). They also deregulated capital markets, privatized economic activity, and relaxed foreign investment regulatory regimes in an effort to attract the financing needed to offset the existing deficits. While devastating to working people and national development possibilities, these policies were, as intended, responsive to the interests of transnational capital in general and a small but influential sector of third world capital. This is the reality of neoliberalism.

The Dynamics of Contemporary Capitalism

While the term “neoliberalism” does, in many ways, capture the essence of contemporary capitalist practices and policies, it is also in some important respects a problematic term. In particular, it encourages the view that a wide range of policy options simultaneously exist under capitalism, with neoliberalism just one of the possibilities. States could reject neoliberalism, if they wanted, and implement more social democratic or interventionist policies, similar to those employed in the 1960s and 1970s. Unfortunately, things are not so simple. The “freeing” of economic activity that is generally identified with neoliberalism is not so much a bad policy choice as it is a forced structural response on the part of many third world states to capitalist generated tensions and contradictions. Said differently, it is capitalism (as a dynamic and exploitative system), rather than neoliberalism (as a set of policies), that must be challenged and overcome.

Mainstream theorists usually consider international trade, finance, and investment as separate processes. In fact, they are interrelated. And, as highlighted above, the capitalist drive for greater profitability has generally worked to pressure third world states into an overarching liberalization and deregulation. This dynamic has had important consequences, especially, but not exclusively, for the third world. In particular, it has encouraged transnational corporations to advance their aims through the establishment and extension of international production networks. This has led to new forms of dominance over third world industrial activity that involve its reshaping and integration across borders in ways that are ever more destructive of the social, economic, and political needs of working people.

During the 1960s and 1970s, most third world countries pursued state directed import-substitution industrialization strategies and financed their trade deficits with bank loans. This pattern ended suddenly in the early 1980s, when economic instabilities in the developed capitalist world, especially in the United States, led to rising interest rates and global recession. Third world borrowing costs soared and export earnings plummeted, triggering the third world “debt crisis.” With debt repayment in question, banks greatly reduced their lending, leading to ever deepening third world economic and social problems.

To overcome these problems, third world states sought new ways to boost exports and new sources of international funds. Increasingly, they came to see export-oriented foreign direct investment as the answer. The competition for this investment was fierce. Country after country made changes in their investment regimes, with the great majority designed to create a more liberalized, deregulated, and “business friendly” environment. Transnational corporations responded eagerly to these changes, many of which they and their governments helped promote. And, over the years 1991–98, FDI became the single greatest source of net capital inflow into the third world, accounting for 34 percent of the total.17

New technologies had made it possible for transnational corporations to cheapen production costs for many goods by segmenting and geographically dividing their production processes. They therefore used their investments to locate the labor intensive production segments of these goods—in particular the production or assembly of parts and components—in the third world. This was especially true for electronic and electrical goods, clothing and apparel, and certain technologically advanced goods such as optical instruments.

The result was the establishment or expansion of numerous vertically structured international production networks, many of which extended over several different countries. According to UNCTAD, “it has been estimated, on the basis of input-output tables from a number of OECD and emerging-market countries, that trade based on specialization within vertical production networks accounts for up to 30 percent of world exports, and that it has grown by as much as 40 percent in the last 25 years.”18

Despite the fierce third world competition to attract FDI, transnational corporations tended to concentrate their investments in only a few countries. In general, U.S. capital emphasized North America (NAFTA), while Japanese capital focused on East Asia, and European capital on Central Europe. The countries that “lost out” in the FDI competition were generally forced to manage their trade and finance problems with austerity. Those countries that “won” usually experienced a relatively fast industrial transformation. More specifically, they became major exporters of manufactures, especially of high-technology products such as transistors and semiconductors, computers, parts of computers and office machines, telecommunications equipment and parts, and electrical machinery.

As a consequence of this development, the share of third world exports that were manufactures soared from 20 percent in the 1970s and early 1980s, to 70 percent by the late 1990s.19 The third world share of world manufacturing exports also jumped from 4.4 percent in 1965 to 30.1 percent in 2003.20

Mainstream economists claim that this rise in manufactured exports demonstrates the benefits of liberalization, and thus the importance of WTO-style liberalization agreements for development. However, this argument falsely identifies FDI and exports of manufactures with development, thereby seriously misrepresenting the dynamics of transnational capital accumulation. The reality is that participation in transnational corporate controlled production networks has done little to support rising standards of living, economic stability, or national development prospects.

There are many reasons for this failure. First, those countries that have succeeded in attracting FDI have usually done so in the context of liberalizing and deregulating their economies. This has generally resulted in the destruction of their domestic import-competing industries, causing unemployment, a rapid rise in imports, and industrial hollowing out. Second, the activities located in the third world rarely transfer skills or technology, or encourage domestic industrial linkages. This means that these activities are seldom able to promote a dynamic or nationally integrated process of development. Furthermore the exports produced are highly import dependent, thereby greatly reducing their foreign exchange earning benefits.

Finally, the transnational accumulation process makes third world growth increasingly dependent on external demand. In most cases, the primary final market for these networks is the United States, which means that third world growth comes to depend ever more on the ability of the United States to sustain ever larger trade deficits—an increasingly dubious proposition.

Few countries have escaped these problems. For example, UNCTAD studied the economic performances of “seven of the more advanced developing countries” over the period 1981–96: Hong Kong (China), Malaysia, Mexico, Republic of Korea, Singapore, Taiwan Province of China, and Turkey. These are among the most successful third world exporters of manufactures. Yet, because much of their export activity is organized within transnational corporate controlled production networks, the gains to worker well being or national development have been limited.

For example, average manufacturing value added for the group as a whole remained consistently below the value of manufactured exports over the entire period, with the ratio declining from 76 percent in 1981 to 55 percent in 1996. And, although the group’s average ratio of manufactured exports to GDP rose sharply, its average ratio of manufacturing value added to GDP remained generally unchanged.21 Moreover, while the group as a whole generally maintained a rough balance in manufactured goods trade until the late 1980s, after that point imports grew much faster than exports. Mexico’s experience perhaps best symbolizes the bankruptcy of this growth strategy: “between 1980 and 1997 Mexico’s share in world manufactured exports rose tenfold, while its share in world manufacturing valued added fell by more than one third, and its share in world income (at current dollars) [fell] by about 13 percent.”22

China: The Latest Neoliberal Success Story

Capitalism’s failure to deliver development is not due to its lack of dynamism; in fact quite the opposite is true. By intensifying the development and application of new production and exchange relationships within and between countries, this dynamism causes rapid shifts in the economic fortunes of nations, creating a constantly changing (and shrinking) group of “winners” and (an ever larger) group of “losers,” and masking the connection between the two. Even East Asia has been subject to the instabilities of capitalist dynamics, as the East Asian crisis of 1997–98 devastated such past “star performers” as South Korea, Indonesia, Thailand, and Malaysia. After quickly distancing themselves from these countries (and their past praise for their growth), most neoliberals have now eagerly embraced a new champion, China.23

According to the conventional wisdom, China has become the third world’s biggest

recipient of foreign direct investment, exporter of manufactures, and fastest growing

economy, largely because its government adopted a growth strategy based on privileging

private enterprise and international market forces. In response to this new strategy,

net FDI in China grew from $3.5 billion in 1990 to $60.6 billion in 2004. Foreign

manufacturing affiliates now account for approximately one-third of China’s total

manufacturing sales. They also produce 55 percent of the country’s exports and a

significantly higher percentage of its higher technology exports. As a consequence

of these trends, the country’s ratio of exports to GDP has climbed steadily, from

16 percent in 1990 to 36 percent in 2003.24 Thus,

Foreign investment has indeed transformed China into a fast growing export platform, with some significant domestic production capacity. At the same time, many of the limitations of this growth strategy, which were highlighted above, are also visible in China. For example, foreign dominated export activity has done little to support the development of nationally integrated production or technology supply networks.25 Moreover, as the Chinese state continues to lose its planning and directing capability, and the country’s resources are increasingly incorporated into foreign networks largely for the purpose of satisfying external market demands, the country’s autonomous development potential is being lost.

China’s growth has enriched a relatively small but numerically significant upper income group of Chinese, who enjoy greatly expanded consumption opportunities. However, these gains have been largely underwritten by the exploitation of the great majority of Chinese working people. For example, as a consequence of Chinese state liberalization policies, state owned enterprises laid off 30 million workers over the period 1998 to 2004. With urban unemployment rates in double digits, few of these former state workers were able to find adequate re-employment. In fact, over 21.8 million of them currently depend on the government’s “average minimum living allowance” for their survival. As of June 2005, this allowance was equal to approximately $19 a month; by comparison, the average monthly income of an urban worker was approximately $165 dollars.26

While the new foreign dominated export production has generated new employment opportunities, most of these jobs are extremely low paid. A consultant for the U.S. Bureau of Labor Statistics has estimated that Chinese factory workers earn an average of sixty-four cents an hour (including benefits).27 In Guangdong, where approximately one-third of China’s exports are produced, base manufacturing wages have been frozen for the past decade. Moreover, few if any of these workers have access to affordable housing, health care, pensions, or education.28

China’s economic transformation has not only come at high cost for Chinese working people, it has also intensified (as well as benefited from) the contradictions of capitalist development in other countries, including in East Asia. For example, China’s export successes in advanced capitalist markets, in particular that of the United States, have forced other East Asian producers out of those markets. Out of necessity, they have reoriented their export activity to the production of parts and components for use by export-oriented transnational corporations operating in China. Thus, all of East Asia is being knitted together into a regional accumulation regime that crosses many borders and in so doing restructures national activity and resources away from meeting domestic needs. Instead, activity and resources are being organized to serve export markets out of the region under the direction of transnational corporations whose interests are largely in cost reduction regardless of the social or environmental consequences.29

The much slower post-crisis growth of East Asian countries, and the heightened competitiveness pressures that are squeezing living standards throughout the region, provide strong proof that this new arrangement of regional economic relations is incapable of promoting a stable process of long-term development. Meanwhile, China’s export explosion has also accelerated the industrial hollowing out of the Japanese and U.S. economies as well as the unsustainable U.S. trade deficit.

At some point the (economic and political) imbalances generated by this accumulation process will become too great, and corrections will have to take place. Insofar as the logic of capitalist competition goes unchallenged, governments can be expected to manage the adjustment process with policies that will likely worsen conditions for workers in both third world and developed capitalist countries. Neoliberal advocates can also be expected to embrace this process of adjustment as the means to “discover” their next success story, whose experience will then be cited as proof of the superiority of market forces.

Our Challenge

As we have seen, arguments purporting to demonstrate that free-trade/free-market policies will transform economic activities and relations in ways that universally benefit working people are based on theories and simulations that distort the actual workings of capitalism. The reality is that growing numbers of workers are being captured by an increasingly unified and transnational process of capital accumulation. Wealth is being generated but working people in all the countries involved are being pitted against each other and suffering similar consequences, including unemployment and worsening living and working conditions.

Working people and their communities are engaged in growing, although uneven, resistance to the situation. While increasingly effective, this resistance still remains largely defensive and politically unfocused. One reason is that neoliberal theory continues to provide a powerful ideological cover for capitalist globalization, despite the fact that it is both generated by and designed to advance capitalist class interests. Another is the dynamic nature of contemporary capitalism, which tends to mask its destructive nature. Therefore, as participants in the resistance, we must work to ensure that our many struggles are waged in ways that help working people better understand the nature of the accumulation processes that are reshaping our lives. In this way, we can illuminate the common capitalist roots of the problems we face and the importance of building movements committed to radical social transformation and (international) solidarity.

Notes

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

May 20, 2020 | www.nakedcapitalism.com

By Jomo Kwame Sundaram, a former economics professor, who was Assistant Director-General for Economic and Social Development, Food and Agriculture Organization, and who received the Wassily Leontief Prize for Advancing the Frontiers of Economic Thought in 2007. Originally published by Inter Press Service

Economic growth is supposed to be the tide that lifts all boats. According to the conventional wisdom until recently, growth in China, India and East Asian countries took off thanks to opening up to international trade and investment.

Such growth is said to have greatly reduced poverty despite growing inequality in both sub-continental economies and many other countries. Other developing countries have been urged to do the same, i.e., liberalize trade and attract foreign investments.

Doha Round 'Dead in Water'

However, multilateral trade negotiations under World Trade Organization (WTO) auspices have gone nowhere since the late 1990s, even with the so-called Doha Development Round begun in 2001 as developing countries rallied to support the US after 9/11.

After the North continued to push their interests despite their ostensible commitment to a developmental outcome, the Obama administration was never interested in completing the Round, and undermined the WTO's functioning, e.g., its dispute settlement arrangements, even before Trump was elected.

To be sure, the Doha Round proposals were hardly 'developmental' by any standards, with most developing countries barely benefitting, if not actually worse off following the measures envisaged, even according to World Bank and other studies.

GVC miracle?

According to the World Bank's annual flagship World Development Report (WDR) 2020 on Trading for Development in the Age of Global Value Chains , GVCs have been mainly responsible for the growth of international trade for two decades from the 1990s.

GVCs now account for almost half of all cross-border commerce due to 'multiple counting', as products cross more borders than ever. Firms' creative book-keeping may also overstate actual value added in some tax jurisdictions to minimize overall tax liability.

WDR 2020 claims that GVCs have thus accelerated economic development and even convergence between North and South as fast-growing poor countries have grown more rapidly, closing the economic gap with rich countries.

Automation, innovative management, e.g., 'just-in-time' (JIT), outsourcing, offshoring and logistics have dramatically transformed production . Labour processes are subject to greater surveillance, while piecework at home means self-policing and use of unpaid household labour.

WDR 2020 Out of Touch

WDR 2020 presumes trends that no longer exist. Trade expansion has been sluggish for more than a decade, at least since the 2008 global financial crisis when the G20 of the world's largest economies and others adopted protective measures in response.

GVC growth has slowed since, as economies of the North insisted on trade liberalization for the South, while abandoning their own earlier commitments as the varied consequences of economic globalization fostered reactionary jingoist populist backlashes.

Meanwhile, new technologies involving mechanization, automation and other digital applications have further reduced overall demand for labour even as jobs were 'off-shored'. Trump-initiated trade policies and conflicts have pressured US and other transnational corporations to 'on-shore' jobs after decades of 'off-shoring' .

Nonetheless, WDR 2020 urges developing countries to bank on GVCs for growth and better jobs. Success of this strategy depends crucially on developed countries encouraging 'offshoring', a policy hardly evident for well over a decade!

As the last World Bank chief economist , albeit for barely 15 months, Yale Professor Pinelopi Koujianou Goldberg recently agreed , "the world is retreating from globalization". "Protectionism is on the rise -- industrialized countries are less open to imports from developing countries. In addition, there is by now a lot of competition".

The Covid-19 crisis has further encouraged 'on-shoring' and 'chain shortening', especially for food, medical products and energy. Although the Japanese and other governments have announced such policies, ostensibly for 'national security' and other such reasons, Goldberg has nonetheless reiterated the case for GVCs in Covid-19's wake .

Trade Does Not Lift All Boats

After claiming that "economists have argued for centuries that trade is good for the economy as a whole", Goldberg has also noted that "trade generates winners and losers", with many losing out, and urges acknowledging "the evidence rather than trying to discredit it, as some do." Following Samuelson and others, she recommends compensating those negatively effected by trade liberalization, claiming "sufficient gains generated by open trade that the winners can compensate the losers and still be better off" without indicating how this is to be done fairly.

Compensation and redistribution require transfers which are typically difficult to negotiate and deliver at low cost. Tellingly, like others, she makes no mention of international transfers, especially for fairly redistributing the unequal gains from trade among trading partners.

Interestingly, she also observes, "There are plenty of examples, especially in African countries, where wealth is concentrated in the hands of a few even when the tide rises, only very few boats rise. Growth doesn't trickle down and doesn't improve the lot of the poor."

Unlikely Pan-Africanist

After decades of World Bank promotion of the 'East Asian miracle' for emulation by other developing countries, especially in Africa, Greek-born American Goldberg insists that what worked for growth and poverty reduction in China will not work in Africa today.

Echoing long time Bank critics, she argues, "If trade with rich countries is no longer the engine of growth, it will be more important than ever to rely on domestic resources to generate growth that does trickle down and translates to poverty reduction."

Instead, as if supporting some contemporary pan-Africanists, she argues, "Africa needs to rely on itself more than ever. The idea that export-led industrialization as it happened in China or East Asia is going to lead growth in Africa becomes less and less plausible".

She argues that "the African market is a very large market with incredible potential. It has not been developed yet. So, regional integration might be one path forward. Rather than opting for global integration, which may be very hard to achieve these days when countries are retreating from multilateralism, it might be more feasible to push for regional trade agreements and create bigger regional markets for countries' goods and services".

Acknowledging "We are still a very long way from there because most countries are averse to this idea -- they see their neighbors as competitors rather than countries they can cooperate with", not seeming to recognize the historical role of the Bank and mainstream trade economists in promoting the 'free trade illusion' and discrediting pan-Africanism.

chuck roast , May 20, 2020 at 9:01 am

hear him, and hear him

Econospeak at its best. Filled with cliches and "on the one hand(s)." This articles perfectly describes why social distancing can ultimately be a boon to mankind. This fellow Sundaram can self isolate at home and still get a paycheck. He can begin puttering about in his garden and start growing his own food. Eventually, he will find this activity to be far more rewarding than cogitating on the various cost and benefits of the international value chains, and will be spending more and more time in his garden. UBI will kick in. He will decide to disengage from "globalization" and being a public nuisance and adopt this new, socially beneficial lifestyle permanently. By doing "piecework at home" he will add to real gross domestic product, and he, the economy and the rest of the planet will be immeasurably improved.The Historian , May 20, 2020 at 10:49 am

Good analysis. But part of my confusion with this article started with the headline: "Covid-19 Straw Breaks Free Trade Camel's Back"

What free trade? Nothing in the article discusses free trade and I doubt that there has ever been free trade for a very long time. Is this more Econospeak?

I do agree with the author that the way trading is done now, however he defines it, has not risen all boats.

Amfortas the hippie , May 20, 2020 at 1:33 pm

Regarding the existence of "Free Trade"

I watched this in real time when Nafta passed(i was agin it, and voted for Perot accordingly, both times)

I knew a middle class mexican american guy father of a friend of mine. His business, pre-Nafta, was going to his extended familia's ranch/farm(100 acres) in Tamaulipas, and returning with fruits and veggies and vanilla and a whole bunch of "junk" like that metal yard art and terra cotta birdbaths and such.

had a dually pickup and a 20 foot trailer.

Post Nafta, this was suddenly illegal he wasn't part of the Club, and went to work as a cook along side me and his son.

since that time, I've heard essentially the same story from numerous mexican american folks who used to do similar stuff.

nafta killed that small time cross border trade and the only "Freedom" involved was for the Maquiladora-owners, US Welfare Corn Corporations and the Cartels.

anecdata, of course, but still

if "they" were really for "free trade", they'd allow me to legally sell a frelling egg or tomato or grow some weed, for that matter(high demand, low quality unstable supply).Susan the other , May 20, 2020 at 2:24 pm

I voted for ross perot too. I even went across the street and talked to my neighbors – the last time I did that – as they always say, it's like staring into the eyes of a chicken – oh so "liberal" at the time – To them Ross Perot was just an insufferable hick. But I loved the guy. And he was right. I think he lived in the same neighborhood as little George in Dallas – but Ross didn't want us to spread our resources too thin whereas little George saw MidEast oil as our best security. So now that that has blown up, it's regionalism v. globalism. It's a brake on turbo trade. It's not a fix. We don't want to be lulled into thinking we've achieved something like a trade balance and an environmental balance – that will take a century – and only if we stop fibbing to ourselves.

Bsoder , May 20, 2020 at 3:28 pm

I worked for Ross, for a while post GM (1987). I liked him very much, although we fought quite a bit. Mostly, I agreed with his public policy outlook, when I didn't and it came up I told him. He didn't surround himself with the wights that the Orange Menace does. Striking -he was very loyal to people in his orbit. NAFTA had protections for labor, unions, & the environment they just never were enforced. There must be some 'law' that says anything neoliberal turns into a racket over time, so it was with NAFTA.

Left in Wisconsin , May 20, 2020 at 4:53 pm

The NAFTA protections for workers were just hand waves. Lance Compa, who is at Cornell, ran the US office trying to get the labor provisions (weak as they were) enforced. As I recall, they were never able to bring even a single case forward.

Adam Eran , May 20, 2020 at 2:32 pm

"Free" trade means removing regulations and tariffs. As Michael Hudson reminds us, in Classical economics, it used to mean free of the unproductive burdens of the rentiers.

As for NAFTA, one might figure shipping a bunch of subsidized Iowa corn down to Mexico would impair the income of Mexican farmers.. The NAFTA treaty compensates the big ones.

Corn is only arguably the most important food crop in the world. The little (uncompensated by NAFTA) Mexican farmers were only keeping the disease resistance and diversity of the corn genome alive with the varieties they grew .But they weren't making any money for Monsanto So they were hung out to dry and migration to "Gringolandia" increased dramatically not all of it "legal."

In the wake of NAFTA, not only did Mexico experience capital flight (remember the Clinton administration's $20 billion bank bailout?), Mexico's real median income declined 34%. (Source: Ravi Batra's Greenspan's Fraud ).

One has to go back to the Great Depression to find that kind of decline in the U.S. Of course that provoked no great migration Oh wait! The Okies!

Imagine the Okies exiting the dust bowl to go to California where they would be caged, separated from their families, and ultimately shipped back to Oklahoma, where they would either be very miserable or even starve. That's what we've been doing to the Mexican refugees U.S. actions created never mind the fact that U.S. military and political attacks on its southern neighbors have been going on for literally centuries. (Between 1798 and 1994, the U.S. is responsible for 41 changes of government south of its borders).

Incidentally, the Harvard-educated neoliberal, Carlos Salinas Gotari, the Mexican president who signed NAFTA, was so despised he had to spend at least the initial years of his retirement in Ireland.

It's not for nothing that the guys who stand up to the Yanquis (Castro!) are heroes in the South.

taunger , May 20, 2020 at 6:47 am

It's amazing how economists can focus solely on economic activity, and the thought that something like climate change or politics might make their pronouncements useless isn't even rebutted.

John Wright , May 20, 2020 at 11:54 am

This reference: https://www.scientificamerican.com/article/why-co2-isnt-falling-more-during-a-global-lockdown/

Has that one of the Covid-19 lockdown effects has been a fall in expected incremental CO2 added to the atmosphere in 2020 relative to 2019:

"Forecasters expect emissions to fall more than 5% in 2020, the greatest annual reduction on record. But it's still short of the 7.6% decline that scientists say is needed every year over the next decade to stop global temperatures from rising more than 1.5 degrees Celsius.*.

Yes, the earth's climate is one of the uncompensated losers of the world's current system of economic growth.

Economists seem to be forever optimizing for the GDP measure, while giving lip service to "uncompensated losers" such as workers and the earth's climate.

TomDority , May 20, 2020 at 8:16 am

Me, being a cynic and all – I thought the way trade worked in the real world (not the one described by well paid economists) was a multi step process

1) target developing country by undermining their core farming, self sustaining activity and export industries through cheap importation of grains and crops and other goods – thus making it impossible for locals to survive through their own industry

2) simultaneous loans (investment) to the country (economic aid) and corruption of political leaders designed to enable step three

3) Whence said country is indebted – force country to export whatever (mineral) wealth onto a glutted market to pay back its debts – this is easily done as the labor component is ripe for the picking/ fleecing

4) crush the country into economic austerity for as long as it takes to enslave its citizens and grab everything of value from the country

5) pretend that the IMF etc did such a great job – but the countries people (victims) or government did not do enough and must take care of themselves better

The Rev Kev , May 20, 2020 at 9:58 am

I think that you covered the Standard Operation Procedure here in better detail than I could. I would only add to point 2) that the bankers will go to these local leaders and show them how to hide their money and help them set up accounts in a place like the Caymans as part of the service.

And if that economist wants to find where all of Africa's wealth is going, he might want to start in the City of London and New York first.

David , May 20, 2020 at 8:43 am

I share the general sense of confusion. I'm not quite sure what the point of this essay is. It's full of wild generalisations like:

"According to the conventional wisdom until recently, growth in China, India and East Asian countries took off thanks to opening up to international trade and investment."

I don't think that's ever been conventional wisdom for Japan, Korea and China, for example, whose economies were (and in part still are) highly protected. Industrialisation in those countries was not "export-led".

It also confuses "trade" in the old sense, of countries importing things they couldn't produce and exporting what they could, with "trade" in the new sense of moving stuff around the world largely for financial reasons. Trade in the classic sense may have benefited the country as a whole (though this is debatable) but trade in the current sense was never intended to. Likewise I hadn't heard that globalisation had fostered a "jingoist backlash" – jingoism after all means aggressive calls for war. But then the whole article is clumsily written and badly constructed.

And the idea that Africa should rely on itself is fair enough, but runs counter to every piece of advice given to Africa since independence: remember, the World Bank master plan was for African countries to grow cash-crops for export to generate cash for industrial development? We know how that worked out. And yes the African market has enormous potential but it's desperately lacking in infrastructure, which makes trade between eve adjacent nations desperately difficult. You need to fix that first.Thuto , May 20, 2020 at 4:37 pm

There's a growing realisation on our continent that outsiders aren't going to lead us to the promised land. The obstacles to effective intra-african trade that you identify will have to be cleared before Africa's potential can be realised, and as an African I have to believe they will be, challenging as that will be.

The overthrow of Omar Al Bashir in Sudan has shown that people in Africa are agitating for real, lasting changing, liberation from the rule of corrupt leaders and true, not pseudo independence from the West and increasingly China as well.

Other leaders have taken notice of this, as have ordinary citizens across the continent. It will take time, ther'll probably be a few false starts, we'll wobble a bit but in the end I believe we'll get there.

a different chris , May 20, 2020 at 9:24 am

"trade generates winners and losers", with many losing out, and urges acknowledging "the evidence rather than trying to discredit it, as some do."

I don't known who "discredits" it.

What I see is that everybody important acknowledges it, but does squat about it. This redistribution never happens, the rich get richer in a role reversal of "I'll gladly pay you Tuesday for a hamburger today". Any attempt to have the rich share the hamburger is greeted with a "not now!" and a assurance that if the rich stop continuously getting richer at this particular point in time then everything will collapse.

The poor, of course, ain't got until this mythical "Tuesday".

HotFlash , May 20, 2020 at 11:23 am

"the African market has enormous potential"

Indeed! Very few Africans have IoT sous-vide sticks yet, or Smart doorbells. I'll bet they are way behind on fast fashion, too. Vast market to sell them things no-one needs and that wreck the earth on credit . Just gotta get those roads built so Jeff can deliver stuff to them in 2 days.

Bsoder , May 20, 2020 at 3:39 pm

The best understanding of what is going on in Africa I got from Jared Diamond – book, "Collapse: How Societies Choose to Fail or Succeed". And for background – "Guns, Germs, and Steel". Global climate heating is going to destroy Africa, already is. The usual story, no water, no forests, too much heat and humidity. It's a terrible reckoning. And largely not of their making.

May 21, 2020 | www.nakedcapitalism.com

TomDority , , May 20, 2020 at 8:16 am

Me, being a cynic and all – I thought the way trade worked in the real world (not the one described by well paid economists) was a multi step process

1) target developing country by undermining their core farming, self sustaining activity and export industries through cheap importation of grains and crops and other goods – thus making it impossible for locals to survive through their own industry

2) simultaneous loans (investment) to the country (economic aid) and corruption of political leaders designed to enable step three

3) Whence said country is indebted – force country to export whatever (mineral) wealth onto a glutted market to pay back its debts – this is easily done as the labor component is ripe for the picking/ fleecing

4) crush the country into economic austerity for as long as it takes to enslave its citizens and grab everything of value from the country

5) pretend that the IMF etc did such a great job – but the countries people (victims) or government did not do enough and must take care of themselves better

The Rev Kev , , May 20, 2020 at 9:58 am

I think that you covered the Standard Operation Procedure here in better detail than I could. I would only add to point 2) that the bankers will go to these local leaders and show them how to hide their money and help them set up accounts in a place like the Caymans as part of the service.

And if that economist wants to find where all of Africa's wealth is going, he might want to start in the City of London and New York first.

May 15, 2020 | www.theamericanconservative.com

Our elites have been responding to incentives which are beneficial to their institutions, and China, but detrimental to America.

A shell of a piano in the lobby of the Lee Plaza Hotel. The decades-long decline of the U.S. automobile industry is acutely reflected in the urban decay of Detroit, the city lovingly referred to as Motor City. (Photo by Timothy Fadek/Corbis via Getty Images) George D. O'Neill Jr. We have come to a point in our nation's public discourse where there is a widespread realization that many of the economic policies pursued and promoted by our political, business and media elites have failed us in multiple ways. We have heard our trade policies called "Free Trade" and "Free Market", but those statements were often dishonest.

When crafting these agreements, our elites have been responding to incentives which are beneficial to their institutions but detrimental to the well-being of American citizens.

... ... ...

The same is true for manufacturing businesses. The closing of a factory has huge costs for a neighborhood: unemployed people. Not just those from the factory, but the people who work at companies which supply goods and services to that factory. The consequences of a factory closing cascades through the economy. The tax base for that neighborhood is also eroded, which reduces the community's ability to maintain and deliver essential services and support civic institutions.

We cannot just turn off a factory like a light switch and turn it back on at will when the Chinese decide to raise their prices at a later date.

None of this takes into account the quality of the goods that we receive. We have just become aware that more than 90% of our pharmaceutical antibiotics are manufactured in China. When you hear of the big drug recalls, keep in mind many of them are from China, which is famous for ubiquitous and flagrant corruption as well as a disregard for quality control. Do we really know if our antibiotics are safe?

Now, back to our leadership, which we have relied on to guide our nation. Their incentives often lead them to make choices which do not benefit the American people. The Chinese have famously made generous deals with a sitting vice-president's son and a Secretary of State's stepson that likely insured high level government silence about their predatory practices. The Chinese have purchased important media assets, such as the largest film distribution company in America and inked lucrative media deals with huge media companies to purchase silence about their predatory behavior. The same is true with many other industries.

... ... ...

The Price Mechanism Theory only works well when there is honest and accurate information to understand the true costs, but our leadership is corrupt and has not been honest with us. In order to protect both American interests and American citizens, it is important to develop mechanisms to fully understand the consequences of many of our policies and who is making them. Who is making the decisions is often just as important as what is being decided.

George D. O'Neill, Jr., an artist, is the founder of The Committee for Responsible Foreign Policy and a board member of The American Ideas Institute, the parent of The American Conservative. Mr. O'Neill has been in the mining industry for more than four decades. He and his wife reside in Florida.

Correct. The so called "free markets & trade" worked in conditions after WWII, when US goverment used it's military and political influence to set up favorable economic & trade conditions for US. It's an utopian vision, that has nothing to do with real world.MPC • 19 hours ago • editedIt's important to recognize that it's not realistic to do all manufacturing in America, at least in the short term. We consume too much. Before the virus, we were already running on all cylinders as employment was concerned and have been for a few years.The Coolie MPC • 10 hours ago • editedThere is a significant difference however in our trade dependencies being on China, versus Japan, Mexico, Vietnam, or India. The former is a geopolitical rival, the latter are not. In fact, laying groundwork to move more of our trade to the latter builds up China's regional rivals at the expense of China, and at comparatively less expense to us.

It's not healthy for a future multipolar world for such a capable power projector as China to be so disproportionately profiting from declining hegemon America.

If you think the hallowing of the US economy with it increasing wage inequalities, outsized wealth allocation to financial sectors, increasingly political divisions, etc. is because CHINA BAD, then you are no different than the other corporate profiteers who dug us in this hole in the first place. This is how the corporatists are trying to avoid blame for their fundamentalist policies over the past four decades. They lash out, "It's only the BAD Chinese, everything will be better if we just move it to Vietnam/Bangladesh/Ethiopia."MPC The Coolie • 10 hours ago • editedYou ascribe things to me that have nothing to do with what I said. The Chinese are not bad, just a competitor, and China is not responsible for America's own choices.The Coolie MPC • 8 hours agoYou're just replacing one utopian thinking about free trade, with another about economic protectionism. The world doesn't fit neatly around ideological dogma.

Until you square America's overconsumption you have to tolerate trade deficits. You can make strategic choices about where they come from at least. Free traders were not honest about impacts on domestic industry. Domestic protectionism is not being honest about the fact that for it to succeed, consumption of imported goods, and some domestic, to free up capacity to import substitute, has to tank, without the prospect of enough domestic production happening to replace them, and certainly not at anything like the price levels that exist currently.

In the long run overconsumption should be attacked. Strategic, mutually beneficial trade relationships will still exist. In the short run we should be more careful about the source of trade deficits. Overconsumption will not be solved overnight. But that's not a neat campaign slogan.

I don't disagree with the problems of an over-consumption reliant economy, which prefers we purchase new TVs every 3 years, smartphones every 2 years, and 3 new winter coats every season. But it's a huge fallacy to imagine that reallocating production to Vietnam or Bangladesh will reduce China's power. Who will be creating those factories? Sorry, Chinese investment. Where will the logistics chain need to connect? Sorry, all roads will lead to China - both for its 1.4 billion consumer and their ability to control the higher end of the manufacturing. When will they demand China's inclusion in a grouping like TPP? Sorry, within 1-2 years of signing that supposed "Keep China Out" agreement. Guess whose economies will be even more reliant on China? You guessed it, all those supposed U.S. allies who want no part in global decoupling.Wally • 17 hours ago • editedIt was ok to let low margin manufacturing move offshore because Americans were going to move up the value chain. These other countries, like China, would develop their economy, lift a few billion people out of poverty, and transform themselves into beacons of freedom and democracy across the developing world. The globalists told us this over and over again. China (and India) would make our plastic junk and we would sell them financial products and services like credit default swaps and make a killing!MPC Wally • 11 hours agoAnd that's how it worked out. The bankers made out. No one cared about the displaced factory workers because it was their own fault they weren't smart enough to become Wall Street masters of the universe. Buying American, we were told way back in the 80s by Saint Ronald Reagan was a scam to support corrupt unions and lazy management. How dare they demand, for example, that Japanese car makers locate here in the US. We should just let them import what they want and let Ford go bankrupt. Union busting was more important than anything else.

What you want with trade is to keep it somewhat balanced, and watch employment. To continue the example Japan exports roughly twice to us what we export to them. Ideally that'd be more even, but who is going to make more products to export to Japan, or produce Japanese products here? You'll have to fight for workers already being employed elsewhere. And many on the right probably would not like the idea of more immigrants to help staff production, or to free up Americans to staff it.kouroi MPC • 10 hours agoAmerica does suck up too many talented people into well paid jobs that do little to advance us, but certainly not enough to correct the trade imbalances of every country we trade with. Probably not even Japan whose imbalance is a tiny fraction of China's.

America's trade imbalances are a collaboration between foreign producers seeing opportunities, domestic elites seeing major profit, but most importantly Americans themselves whose consumption impulses are so, so lucrative. Americans cannot make all the stuff that Americans want right now. Enter immigrants. Enter outsourcing. Enter major trade deficits. People profit on the exchange, but this is a setup that America collectively has voted for with its wallet, over and over again.

Also America makes/made products that other people don't want. From 2 by 4 lumber in inches and feet, when the rest of the world is in metric system, to oversize fridges and pick-up trucks that do not fit in the European or Japanese size houses and roads.Kent • 16 hours ago"Deliver a good product at a price and quality acceptable to the customer."FND Kent • 15 hours agoLOL. Obviously a failed businessman. The purpose is to put your customer's money in your pocket. If your customer is making a profit off of your product, raise the price. If the customer balks and buys from a different vendor, buy all the vendors. Create a monopoly. Once you have a monopoly, stop paying whiney American workers who expect decent pay and respect, and have Chinese slaves make your product. The purpose of the "Free Market" is not about price. It's about maximizing shareholder value. It's not about creating good jobs, America or any of that other nostalgia from the pre-Free Market days.

It's about liberty. The liberty of the property and capital owning class to keep their wealth (their wealth is the same thing as your labor), in their hands and away from you and your stupid government's grubby, unwashed hands.

The ideal market conditions result in happy customers and profitable businesses. Its true that ideal market conditions often don't prevail when a monopoly is created. But what makes it even worse is when government enables those conglomerates to become even larger by making it impossible for small businesses to compete due to onerous regulations and gobbletygook tax loopholes gained by conglomerate lobbyists.joeo • 14 hours agoI believe the economic policies based on the dominant economic theory in Germany is the best approach for a solid, competitive economy. That theory is Ordo-liberalism, which allows government to make sure a proper legal environment for the economy exists to maintain a healthy level of competition through measures that adhere to market principles.

The Ordo-liberalists believe if the state does not take active measures to foster competition, firms with monopoly power will emerge, which will not only subvert the advantages offered by the market economy, but also possibly undermine good government, since strong economic power can be transformed into political power. We have seen this happen in the US and it is BIPARTISAN. In fact some of the worst examples of unholy alliances between corporations and government come from the Dem side of the aisle.